Month: July 2022

Investment market update: June 2022

Rising inflation and concerns about recession risks continue to place pressure on households and affect economies around the world.

The World Bank has slashed its 2022 global growth forecasts from 4.1% to 2.9%. The organisation also warned the global economy is at risk of experiencing stagflation, where economic growth is stagnant, but inflation is high.

As an investor, you may be worried about the effect the current situation could have on your portfolio and long-term plans. Remember, short-term volatility is part of investing, and you should focus on investment performance over years rather than months.

If you have any questions, please contact us.

UK

Once again, inflation reached another 40-year high in the 12 months to June. The rate of 9.4% is slightly higher than the 9.1% recorded the previous month.

The conflict in Ukraine is significantly affecting both energy and food prices, which is likely to place pressure on household budgets.

The latest economic data has led to some experts suggesting the economy will be stagnant, or even contract, in the coming quarters. The British Chambers of Commerce now expects GDP to contract by 0.2% in the last three months of 2022, while the CBI has warned there is a risk of a recession.

The Bank of England (BoE) increased its base interest rate for the fourth time this year to 1.25% in a bid to tackle inflation. The Bank also commented that it expects inflation to hit 11% in October.

In May, former chancellor Rishi Sunak unveiled a package of measures designed to support families through the period of high inflation, paid for through a one-off windfall tax on energy firms.

British Gas has criticised this step saying it will “damage investor confidence” while the industry is trying to build up green energy supplies.

Rising inflation is affecting both consumer and business confidence.

According to a survey from the Office for National Statistics (ONS), three-quarters of British adults are worried about the cost of living crisis.

It’s not surprising that many households are feeling anxious about their financial security. Further ONS data found that once inflation is considered, regular pay, which excludes bonuses, has fallen by 2.2% in the last 12 months.

A consumer confidence index from GfK suggests that people have a gloomier outlook now than they did during the pandemic or the 2008 financial crisis.

The Institute of Directors’ economic confidence index found that business confidence is at its lowest level since October 2020, which was just before the successful Covid-19 vaccine trial results were released. The pessimism was linked to inflation and the effects of Brexit.

S&P Global’s purchasing managers index (PMI) data shows the current situation is affecting businesses:

- In May 2022, UK factory growth expanded at its weakest rate since January 2021 when Covid restrictions were still affecting operations. The slowdown has been blamed on weak domestic demand, falling exports, disruptions to supply chains, and rising costs.

- The service sector is also experiencing weak growth as profit margins are being squeezed by rising prices.

Strikes across the UK are affecting business operations as well.

Public transport has been particularly affected, with train and Tube strikes expected to continue over the summer months. Barristers are also striking over legal aid fees, while other unions, including the country’s largest teaching union, are considering balloting members.

There are many reasons why workers are striking, but pay failing to keep up with inflation is among them.

The aviation industry is also facing staff challenges. A shortage in workers has led to flight chaos across the country. Hundreds of flights have already been cancelled as airlines and airports struggle to operate effectively with fewer employees. It’s left some holidaymakers stranded or out of pocket.

Mike Ashley, chief executive of the Fraser Group, continues to expand his retail empire despite the challenges facing the sector. He has purchased online fashion retailer Missguided out of administration in a £20 million deal.

Europe

Factory growth in the eurozone hit an eight-month low. Germany, often seen as a European powerhouse, saw factory orders fall by 2.3%. It’s the third consecutive monthly fall and could suggest the country will enter a recession.

While the European Central Bank (ECB) has been slower than the BoE and Federal Reserve in the US to increase interest rates to tackle rising inflation, it’s indicated that it will act in July. The plan will see key rates increase by 0.25 percentage points. It’s the first time the ECB will have increased interest rates in more than a decade.

US

Inflation in the US reached a four-decade high in the 12 months to May 2022 at a rate of 8.6%.

Matching the pattern seen in the UK and Europe, US factory growth also slowed. Production rates and new orders are still increasing but at a slower pace. Again, this was caused by falling demand and a shortage of some essential materials.

In previous months, business confidence has remained high despite the challenges. However, the rising number of jobless claims in the US could indicate that companies are letting staff go.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Inflation: What happened the last time the cost of living was rising this rapidly?

The cost of living is rising quicker than has been normal in the last few decades. Indeed, the last time inflation was this high was in the 1980s. So, what happened then compared to now?

According to the Office for National Statistics (ONS), inflation in the 12 months to June 2022 was 9.4%. As a result, the cost of living is creeping up, from your household bills to days out. The Bank of England (BoE) expects inflation to reach 11% this year before it begins to fall.

There are several key reasons why inflation is higher now. The effects of the pandemic and related lockdowns have caused the price of some items and raw materials to rise. The war in Ukraine has exacerbated this, most notably increasing energy and food prices.

While ONS data shows that average wages are rising, they haven’t kept pace with inflation. As a result, household budgets need to stretch further to accommodate rising prices and there are concerns that families tightening their belts could affect the economy.

While this will be a challenge for many, older generations may remember much higher rates of inflation.

