Category: News

Plans changed? Updating your financial plan could offer reassurance

Even the best-laid financial plan might need to change at times. If you find yourself in that position, you might benefit from reassurance that you can still reach your goals and will be financially secure.

There’s a whole host of reasons why you might want to adjust your financial plan.

In some cases, it might be a decision you’ve made. Perhaps you’ve decided you want to gift money to loved ones to help them reach their goals, or you want to take a higher income from your pension to fund a new-found hobby.

Other times, the changes might be due to factors outside of your control. For example, if you’ve been made redundant, you might need to create an income until you can find a new position.

Whatever the reason, it can be scary to change course. One cause of apprehension might be the fear of the unknown. Fortunately, updating your financial plan could help you feel more in control and confident.

Updating your cashflow model could help you analyse the impact of the changes

When you create a financial plan, one useful tool that you might use is a cashflow model.

You start by inputting some basic financial information into the model. For example, you might add the value of the assets you hold now, your income, and your outgoings.

One of the key benefits of a cashflow model is that it can help you visualise how your wealth might change over time.

So, you need to provide information to allow it to create a forecast too. This data often falls into two categories:

- Your actions – These would be the financial steps you plan to take, such as how much you plan to contribute to your pension each month or the amount you’ll add to an emergency fund.

- Assumptions – Some factors that might affect your finances are outside of your control, so for these areas, you may make realistic assumptions. For example, you might review your pension and include average annual returns of 5%.

With these details, a cashflow model can project how your assets and wealth may change and even look decades ahead so you can consider long-term goals.

As a result, cashflow modelling can help you understand if the steps you’re taking now are enough to secure the future you want. But it’s not just useful when everything is going to plan, a cashflow model may be even more valuable when you face unexpected changes.

It’s important to note that the projections from a cashflow model cannot be guaranteed. However, it can provide a useful indicator and highlight where there could be potential gaps in your financial plan.

A cashflow model could help you assess the short- and long-term impact of your new plans

So, you’ve worked with a financial planner and created a cashflow model that aligned with your aspirations. But now, your plans have been derailed. Luckily, you can update the information and model your new circumstances or goals.

Let’s say you’d previously planned to retire at the age of 65. However, ill health has forced you to step back from work five years sooner than you expected. You might have questions like:

- Can I afford to take an income from my pension in line with my previous plan?

- If I had to take a lower income, how would it affect my lifestyle?

- Are there other assets I could use to supplement an income from my pension?

- Could retiring sooner affect the value of the estate I leave behind for loved ones?

You can alter the information that goes into your cashflow model to help you answer these questions. So, in the above scenario, you might see how taking the same income you’d previously planned but five years earlier affects your risk of running out of money during your lifetime.

You might find that you have enough to be financially secure and can move forward with your retirement plans.

Alternatively, you may find that your new plan might leave you in a financially vulnerable position in the future. In this case, you can use the cashflow model to try different solutions to understand what might work for you.

By realising there’s a potential shortfall sooner, you’re in a better position to bridge gaps or find a different option, so you’re able to proceed with confidence.

Get in touch to update your financial plan

If your circumstances or goals have changed, you can arrange a meeting with our team to update your financial plan. It could help you assess the potential long-term implications of the changes and understand what steps you might need to take to keep your plan on track.

Please note:

This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate cashflow modelling.

Why building emotional resilience could improve your finances

Emotions can affect how you feel about different scenarios and your response to them, including when you’re making financial decisions. Improving your emotional resilience could mean you’re better equipped to handle stressful situations. Read on to discover why and how it might support your financial goals.

Emotional resilience simply refers to your ability to adapt to and deal with stressful situations. It could help you remain level-headed even when you’re facing challenges.

It’s not about repressing your emotions, but recognising them and not letting them rule your decisions. As a result, it may be a valuable skill in your day-to-day life as well as when you’re managing your finances.

Here are five ways you could improve your emotional resilience.

1. Give what you do a meaning

Giving your actions a meaning could be hugely valuable. Indeed, a purpose could improve your resilience and mean you make better lifestyle choices.

Day-to-day that might mean finding a purpose in your work or social life. For instance, what motivates you to work, or what brings you joy in your free time?

When it comes to your finances, you can give your decisions a purpose too. When you’re setting money aside having a goal could mean you’re more motivated.

For instance, while you might make a pension contribution each month, it’s easy to feel disconnected from your retirement savings as the milestone could be decades away. So, taking some time to understand how these contributions will add up and what it could mean for your future might be useful. It may also mean you’re less likely to act on potentially harmful emotions, such as selecting a low-risk approach to investing because you’re worried, even if your circumstances mean more risk could be appropriate.

2. Focus on the positive

When you’re faced with a challenge, it can be easy to overlook the positives in a situation. Someone who is emotionally resilient is more likely to look for the silver lining even while acknowledging there are negatives.

It’s a strategy that could help stressful situations feel more manageable and mean that you’re in a better mindset to tackle what you need to do or make decisions. Next time you’re experiencing negative emotions like stress or worry, try to look on the bright side.

3. Be self-aware

One of the biggest challenges of managing your emotions is recognising when they could be harming your approach to the situation.

