Month: April 2022

Investment market update: March 2022

Throughout March, the war in Ukraine continued to dominate headlines and affect investment portfolios around the world.

Many companies, from well-known businesses like L’Oréal and Coca-Cola to smaller firms, have withdrawn operations from Russia, including online sales. Others, such as Unilever and Nestlé, have halted investment in the country but are continuing to provide some goods.

This has led to some volatility within the markets, although they did rally towards the end of the month.

Sanctions on Russia mean the price of some goods have boomed globally. Aluminium reached a record high, and the price of fuel also climbed. As both Russia and Ukraine are major exporters of wheat and corn, the conflict may affect food prices too.

The ongoing uncertainty has played a role in the higher levels of inflation many countries are experiencing. The after-effects of the pandemic and the supply issues it caused are also partly to blame for inflation rates.

It’s natural to be worried about your plans during times of uncertainty. What’s important is that you keep your long-term plans in mind and don’t make knee-jerk decisions based on headlines. If you have any questions about your investment strategy or wider financial plan, please contact us.

UK

Chancellor Rishi Sunak delivered the spring statement on Wednesday 23 March.

He opened with subdued growth forecasts from the Office for Budget Responsibility (OBR). The organisation now expects GDP to rise by 3.8% in 2022, down from the 6% forecast in October last year.

Among the measures Sunak announced were a fuel duty cut of 5p a litre as prices at petrol stations soared, and a cut in VAT for home energy efficiency installations.

While the government will continue with its plans to raise National Insurance (NI) in the 2022/23 tax year, the threshold that workers will start paying NI will increase.

The National Insurance Primary Threshold and Lower Profits Limit will rise from £9,880 to £12,570 from July 2022. Sunak also suggested that the basic rate of Income Tax could be cut in 2024, but only if certain conditions were met.

The statement followed the news from the Office for National Statistics (ONS) that in the 12 months to February 2022, inflation reached a 30-year high of 6.2%. The rate is now expected to peak at around 8%, but the Bank of England (BoE) hasn’t ruled out the possibility of double-digit inflation.

In a bid to slow the pace of inflation, the BoE also announced a base interest rate rise. It’s the third time the BoE has increased the rate since December 2021, and it now stands at 0.75%.

Inflation rising means that, in real terms, basic pay fell by 1% in the year to February – the steepest decline since 2014 – according to the ONS.

One of the biggest challenges families are facing is the rising cost of living, particularly energy prices. British wholesale gas for April delivery has increased by 20%. If prices remain high it could mean that household energy bills, which will be rising on average by 54% in April, will rise even further following the next review in October.

It’s an issue that is also affecting businesses. The Confederation of British Industry (CBI) has urged the government to offer support as energy bills rise. A CBI survey found that this pressure could lead to rising prices. 82% of British manufacturers expect to increase prices in the coming months.

As consumers are forced to cut back, some businesses are likely to find they’re affected by a reduction in discretionary spending.

Another news story that caught the attention of headlines was P&O Ferries’ decision to dismiss 800 members of staff and replace them with agency workers, who would earn less than the UK minimum wage. The decision caused outrage, prompted safety concerns, and led to suggestions that it may have been illegal.

Europe

Much like the UK, European economies are struggling with inflation and rising energy costs.

The European Central Bank (ECB) has raised its inflation forecast for 2022 to 5.8% compared to its earlier prediction of 3.2%. Again, energy prices are having a significant effect as costs increased by more than 30%.

Christine Lagarde, the president of the ECB, said the war in Ukraine “will have a material impact on economic activity through higher energy and commodity prices, the disruption of international commerce, and weaker confidence”.

However, unlike the BoE, the ECB elected to hold its interest rate at 0%.

The war in Ukraine has affected the outlook of Europe’s largest economy, Germany. A report from the Ifo research institute reported that business confidence in the economy has “collapsed” since the start of the conflict due to energy and supply chain challenges.

An agreed partnership between the European Commission and the US to reduce Europe’s reliance on Russian energy could relieve some of the pressure later this year. The US will aim to deliver larger shipments of liquefied natural gas to cut the European Union’s dependency on Russian Gas by two-thirds this year and end it before 2030.

After limiting activity for a month, the Moscow stock exchange reopened on Monday 28 March. Unsurprisingly, stocks fell but measures were put in place to prevent a sharp sell-off, including banning foreigners from selling Russian shares.

US

Inflation in the US increased to 7.9% in the 12 months to February 2022 – a 40-year high – according to the Labor Department.

The rising cost of living is having a knock-on effect on consumer confidence. A barometer from the University of Michigan found falling incomes in real terms means consumer sentiment has fallen to an 11-year low.

Despite the challenges, employment statistics indicate that businesses remain confident. The unemployment rate fell to 3.8% after firms took on 678,000 workers, far higher than the 400,000 expected, according to the Bureau of Labor Statistics.

US technology companies Alphabet (Google) and Meta (Facebook) are facing an antitrust investigation launched by the EU and UK. The two firms are accused of colluding to carve up the online advertising market between them. The deal between the two firms is already under investigation in the US. If found to be illegal, the deal, called “Jedi Blue”, could result in hefty fines of up to 10% of their global turnover.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

3 interesting pieces of data that show why you shouldn’t panic during market volatility

Over the last two years, investors have experienced a lot of volatility. If you’ve been tempted to change long-term plans, data can highlight why you shouldn’t panic.

At the start of the Covid-19 pandemic, markets fell sharply, and investors continued to experience volatility as the situation and restrictions changed. Just as things were slowly getting back to “normal”, tensions with Russia began to rise and stock markets reacted strongly when Russia invaded Ukraine in February.

Seeing the value of your investments fall can be nerve-racking, so much so that you may be tempted to make withdrawals or changes to your portfolio.

While there are times when it may be appropriate to change your investments, changes should reflect your personal circumstances. They shouldn’t be a knee-jerk reaction to periods of volatility.

Tuning out the noise and looking at long-term investment trends can be easier said than done. So, these three pieces of data can help you see why, in most cases, sticking to your investment strategy is the best option.

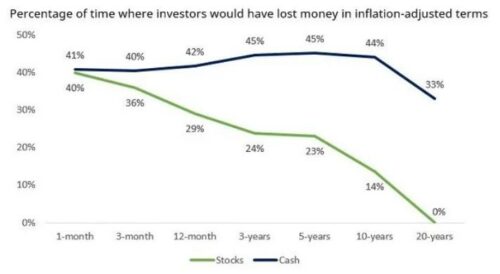

1. Stock market risk falls the longer you invest

All investments carry some level of risk, and the value of your investments can fall.

However, over the long term, the ups and downs of investment markets can smooth out. This means that the longer you invest, the less risk there is that you will lose money when you look at the long-term outcomes. This is why you should invest for a minimum of five years.

The below graph shows how the risk of losing money overall falls when you invest for a longer period. This compares to holding cash, which can lose value in real terms as the cost of living rises, which interest rates are unlikely to keep up with.

Source: Schroders

So, while you may think about withdrawing your money amid volatility, leaving your money invested could reduce the risk of your portfolio falling in value.

Your investments should reflect your risk profile, which considers several factors, such as your goals and capacity for loss.

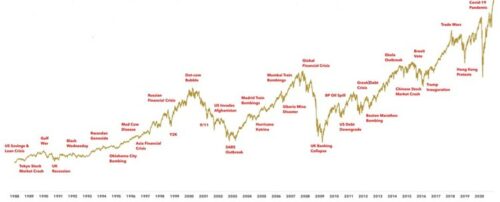

2. Markets have historically bounced back

When you’re experiencing volatility, it can seem like a one-off event. Yet, if you look back over the years, you’ll see there are often events that can seem like reasons not to invest or to change your investment strategy.

In the last decade alone, there’s been the Brexit vote, Trump’s inauguration, trade wars, and protests in Hong Kong.

During these periods, your investments may have fallen in value. Yet, if you review the long-term trend, markets have historically bounced back and gone on to deliver returns.