Being self-aware and understanding the effect your emotions are having could help you rein them in when appropriate. Asking yourself questions in the moment could help you reassess situations and come up with a solution that’s right for you.

So, trying to be more self-aware could be useful. There are many different ways to do this. You might find that when your emotions are heightened, taking a quick break from a task or decision gives you the space you need to become more level-headed. Some people find that keeping a journal provides them with a great opportunity to reflect on their day and recognise patterns.

4. Discover how to regain your sense of calm

Even with emotional resilience, there will be times when emotions like stress and fear will affect you.

Knowing what steps you can take to regain your sense of calm and feel in control again could be immensely useful. There’s not a single solution to lowering your blood pressure, so try different activities and find something that works for you. Some might find that quietly reading a book puts them at ease, while, for others, getting active is the perfect way to beat stress.

It could mean next time you feel that emotions might be affecting your decisions, you know what steps to take to regain your sense of calm.

5. Have someone you can turn to

When you’re struggling with emotions, having the right support network around you could make all the difference.

Having someone listen to you might help you keep your emotions in check. In your day-to-day life, those people might be your family, friends, or colleagues. They could also be a valuable source of support when you’re facing challenges around financial decisions.

In addition, your financial planner may also be someone you want to turn to in these circumstances. As they understand your financial position and goals, they could offer tailored advice that helps you assess situations with your circumstances in mind and formulate a plan that suits your needs.

If you’d like to talk to one of our team about your financial plan, please get in touch.

Please note:

This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

Guide: The surprising benefits of choosing a “living legacy” for your loved ones

Leaving wealth behind for your loved ones may be a priority when developing your financial plan. After all, you’ll likely want to see your family thrive and an inheritance could help them achieve important goals in life.

Traditionally, you would transfer wealth to your loved ones when you passed away, leaving instructions in your will about how your family should divide your estate.

However, in recent years, more people have chosen to instead leave a “living legacy” – passing wealth to their loved ones while they’re still alive.

This informative guide explains why a living legacy could help you:

- Encourage your beneficiaries to think about their long-term finances

- Lend a helping hand to loved ones when they need it most

- Reduce a potential Inheritance Tax bill on your estate

- Offer valuable support around how to use the wealth.

As well as the potential benefits, this guide also considers the downsides you might need to consider, such as making estate planning more complex and balancing gifts with your own long-term financial security.

Download your copy here: ‘The surprising benefits of choosing a “living legacy” for your loved ones’ to find out more now.

If you want to discuss ways to pass wealth to your loved ones while ensuring that you can meet your own financial goals, please contact us to arrange a meeting.

Your Autumn Budget update – the key news from the chancellor’s statement

Almost four months after Labour won the general election, chancellor Rachel Reeves has delivered her 2024 Autumn Budget, outlining the government’s plans for this tax year and beyond.

Arguing that the July general election had given Labour a “mandate to restore stability and start a decade of renewal”, Reeves described it as “a Budget to fix the foundations and deliver change”.

Against a backdrop of a manifesto pledge not to increase Income Tax, employee National Insurance, or VAT, Reeves also announced that her Budget would raise taxes by £40 billion, stating that any other chancellor would “face the same reality”.

Read on for a summary of some of the key measures and announcements from this year’s Autumn Budget – the first ever delivered by a woman – and what they might mean for you.

Extra investment in infrastructure

The chancellor argued that “the only way to drive economic growth is to invest, invest, invest.”

In the run-up to the Budget, Reeves announced she was making a technical change to the way debt is measured, which will allow the government to fund extra investment. This wider debt measure will allow for more borrowing to invest in big building projects such as roads, railways, and hospitals.

It’s important to note that this additional room for manoeuvre for spending on investment projects will not be used to support day-to-day spending, as the chancellor has committed to fund that with tax receipts.

A rise in employer National Insurance contributions

As many analysts had predicted, Reeves increased employer National Insurance (NI) rates by 1.2% from 13.8% to 15%, effective 6 April 2025.

Currently, employers pay NI only above a threshold of £9,100 a year. The chancellor reduced this threshold to £5,000 a year, effective 6 April 2025. The threshold will remain at £5,000 until 6 April 2028 and then increase in line with the Consumer Prices Index (CPI) thereafter.

These reforms will raise £25 billion a year by the end of the forecast period (2029/30).

At the same time, the government is increasing the Employment Allowance.

The current Employment Allowance gives employers with NI bills of £100,000 or less a discount of £5,000 on their employer NI bill.

From 2025, the Employment Allowance will rise to £10,500. Moreover, the government will expand the Employment Allowance by removing the £100,000 eligibility threshold so that all eligible employers now benefit.

Taken together, the government says that 865,000 businesses will pay no NI contributions at all, and more than half of employers with NI liabilities will either see no change or will gain overall next year.

An end to the freeze on Income Tax thresholds from 2028

Back in 2021, the then-chancellor, Rishi Sunak, raised both the Personal Allowance and the threshold at which higher-rate Income Tax is due by £70 and £270 respectively.

Importantly, however, he also fixed these thresholds until 2026. Then, in the 2022 Autumn Statement, Jeremy Hunt extended this freeze until 2028.

Unexpectedly, Reeves decided against extending the freeze beyond 2028. From 2028/29, personal tax thresholds will be uprated in line with inflation once again.

Capital Gains Tax reforms

The chancellor announced several changes to the Capital Gains Tax (CGT) regime.

Firstly, as of 30 October, the main rates of CGT have increased. The basic rate has risen from 10% to 18% and the higher rate has increased from 20% to 24%.

The government will maintain the lifetime limit for Business Asset Disposal Relief (BADR) – formerly Entrepreneurs’ Relief – at £1 million. Meanwhile, the lifetime limit for Investors’ Relief (IR) will be reduced from £10 million to £1 million.

The BADR and IR rate of CGT will continue to be charged at 10%, before rising to 14% on 6 April 2025 and 18% on 6 April 2026.

These measures will raise £2.5 billion a year by the end of the forecast period.

Furthermore, CGT on carried interest – paid by private equity managers – will rise from 18% (basic rate) and 28% (higher rate) to 32% from 6 April 2025. There will be further reforms from April 2026 to bring carried interest within the Income Tax framework, under bespoke rules.

Changes to some Inheritance Tax reliefs

As expected, the chancellor made key announcements that could affect estate planning.

Nil-rate bands

The freeze on IHT thresholds will be extended by an additional two years, to 2030. The nil-rate band and residence nil-rate band will remain at £325,000 and £175,000 respectively.

Pensions

Reeves announced she was closing the “loophole” that gives pensions preferable IHT treatment. She will bring unused pension funds and death benefits payable from a pension into a person’s estate for IHT purposes from 6 April 2027.

The government estimates this measure will affect around 8% of estates each year.

Agricultural Property Relief

Currently, individuals can claim up to 100% relief on agricultural property (land or pasture that is used to grow crops or rear animals).

From 6 April 2026, the first £1 million of combined business and agricultural assets will continue to attract no IHT at all. However, for assets above this threshold, IHT will apply with 50% relief.

Business Property Relief

From 6 April 2026, the government will also reduce the rate of Business Property Relief from 100% to 50% in all circumstances for shares designated as “not listed” on the markets of a recognised stock exchange, such as the AIM.

ISA subscription limits frozen until 2030

Prior to the Budget, there was speculation that the chancellor may make changes to simplify the ISA regime.

While these did not materialise, the Budget did confirm that annual subscription limits will remain at £20,000 for ISAs, £4,000 for Lifetime ISAs and £9,000 for Junior ISAs and Child Trust Funds until 5 April 2030.

Additionally, the starting rate for savings will be retained at £5,000 for 2025/26, allowing individuals with less than £17,570 in employment or pension income to receive up to £5,000 of savings income tax-free.

A change to business rates relief

The current business rates relief system is set to run until April 2025. It effectively serves as a reduction on business rate bills for eligible businesses, with retail and hospitality firms having been key beneficiaries.

The chancellor announced that, from 2026/27, permanently lower tax rates will be introduced for retail, hospitality and leisure properties.

Additionally, for 2025/26, some retail, hospitality, and leisure properties will receive 40% relief on their bills, up to a cash cap of £110,000 per business.

Corporation Tax capped at 25%

The government plans to support businesses to invest by publishing a Corporate Tax Roadmap. This confirms that the government will cap Corporation Tax at 25% for the duration of the parliament.

A rise in the national living wage

Reeves announced a 6.7% rise in the national living wage for workers aged 21 and over, from £11.44 to £12.21 an hour, effective April 2025. For a full-time employee earning the national minimum wage, this means a £1,400 annual pay boost and is expected to benefit more than 3 million workers.

In addition, the national minimum wage for people aged 18 to 20 will rise from £8.60 to £10 an hour. Apprentices will receive the biggest pay increase, with hourly pay rising from £6.40 to £7.55 an hour.

The announcement could significantly increase outgoings for businesses, particularly when coupled with reforms to employers’ NI.

A freeze in fuel duty

Fuel duty has been frozen since 2011, and the 5p cut brought in by the Conservatives in 2022 has been extended at every subsequent Budget.

Despite speculation that Reeves might increase fuel duty, she confirmed the freeze for another year and extended the 5p cut. This will save the average motorist £59 in 2025/26.

Second home Stamp Duty surcharge increasing

With effect from 31 October 2024, the Stamp Duty surcharge on the purchases of second homes, buy-to-let residential properties, and companies purchasing residential property in England and Northern Ireland will increase from 3% to 5%.

This surcharge is also paid by non-UK residents purchasing additional property.

Reforms to the non-dom regime

Currently, for UK residents whose main residence – or “domicile” – is elsewhere in the world, income and gains are taxed differently, depending on factors such as how long individuals are resident in the UK.

The chancellor confirmed that the tax regime for non-domiciled individuals (non-doms) will be abolished from April 2025, claiming that the rules will ensure that those who “make the UK their home will pay their taxes here”.

Moving forward, there will be a residence-based scheme with “internationally competitive arrangements” for those who come to the UK on a temporary basis.