The graph below highlights how negative world events can cause stock markets to fall.

Source: Bloomberg, Humans Under Management. Returns are based on the MSCI World price index from 1988 and do not include dividends. For illustrative purposes only.

While there have been sharp falls, the general trend of stock markets has been upwards over the last 30 years.

Data from Schroders shows that stock market corrections, where there is a 10% drop, are not as rare as you might think either. The US market has fallen by at least 10% in 28 of the last 50 calendar years. Yet even with these dips, the market has returned 11% a year over the last 50 years on average.

3. Trying to time the market could cost you money

As stocks rise and fall, it can be tempting to try and time the market.

Everyone wants to buy stocks at a low price and sell them when the value is high. But it’s incredibly difficult to consistently predict how the markets will change.

Even if you miss out on just a handful of the best performing days of the market, you could lose out. The below table shows the returns from an investment of £1,000 between 1986 and 2021 based on leaving your money invested and missing some of the best days.

Source: Schroders

If you had invested in the FTSE 250, missing just the 30 best days over these 35 years would cost you almost £33,000.

The findings highlight why “it’s time in the market, not timing the market” is a common saying when investing. Staying the course and having faith in your long-term investment strategy makes sense for most investors.

Creating an investment strategy that’s right for you

The above graphs and table highlight why you shouldn’t panic when investment markets experience volatility.

That being said, it’s important to remember that investment performance cannot be guaranteed, and that past performance is not a reliable indicator of future performance.

Building an investment portfolio that reflects your goals and takes an appropriate amount of risk is crucial. If you’d like to talk about investing, whether you have concerns about market volatility or want to start a portfolio, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

8 things entrepreneurs can do to improve their financial resilience

More people than ever before are working for themselves and setting up businesses. It can be incredibly rewarding, but you also need to consider how it’ll affect your financial resilience.

The UK has a great spirit of entrepreneurship. According to the Office for National Statistics, around 4.8 million people (more than 15% of the labour force) is self-employed, and it’s something younger generations are continuing.

According to a report in Business Leader, 50% of new businesses set up between July 2020 and June 2021 were done so by people aged between 25 and 40.

And Generation Z, who are under 25, is already responsible for 7.8% of new companies.

The data suggests that being self-employed is going to become even more common in the coming years. The graph below shows the different types of self-employment across the UK.

Source: Office for National Statistics

If you’re among those who are self-employed, taking these eight steps can help improve your financial resilience and long-term wellbeing.

1. Set personal goals

When you’re building up connections or starting a business, it can be easy for that to become your sole focus. However, personal goals are just as important and can help you live a more fulfilling life.

Personal finance goals, like being able to pay off your mortgage or retire early, can provide motivation and ensure you have a clear direction for life outside of work.

2. Review your budget

As you’ll be responsible for your income, understanding your budget is crucial. The questions below can help you track your cash flow and make informed decisions about your spending:

- How much are you making?

- Does your income vary?

- What are your essential expenses?

- How much are you saving regularly?

3. Consider income protection

While on the subject of managing your income, how would you cope financially if you became too ill to work? While no one wants to think about being involved in an accident or having a long-term illness, it does happen.

Income protection policies can provide a regular income if you’re not able to work. You will need to pay regular premiums, but it means you can focus on recovering should something happen to you.

How much your premiums are will depend on your health, lifestyle, and level of cover required, and it can be cheaper than you expect.

Despite this, a Nationwide Building Society poll found that 3 in 10 people had nothing in place to support them financially if they couldn’t work. Many others would rely on savings, borrowing from family or friends, or using a credit card or loan.

4. Review whether critical illness cover is right for you

As well as income protection, you may also want to consider critical illness cover.

This type of policy would pay out a lump sum on the diagnosis of illnesses named within the policy. It can provide financial security if you’re diagnosed with an illness like cancer, stroke, or multiple sclerosis. You can use the lump sum however you like, from paying off your mortgage to covering day-to-day costs.

Again, you will need to pay premiums and the cost will depend on your health, lifestyle, and level of cover.