Over the next five years, Office for Budget Responsibility (OBR) figures estimate that these reforms will raise £12.7 billion.

VAT on private school fees from January 2025

As they had promised in their election manifesto, Labour announced that, from 1 January 2025, VAT will apply to all education, training, and boarding services provided by private schools.

Additionally, the chancellor announced that she was removing business rates relief from private schools from April 2025.

An end to the £2 bus fare cap

The £2 cap on bus fares introduced by the previous Conservative administration is due to end on 31 December 2024.

Labour has announced that it will extend the cap for a further 12 months but that the cap will rise from £2 to £3.

Changes to duties for alcohol, tobacco, and vaping

The chancellor confirmed a reduction in the duty for draught alcohol, cutting duty on an average strength pint by a penny. Rates for non-draught products will increase in line with the Retail Prices Index (RPI) from 1 February 2025.

Furthermore, a new vaping duty will be introduced from 1 October 2026, standing at £2.20 per 10 ml of liquid. Meanwhile, there will be a one-off tobacco duty rise designed to maintain the incentive to choose refillable vaping over smoking.

Confirmation of the 4.1% increase to the State Pension under the triple lock

The basic and new State Pension will increase by 4.1% in 2025/26, in line with earnings growth, meaning over 12 million pensioners will receive up to £470 a year more.

Please note

All information is from the Autumn Budget documents on this page.

The content of this Autumn Budget summary is intended for general information purposes only. The content should not be relied upon in its entirety and shall not be deemed to be or constitute advice.

While we believe this interpretation to be correct, it cannot be guaranteed and we cannot accept any responsibility for any action taken or refrained from being taken as a result of the information contained within this summary. Please obtain professional advice before entering into or altering any new arrangement.

Investment market update: September 2024

Economic data suggesting some developed countries, including the US, could fall into a recession continued to affect investment markets in September 2024. Read on to discover other factors that may have affected the performance of your investments.

UK

Data from the Office for National Statistics (ONS) shows inflation remained stable at 2.2% in the 12 months to August. The figure is slightly above the Bank of England’s (BoE) 2% target.

Despite speculation that inflation data would lead to the BoE cutting interest rates, the Bank opted to maintain its base rate at 5%. While good news for savers, it means borrowers, including mortgage holders, are still likely to face higher outgoings when compared to 2021.

Many economists expect the BoE will make an interest rate cut before the end of the year. Indeed, investment bank Goldman Sachs predicts the interest rate will fall to 3% over the next 12 months.

GDP data showed the UK economy returned to growth in July after a plateau in June. However, the figures were disappointing, with just 0.5% growth in the three months to July 2024.

There could be more positive news in the coming months though. Investment bank Peel Hunt optimistically said the UK economy is heading for “above-average growth” as inflation stabilises and consumer demand picks up.

A report from the Office for Budget Responsibility (OBR) provided a less cheerful outlook for the UK. The latest risk and sustainability report warned the UK, and other countries in the world, face long-term pressures, such as an ageing population, climate change, and rising geopolitical tensions.

In addition, the OBR said, based on current policy, public debt is projected to almost triple to more than 270% of GDP over the next 50 years. The comments highlight the challenging backdrop chancellor Rachel Reeves will need to consider as she prepares to deliver her first Budget on 30 October.

There was positive data released from the manufacturing sector. S&P Global’s Purchasing Managers’ Index (PMI) recorded the strongest month in two years. Both output and new orders continued to recover.

Yet, many businesses continue to face significant headwinds. Among those is UK shipbuilder Harland & Wolff, which owns the Belfast shipyard that once built the Titanic. The company entered administration in September.

Research also suggests that trade difficulties following Brexit could worsen. Aston Business School analysed the effect of the Trade and Cooperation Agreement on UK-EU trade relations, and found that trade is down by almost a quarter.

The FTSE 100 experienced ups and downs, including falling 0.6% to a three-week low on 4 September. Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: “Fresh worries about the health of the global economy have gripped markets, with the FTSE 100 far from immune.”

Europe

Eurozone inflation fell to 2.2% in the 12 months to August 2024. The news gave the European Central Bank the confidence to cut interest rates for the second time this year.

The Paris Olympics provided a short-term boost to the eurozone economy. A PMI output index increased for the first time since May in August 2024 to reach a three-month high of 51.0 – a reading above 50 indicates growth.

However, as the temporary boost of the Olympics fades, additional PMI data isn’t as positive. Indeed, HCOB’s flash PMI suggests the eurozone economy shrank for the first time in seven months in September.

The manufacturing sector in particular is struggling, with a PMI reading of 45.8 in August 2024. Dr Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said: “Things are going downhill, and fast. The manufacturing sector has been stuck in a rut.”

As the largest economy in the EU, the conditions in Germany can affect the bloc, and statistics suggest there are risks ahead.

Indeed, the Kiel Institute for the World Economy predicts Germany’s GDP will shrink by 0.1% this year and has halved its growth forecast for 2025 to 0.5%.

Statistics body Destatis reports industrial production in Germany fell by 2.4% in July – far more severe than the 0.3% fall economists had predicted. The automotive sector suffered the largest fall (8.1%) followed by electrical equipment (7%).

German carmaker Volkswagen has spoken about the challenges it faces. The company warned that it has a “year, maybe two” to adapt to lower demand. The economic environment has led to Volkswagen considering making unprecedented closures in its home market for the first time in its history as it tries to cut costs.

US

Inflation in the US fell to its lowest level since February 2021 in August 2024 to 2.5%. In response, the Federal Reserve cut its base interest rate from 5% to 4.75%.

The inflation and interest rate announcements led to the S&P 500 – an index of the 500 largest public companies in the US – jumping 1.5% on 19 September.

Similar to Europe, data indicates the manufacturing sector in the US is struggling. Indeed, the Institute of Supply Management reported it contracted for the fifth consecutive month in August. The news led to a dip in the markets around the world at the start of the month.

Figures from the Bureau of Economic Analysis also indicate a business threat as the trade deficit increased by $5.6 billion (£4.19 billion) in July to $103.1 billion (£77.13 billion).

American company OpenAI, the firm behind ChatGPT, announced it was in talks to raise $6.5 billion (£4.86 billion) from investors at a valuation of $150 billion (£112.21 billion) – making it one of the most valuable start-ups in the world.

Asia

Investment market volatility in Asia highlighted how factors around the world can affect markets. On 4 September, Japan’s Nikkei lost 4.2% and South Korea’s Kospi fell 3.4% after investors were spooked by fears that the US could experience a downturn when poor manufacturing data was posted.

A survey of China’s manufacturers from Caixin suggests export orders were subdued in August and fell for the first time this year as it faced external challenges.

However, China announced stimulus measures aimed at boosting the economy and stock market, as well as supporting the property sector on 24 September.

The news led to stock markets across Asia-Pacific rising – China’s CSI 300 index was up more than 4%. In fact, the announcement led to world stocks hitting a record high when the MSCI World Stocks index increased by 0.3%.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Landlords: How to make your property more energy-efficient

Landlords could be banned from renting out properties that don’t meet energy efficiency rules after 2030. While the deadline might seem a long way off, it could mean some landlords need to carry out substantial work. So, reviewing your options now may be useful.

The previous Conservative government proposed rules that would set a minimum Energy Performance Certificate (EPC) rating for properties that were let out. Ed Miliband, secretary of state for energy security and net zero, has indicated that the Labour government will take these plans forward.

It’s thought that landlords will need to upgrade properties that have an EPC rating below C.

The plans are likely to have a significant effect on landlords as the Office for National Statistics (ONS) estimates that around 58% of homes in England and 62% in Wales are rated below C – the equivalent of more than 8.4 million properties.

So, where should you start when assessing how to make your property more energy-efficient?

Reviewing your property’s Energy Performance Certificate

All properties in England and Wales must have an EPC, and it’s a good place to start when assessing how to boost the EPC rating of your property. If you’ve completed work on your property recently, you might want to have a new assessment carried out.

Several sections could be useful when you’re reviewing how to upgrade your property.

Your current and potential EPC rating

The EPC not only lists the property’s current rating but also its potential. So, you could see if your property can achieve a C rating and how wide the gap is between the two.

The top actions

Next, look at the top actions of your EPC. This will list the steps you can take to make your property more energy efficient, it might include large projects, such as adding external wall insulation, or relatively simple ones, like switching to lower energy lighting.

As well as listing the steps, the EPC will also provide a cost outline. Of course, this cannot be guaranteed, but it can be useful when you’re calculating a budget and want to understand which projects could fit into your plan.

You can also check out the recommendations section for areas that need further improvement. Helpfully, this shows how the recommended measures would affect your EPC rating. So, if you’re deciding which measures to pursue and want to understand which would deliver the biggest impact, this section is useful.

The energy performance of your home

Finally, look at the energy performance of your home section – this provides a breakdown of how different elements of your property are performing. It gives a rating out of five for energy performance so it’s simple to compare the different areas.

For example, you might notice that while your windows and doors are efficient, a lack of insulation in the loft is pulling down your overall EPC rating.

Use your EPC to guide your energy efficiency decisions

Using the information on your EPC, you’re in a good position to target areas that could help boost your EPC rating to a C or above and comply with regulations that Labour proposes to introduce.

The indicative cost is also valuable when you’re reviewing quotes you receive for carrying out work. However, keep in mind that the cost of work can vary significantly across the country and is a guideline only.

Landlords could benefit from making their properties greener

While updating homes to comply with new regulations could be difficult and costly, there are benefits for landlords.

Energy-efficient homes will reduce utility bills for tenants, who may be willing to pay a higher rate of rent as a result. So, while you need to consider the initial cost of updating your property, it could deliver higher returns overall.

In addition, if you own a property with an EPC rating of A or B, you might be eligible for a green mortgage. In some cases, a green mortgage could mean you’re able to access a lower rate of interest, so your mortgage repayments may fall.

Contact us to talk about your buy-to-let mortgage

If you have a buy-to-let mortgage and would like to discuss the different options or want the support of a mortgage adviser when searching for a deal, please get in touch.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

How would soaring property prices affect a 2024 Monopoly board?