5. Don’t neglect your emergency fund

Whatever your employment status, an emergency fund is important. It provides a financial buffer in case you face unexpected costs, such as repairing your roof after a leak.

If you’re working for yourself, it can also be a useful fund if you experience a slow period or need to take time off.

How much you should hold in an emergency fund will depend on your commitments and other assets. A rule of thumb is to have three to six months of expenses in a readily accessible account.

An emergency fund is vital for building financial resilience. Yet, a report in International Adviser suggests that 51% of UK adults do not have enough emergency savings. The poll found that it wasn’t just an issue for low earners either: 23% of households earning more than £100,000 said they couldn’t cover their essential outgoings for three months.

6. Set up a pension and make regular contributions

While most employees now have a pension opened on their behalf by their employer, entrepreneurs will need to take their own steps to secure their retirement.

Opening a pension and making regular contributions is a great first step to building long-term financial resilience. As well as your own contributions, your pension can also benefit from tax relief and will be invested to hopefully deliver growth over the long term.

Understanding if you’re saving enough for retirement can be difficult. We can help you create a retirement plan that suits your goals, and balances your spending now with the future.

7. Make the most of tax allowances

Managing your tax bill can help your money go further. As an entrepreneur, there may be additional tax allowances you can make use of now or in the future.

Business Asset Disposal Relief (BADR), for example, can be used when you want to sell all or part of your business, to reduce the amount of Capital Gains Tax (CGT) you pay. Or paying yourself dividends could reduce your Income Tax liability.

Understanding tax rules and which ones make sense for you can be difficult. So, seeking professional support can mean you’re better off financially overall.

8. Set up regular financial reviews

Finally, over time your goals and financial circumstances will change. Regular financial reviews can help ensure the steps you’re taking are still appropriate and support your wider goals.

To create a financial plan that will include frequent reviews to make sure you remain on track, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The value of your investments (and any income from them) can go down as well as up, which would have an impact on the level of pension benefits available.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances. Levels, bases of and reliefs from taxation may change in subsequent Finance Acts.

The Financial Conduct Authority does not regulate tax planning.

Will disputes are on the rise. 3 things you can do to minimise the chances of your wishes being challenged

A will is the only way for your wishes to be legally enforceable when you pass away. However, it’s becoming more common for families to dispute wills. So, what can you do to ensure your will is upheld?

In most cases, a will is followed, and families will respect the wishes of the deceased. But the possibility of someone contesting your will is something you should think about.

According to a report in iNews, the number of Inheritance Act claims increased by 72% in 2021. The Inheritance Act allows a court to make orders for the provision of a spouse, child, or other dependents from a deceased person’s estate.

In addition, the number of will disputes fought in the High Court in 2020 was 192. This figure compares to 128 in 2018.

While disputes represent only a small proportion of estates, they can be costly and stressful for your loved ones. If you’re worried that someone could dispute your wishes, taking steps now to minimise the chances can provide you with peace of mind and help ensure your estate is distributed how you’d like.

Here are three things you can do.

1. Talk to loved ones about your wishes

Some disputes occur due to misunderstandings when people are grieving. In these cases, a conversation with your loved ones now can make a difference.

It can be difficult to talk about passing away and what you’d like to happen to your assets when you do, but it’s an important conversation.

It allows you to explain your decisions and provide loved ones with an opportunity to ask questions. It means that when you pass away, they won’t be surprised by the contents of your will.

You may also want to write a letter of wishes. This document isn’t legally binding, but it can be used alongside your will to provide guidance and explain what you want in your own words.

2. Take care to avoid mistakes in your will

Someone can’t dispute your will simply because they don’t like the contents, they must have valid grounds for doing so.

One common reason is that the will is not valid, and this is often due to avoidable errors. For instance, if your will is not properly signed and witnessed, someone could challenge it.

While you can write your will yourself, seeking the support of a legal professional can minimise mistakes and provide you with peace of mind.

You may want to change your will in the future. You can do this either through a codicil, which makes an official alteration to your existing will, or by writing a new will. You should make sure alterations are clear and destroy any previous wills to avoid confusion and potential reasons for disputes.