Classic board game Monopoly hit shelves in 1935 and has been causing family arguments ever since. As the real estate game was loosely based on property values at the time it was launched it provides some interesting insights into how the market has changed over the last nine decades.

The original Monopoly game was based on Atlantic City, US, but it didn’t take long for the game to be adapted to new locations. Indeed, a London version of the game was available within months.

Since its launch, the game has sold more than 275 million copies worldwide and there are hundreds of different editions to choose from. So, if the game was updated to reflect 2024 prices, how would it be different?

Mayfair would continue to hold the top spot but prices have soared

Unsurprisingly, if you updated the property prices to reflect today’s figures, they would be much higher than they were in 1935, and some locations have fared better than others.

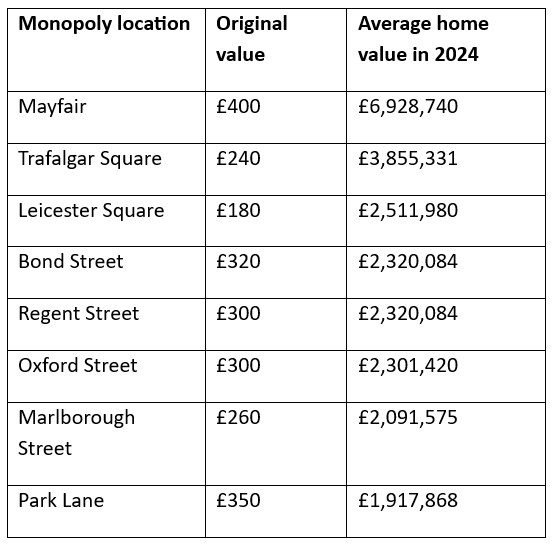

According to a report in IFA Magazine, using today’s prices, the top locations on the Monopoly board would be:

You might notice that the top properties don’t appear in the same order as they do on the board as some areas have seen prices rise far more rapidly than others.

In fact, the iconic dark blue set – the most expensive on the board – has changed. Mayfair continues to hold the top spot, with a value that’s significantly higher than other locations. However, Park Lane, once the second most expensive property, has fallen six places.

Even the cheapest properties on the board have seen huge increases in value.

Indeed, the first property on the board, Old Kent Road, was priced at an affordable £60. At today’s prices, a home on the same street would set you back around £342,000.

While property prices in London remain the highest in the UK, the trend is reflected across the country.

Land Registry data doesn’t go back to 1935, but the average property price in the UK was £3,595 in April 1968. By July 2024, the average price has increased to £289,723 – an increase of almost 8,000%.

Property prices have increased at a quicker pace than inflation

In the classic rules of Monopoly, you start with £1,500 and receive £200 every time you pass “GO”. According to the Bank of England, inflation would mean these figures rise to £89,644 and £11,952 respectively in August 2024.

Yet, they wouldn’t have the same spending power as rising property prices have outstripped average inflation over the last 90 years.

With your initial £1,500, you’d be able to buy several properties on the Monopoly board, even if you’re lucky enough to land on the more expensive tiles. Yet, with 2024 prices, you would still be some way short of being able to afford even the cheapest property – Old Kent Road at £342,000 – with your starting sum after it’s been adjusted for inflation.

Relying on the money you receive when passing GO would mean you’d need to go around the board more than 1,260 times to build up enough cash to buy Old Kent Road, which would be sure to lead to a long and tedious game.

The gap between rent and mortgage repayments is much closer

In Monopoly you make money and try to bankrupt others by charging players rent when they land on a tile you own.

Before you start adding houses and hotels to your tiles, the rent is usually half the purchase price. So, when you buy Old Kent Road for £60, you charge £30 rent. In reality, the cost of rent and mortgage repayments are far closer.

Indeed, according to Zoopla, between 2011 and 2022, renting a home was more expensive than paying a mortgage. Even with rising interest rates leading to mortgages becoming more expensive for the first time in 13 years, rent is only around 9.5% lower.

Contact us to talk about your mortgage

If you need a mortgage to buy your new home, whether the location is on the Monopoly board or not, we could help you find a lender that’s right for you and may be able to save you money. Please get in touch to talk about your needs.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

How to balance philanthropy with your long-term financial security

Using your wealth to support good causes might be one of your priorities. Yet, the challenges of balancing philanthropy with your long-term financial security and that of your loved ones might mean you’re hesitant to give back during your lifetime. Read on to find out how a financial plan could give you confidence.

Philanthropic giving is something many people already make part of their financial plan, and research suggests it could grow as it’s increasingly popular among younger generations.

Indeed, according to a report from UK Fundraising, 90% of wealthy young people express a strong desire to have a positive impact with their money, and 88% already donate to charity. Around 63% of those under 35 said they would consider increasing their charitable donations despite the difficult economic climate, compared to 13% of over-55s.

Whether you already have a charitable cause in mind or not, making philanthropy part of your overall financial plan could give you confidence. Read on to discover three questions you might want to consider to help balance your priorities.

1. How would philanthropic giving affect your finances?

To understand how supporting a good cause might affect your long-term financial security, it may be helpful to set out what you’d like to give. For instance, would you prefer to give regular financial gifts or a one-off lump sum?

With this information, you can start to incorporate your philanthropic goals into your financial plan.

Cashflow modelling could be useful here as it provides a way to visualise the effect your decisions could have on your long-term wealth. For example, you might model how giving away £10,000 each year may affect your disposable income in the short term, and the effect it would have on wealth accumulation. You could then see what may happen if you increase or decrease the figure.

By making donations part of your financial plan, you might be in a better position to strike a balance that suits you. If you’ve put off donating because you’re worried you could run out of money in retirement or be unable to cover other expenses, it could give you the confidence to proceed.

2. Do you want to consider the effect it’ll have on your estate and beneficiaries?

As well as your own long-term finances, you might want to consider the effect gifting to charity could have on your estate and beneficiaries.

Giving away some of your wealth during your lifetime or through a will could mean passing on less than you expect to loved ones. So, if supporting your family is a priority for you, it might also play an important role in your philanthropic decisions.

Again, cashflow modelling could help you understand the effect of giving away some of your assets for your beneficiaries. In some cases, it might be worthwhile to talk to your beneficiary so you understand how best to support them and ensure you’re on the same page.

3. How could you make philanthropic donations tax-efficiently?

It might seem strange to consider tax when you’re making a philanthropic donation. However, doing so could reduce your overall tax bill or mean that the charity benefits.

For example, gifting directly from your salary, before tax is deducted, could be a useful way to reduce your Income Tax bill. Similarly, you could pass on assets that might be liable for Capital Gains Tax if you sold them and made a profit.

If you’re a UK taxpayer, charities can also reclaim the basic rate of Income Tax you’ve already paid on your donation through Gift Aid. So, if you donate £100 to charity, they’d receive £125. In addition, if you’re a higher- or additional-rate taxpayer, you may be able to claim tax relief.

Alternatively, if you want to support a good cause when you pass away, it could reduce the Inheritance Tax (IHT) bill your estate is liable for.

If the total value of your estate exceeds the nil-rate band, which is £325,000 in 2024/25, it may be liable for IHT at a standard rate of 40%. However, if you leave more than 10% of your estate to charity when you pass away, the IHT rate may fall to 36%. In some circumstances, this could help you leave a charitable legacy and pass on more wealth to your loved ones.

Contact us to make philanthropy part of your financial plan

If you’re keen to make philanthropy part of your financial plan, please get in touch. We can work with you to understand your philanthropic goals and how to balance them with your personal aspirations.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate cashflow planning or tax planning.

5 reassuring ways a financial plan could help you deal with life’s scares

Halloween is just around the corner, but there’s more than ghouls and ghosts to be scared of. Sometimes, daily life can be just as frightful as the latest horror film.

Here are five reassuring ways a financial plan could help you next time you encounter one of life’s scares.

1. A financial plan could help you build financial resilience to overcome obstacles

Even the best-laid plans can be knocked off course by events outside of your control. Dealing with obstacles like long-term illness or losing your job can be scary, especially if low financial resilience means you’re also facing additional pressure.

For example, if you’re diagnosed with a serious illness, you may want to focus on your recovery, spending time with your loved ones, or adapting to a new lifestyle. But if your income has stopped and you don’t have a plan in place, you could find you’re more worried about how to meet bills or support your family.

So, as part of your financial plan, we’ll work with you to assess your financial resilience and the steps you might take to improve it.

Depending on your circumstances, that could include building an emergency fund, taking out appropriate financial protection, and assessing how you might use your other assets to provide a regular income if necessary.

A financial plan can’t remove unexpected obstacles, but it could provide you with a way to overcome them and mean they’re less scary to face.

2. A financial plan could help you prepare for the future

Effective financial planning often involves considering the future. In some cases, you might need to consider what you want your life to look like in several decades.

It can be exciting to set out your life goals, but, at the same time, it may be frightening too. There might be many different factors you need to weigh up and, for some goals, the steps you need to take to achieve them can seem impossible.

Take retirement planning, for example. The figure you want to save into your pension to secure the retirement you want may seem dauntingly high. Even as you near the milestone, you might still have retirement worries. Indeed, according to a report in IFA Magazine, almost half of pension savers are worried they won’t have enough to last their lifetime.

A financial plan could help you prepare for the future and break down large goals so you can see how to reach them.

3. A financial plan could provide answers to questions that keep you up at night

It’s not just the memories of a horror film that might keep you up at night, wondering “what if?” could be just as harmful to your wellbeing.

Dealing with uncertainty can be terrifying. If you’re kept up at night by wondering what would happen in different scenarios, a financial plan could offer some reassurance.

A financial plan doesn’t just consider how your finances will change if everything goes according to plan. It also looks at how factors outside of your control could affect your wealth and lifestyle. As a result, it could help you answer the questions you’re worried about.

You might want to understand:

- If your partner and children would be financially secure if you passed away

- Whether you could afford the cost of care if you needed support later in life

- How your finances would be affected if you’re no longer able to work due to an illness

- If your retirement would still be secure if investments underperformed or the pace of inflation increased.