3. Make it clear you understand your decisions and have the mental capacity to make them

Other reasons for contesting a will include that you didn’t understand the decisions you were making, that they were made under duress, or that you lacked the mental capacity to make them.

Maintaining clear records about your plans and speaking to people about them can be enough to show that you understand the contents of your will. As well as family, this may include professionals, such as a solicitor. Emails to your solicitor may demonstrate your wishes and that you fully understood the implications if a dispute arises.

If you’re worried that mental capacity may be used as a reason for contesting your will, obtaining the opinion of a qualified doctor, usually your GP, can help.

A trust could provide you with an alternative way to pass on wealth

A trust isn’t the right option for everyone, but it can provide you with an alternative way to pass on wealth if you’re worried about your will being disputed.

One of the reasons you may use a trust is that you can set out rules that must be followed by the trustee, who will manage it. This may include who will benefit from the assets held in a trust and when certain assets will be distributed.

A trust can also be an effective way to pass on wealth during your lifetime.

Trusts can be complex, and they may not be the right option for you, so it’s important to seek advice.

If you’d like help creating an estate plan, from understanding your assets to how you can pass on wealth while minimising disputes, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Will writing and estate planning are not regulated by the Financial Conduct Authority.

Why good retirement planning is about more than your pension and money

If you’re nearing retirement, you may be starting to think about planning the next stage of your life.

What steps spring to mind? You may prioritise organising your pension, claiming your State Pension, or reviewing how much you have in a savings account. These steps are important for creating security, yet good retirement planning goes further than your finances.

So, what should retirement planning include? Setting out lifestyle goals is crucial for building a retirement plan that means you get the most out of your life.

Here are five questions that you should think about as you approach retirement. They can also help you get the most out of the financial planning process by ensuring your aspirations are at the heart of any decisions you make.

1. What are you looking forward to in retirement?

If you’re nearing retirement, you may be excited about the next stage of your life. Setting out what it is you’re looking forward to can help you make decisions that are right for you.

According to the Great British Retirement Survey from interactive investor, 49% of people that haven’t yet retired are looking forward to greater freedom and 42% see retirement as an opportunity for a new business or hobbies.

3 in 10 people still working think their life will improve when they retire. Pinpointing what it is that will make retirement an exciting milestone for you is crucial.

2. How will you fill your days when you retire?

While you may have big plans for your retirement, it can be easy to overlook the day-to-day when you set out your lifestyle.

Going from working full-time to having freedom can be overwhelming at first. Some retirees can find they don’t know how to fill their days initially and you may need a period of adjustment. By setting out how you’d like to spend your time before you retire, you can start building a retirement lifestyle that you find fulfilling.

3. What will give you purpose in retirement?

Much like filling your days, retiring can pose a challenge for some retirees if they feel like they’ve lost their purpose and drive when giving up work.

According to an Aegon report, just 4 in 10 people think about what gives their life joy and purpose.

Considering your driving force is a useful exercise at any point in your life and reviewing this as you retire is an important task.

4. How will you maintain social connections in retirement?

Work can play a pivotal role in your social life. So, when you retire, it can leave a gap.

Thinking about how you’ll maintain or create new social connections can improve your retirement lifestyle. That may mean making sure you stay in touch with family and friends or planning ways to get out of the house to meet new people, like joining a club that interests you.

Research from the National Institute for Health Research found that 1 in 3 people aged 50 years and over in the UK report feeling lonely. A lack of social connections can harm your mental health and has been linked to depression, so your social life in retirement is vital for your overall wellbeing and happiness.

5. Do you have any concerns about retirement?

While you may be looking forward to retirement, it’s natural to have some concerns too.

From worries about your finances to being anxious about the lifestyle change, thinking about your concerns is as important as setting out what you’re looking forward to.

It means you can address any worries that you have and put a plan in place to deal with them. By being proactive, you can really focus on enjoying your retirement to the fullest.

Using your lifestyle goals to shape your financial decisions

Lifestyle aspirations play a crucial role in effective retirement planning, but getting to grips with the finances remains important.