Often “what if” scenarios are scary because of the unknown. It’s impossible to know what’s around the corner, but we could help you understand the potential impact and then take steps to keep your long-term plans on track.

4. A financial plan could help you tackle conversations you’re dreading

There might be times when you need to have a difficult conversation with your loved ones about your finances or long-term plans. For some, the nerves around talking about certain subjects could lead to anxiety or putting them off altogether.

Indeed, according to a Canada Life survey, 5.1 million UK adults who received an inheritance in the last five years did not discuss the value of it with the benefactor beforehand.

It’s easy to see why some benefactors choose not to discuss inheritances. Talking about passing away may be difficult or they might not feel comfortable divulging the value of their estate. However, doing so could help beneficiaries better manage an inheritance when they receive it.

Other difficult conversations could include how you’d like someone to handle your affairs if they become your Power of Attorney or your preferences for a funeral.

Setting out your goals and taking steps to improve your financial wellbeing could mean you feel more confident tackling difficult conversations around money and your life.

In some cases, you might decide to have your financial planner be part of the conversation too. Having a third party who understands the financial aspect could help you all get on the same page.

5. You’ll have someone to turn to for support

By working with a financial planner, you don’t have to tackle life’s scares alone – you’ll have someone to turn to who understands your goals, worries, and financial circumstances. Knowing that a professional has reviewed your plan and is there to answer questions could make the intimidating far less daunting.

If you’d like to arrange a meeting to talk about your aspirations and worries, please get in touch.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

3 insightful pieces of data that could help you remain calm during market volatility

When you read that investment markets have fallen you might feel nervous or scared about the effect it could have on your future. Emotions like these sometimes lead to impulsive decisions that aren’t always in your best interest when you consider the long term. So, read on to discover some insightful pieces of data that could help you remain calm.

Volatility is part of investing – a huge range of factors might influence whether a stock market rises or falls. However, history shows that, over the long term, markets typically go on to deliver returns.

Recently, markets experienced volatility amid fears that the US was on track for a recession. Indeed, on 2 August 2024, US technology-focused index Nasdaq fell 10% from its peak. Just a few days later, the market rallied, and it was technology firms that led the way.

Concerns about the US economy weren’t confined to the US indices either. Markets fell in Europe and Asia too. In fact, Japan’s Nikkei index suffered its worst day since 1987 following the news. Again, it didn’t take long for the markets to bounce back.

Returns cannot be guaranteed and recoveries may be over longer periods. Yet, the above example highlights how making a knee-jerk decision due to volatility could harm your long-term wealth. If you’d responded by selling your investments when you saw markets were falling, you’d have missed out on the recovery.

So, if volatility is part of your experience when investing, how can you remain calm? These pieces of data could help you hold your nerve.

1. Investment risk falls over a longer time frame

It’s important to note that all investments carry some risk. There is a chance that you could receive less than the original amount you invested. However, the level of risk varies between investments, so you could invest in a way that reflects your risk profile and financial circumstances.

Usually, it’s a good idea to invest with a five-year minimum time frame. By investing for longer, you’re giving your investments a chance to recover if they fall due to short-term volatility.

Research supports this too. Using almost 100 years of data on the US stock market, Schroders found that if you invested for a month, you would have lost 40% of the time. Interestingly, when you invest for longer, your odds of losing money start to fall.

When invested for five years, the odds of losing money fall to 22%, and at 10 years it falls to 13%. The research shows there have been no 20-year periods during the time analysed where stocks lost money overall.

You can’t rule out risk entirely, but by investing for a long-term goal, you could minimise the chance of losing money.

2. Sharp drops in the market occur more often than you think

One of the reasons investors react to market movements is that sharp falls may feel like they’re unprecedented and that you should act as a result. Yet, the Schroders research suggests that sharp falls are more common than you might think.

Analysing the MSCI World Index, which captures large and mid-cap representations across 23 developed countries, the study found that 10% falls happen in more years than they don’t. Indeed, in the 52 calendar years to 2024, investors experienced a 10% fall in 30 of them.

Even significant falls of 20% may occur more than you expect – roughly every six years.

Despite these dips, markets have delivered returns over the 50 years analysed. So, holding your nerve during these sharp falls often makes sense when you take a long-term view.

3. Periods of “heightened fear” could be more lucrative

The Vix Index measures expected volatility in the US market– it’s often referred to as the market’s “fear gauge”. It can highlight when investors perceive there is a greater risk of losing money. For example, it last reached a significant peak in May 2022 in the aftermath of the invasion of Ukraine.

Schroders has assessed how your investments would fare if you sold assets during periods of “heightened fear” to hold your wealth in cash, and then shifted back to investments when the fear receded. Taking this approach when invested in the S&P 500 – an index of the 500 largest public companies in the US – would have yielded average returns of 7.4% a year between 1990 and 2024.

However, if you didn’t let fear affect your investment decisions and remained invested, you may have benefited from average annual returns of 9.9%.

So, even when it seems like investing isn’t a good idea because of the economic environment or geopolitical tensions, it could be worthwhile taking a step back to consider what’s driving your decision.

Contact us to talk about your investments

If you have questions about investing and how it could support your financial goals, please get in touch.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Recent Comments