Having a clear idea about what you want to get out of retirement can help shape your financial decisions so they reflect your priorities.

If you want to see more of the world when you initially retire, taking a larger income from your pension during the first few years could make sense. Or if you hope to make workshops, classes, and hobbies a regular part of your schedule, including these costs in your budget can ensure you’re able to fill your days how you want.

By combining lifestyle and finances when you’re retirement planning, you can have confidence in the decisions you make. Please contact us to discuss your retirement and the lifestyle you’re looking forward to.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your older pensions could be delivering “poor value for money”, and it could cost you thousands of pounds

If you opened a defined contribution (DC) pension in the 1990s or 2000s, the charges you’re paying could be higher than comparable pensions opened more recently. Between now and your retirement, the difference could add up to thousands of pounds.

Research conducted by the Institute for Fiscal Studies found that many older DC pensions deliver “poor value for money”. Among people in their 50s, the average annual fee for a DC pension taken out in the 1990s is above 1.1%. This compares to a charge of 0.8% for DC pensions opened in the last decade.

The difference between 1.1% and 0.8% can seem small. However, over the decades your pension will be invested, it can add up.

For example, a 50-year-old with a pension worth £21,000 could have an additional £2,400 at the age of 67 if they switched from a pension charging 1.1% to one with a 0.8% fee. This example assumes that annual investment returns in the future are the same as the average over the last five years.

The larger your pension, the more you could gain by switching.

The research assessed the returns of different pensions too. It found that the higher fees of older pensions are not justified by better performance in many cases. So, if you do have an older DC pension, moving your retirement savings to another scheme could make sense.

Kate Ogden, a research economist at the Institute for Fiscal Studies, said: “It is vital that people get the most out of the retirement saving they have done over their working lives. This won’t happen automatically. Older pensions risk becoming poor value for money. The fee charges are often higher than those on pensions taken out more recently.”

In addition to potentially higher charges, older DC pensions may not be invested in the way you’d like. Asset allocation decisions you made many years ago may no longer suit your retirement plans.

Your pension should reflect your investment risk profile and other factors, like when you plan to retire.

Even if you’re no longer contributing to a pension, it’s important to continue to assess performance and engage with it to ensure it helps you reach your goals.

What value is your pension delivering?

If you took out a DC pension a long time ago, it’s likely delivering poor value for money in terms of charges. The research found four-fifths of pensions started in 2013 have a charge of 0.75% or less. In contrast, just 1 in 9 pensions opened in 1993 do.

To determine the value of your pension, you should assess what fees you’re paying and compare this to alternatives available today. It could save you thousands of pounds, which can then be invested to boost your retirement savings.

Charges are an important part of reviewing your pensions, but you shouldn’t automatically switch your pension if they are high. There may be other things that make the pension valuable, such as:

- Investment performance: You should review charges in the context of the pension’s performance. A higher charge may be justified if your retirement savings are growing at a faster pace.

- Greater flexibility: Some older pensions may allow you to access your savings sooner than newer pensions. If you want to retire early, this can provide you with more freedom.

- Guaranteed annuity rate (GAR): Some older pensions may have a GAR. Today’s annuity rates are typically lower than the 1990s and earlier, so you could receive a higher retirement income by retaining an older pension.

Before you make any decisions about your pension, you should carefully review it. Once you’ve left a scheme, you may not be able to go back, and you could lose any benefits you hold now. You may also need to pay an exit fee.

Transferring your pension

If you decide that a pension isn’t delivering value, you’ll need to find another pension scheme to move your savings to. This could be an existing pension or one with a different provider.

There are a lot of pension providers to choose from. You should consider the fees of pension schemes as well as other factors, such as the choice of investment funds on offer and past performance, although you should remember that past performance is not a guarantee of future performance.

Some providers may also have minimum or maximum contribution levels or require regular deposits.

With so many providers to choose from, it can be difficult to know which option is right for you. If you have questions about your current pension or are thinking about switching, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation, which are subject to change in the future.

Recent Comments