Inflation exceeded 20% in the 1970s

While the last time inflation was as high as it is now was in the 1980s, the roots of the issue go back further.

In the mid-1970s, the inflation rate reached more than 20%. As now, rising energy prices played a significant role after oil producers increased prices sharply, which led to the cost of living soaring.

In addition, union demands and wages rising, in turn, led to companies facing higher costs and increasing their own prices. So, while wages increased, so too did household outgoings. The prices of some essential goods, such as sugar and carrots, more than doubled in just a year.

The situation led to prime minister Edward Heath declaring a three-day working week as strikes by coal miners led to a drastic energy shortage.

The result of this economic situation was a period of stagflation. This is where the economy is experiencing high levels of inflation and a stagnant economy.

It was against this backdrop that Margaret Thatcher became prime minister in 1979. She was voted in just after the “winter of discontent” that saw supply chains grind to a halt – one of her promises as leader of the Conservative party was to tackle the rampant levels of inflation.

Interest rates of 17% and curbs to public spending were used to control inflation

Just months after Thatcher became prime minister, interest rates increased. They reached a high of 17% that many people will remember well. The rising interest rates aimed to reduce consumer spending, but it placed huge pressure on people with debt, including mortgages.

This is something the BoE has done in response to inflation in 2022, although not at the same levels.

Since the start of the year, the BoE has increased its interest rate four times. After more than a decade of very low interest rates, the base rate is now 1.25% and expected to gradually rise to curb inflation.

In addition to higher interest rates, Thatcher’s government reduced the power of trade unions, lowered Income Tax rates, and cut public spending in a bid to control inflation. It was also a time when public services were privatised to reduce spending further, with the likes of British Telecom and British Airways being sold during this period.

While the policies were controversial and divisive, by the mid-1980s, inflation had fallen below 5%.

However, it came at a cost. The country was in a deep recession in 1980 and 1981. Unemployment was also high; it reached 10%, with those working in the manufacturing sector being particularly affected. The high levels of unemployment didn’t fall back to normal levels until the end of the decade.

What does high inflation mean for your plans?

It’s unlikely we’ll see the high levels of inflation and economic policy that happened in the 1970s, as the situation today is very different.

However, it’s natural to be worried about how the current circumstances may affect your long-term plans and goals. The government has already taken some measures to support the economy while inflation is high.

Keeping track of the changes and what they mean for you can be difficult, but we’re here to help ensure that your financial plan continues to reflect your priorities and the current circumstances.

If you’d like to review your finances or create a long-term plan, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

5 compelling reasons why you should share a financial planner with your family

Money and financial decisions are often seen as a personal matter. However, making your family part of the financial planning process and discussing your goals with them can be valuable.

A report from M&G Wealth found that 33% of advised families share the same adviser, with around 57% of those sharing the same adviser as their parents.

If you’re used to keeping your finances separate, it can be difficult to begin sharing an adviser and discussing opportunities or concerns you have with others. However, sharing a financial planner doesn’t have to mean sharing every detail of your financial plan, and it can help you and your family get the most out of your assets.

Here are five reasons you should think about involving your family in your financial plan.

1. Your plans are likely to be intertwined

When you set out what’s important to you, it’s likely your family will be included in some way.

By using the same financial planner as your parents, children, or other family members, you can create a plan that reflects your priorities and the situation of others more accurately.

It’s also a step that can provide peace of mind. You will know that the people important to you are receiving expert financial advice that will help them reach their goals and achieve long-term financial security.

2. It provides an opportunity to understand the situation of others

The report found that 37% of people that share a financial adviser believe being aware of the financial situation of others is a benefit.

Intergenerational wealth planning can be complex, and there are likely to be many different concerns. However, using the same financial planner can help you understand what your family is worried about and the steps that can be taken to improve their financial security.

The report highlighted how concerns are likely to vary significantly between generations.

Among baby boomers, the biggest concern was rising inflation, followed by their investments losing money. As many baby boomers will have retired, investments can provide a valuable source of income and they may not have an opportunity to grow their portfolio with further contributions. As a result, managing investments is crucial.

In contrast, millennials were most concerned about not being able to save enough. The younger generation may be struggling to get on the property ladder and put enough away for retirement as they face cost of living challenges.

3. You could reduce your family’s tax burden

Having a combined financial plan that considers a variety of goals and concerns can mean you’re able to take advantage of more tax allowances.

In the M&G Wealth survey, 35% of families said saving on tax was a positive outcome of family financial planning.

Many different allowances may be suitable for your family, from the annual exemption, which allows you to pass on up to £3,000 in a tax year without worrying about Inheritance Tax, to the Dividend Allowance.

Which ones are right for you and your family will depend on your circumstances and priorities. A combined financial plan can help you make the most out of them.

4. It can help you pass on wealth more effectively

If you want to leave wealth behind for loved ones, working together can ensure you do so more effectively.

According to the report, younger generations can expect to inherit £293 billion over the next 20 years, and it could reach as much as £5.5 trillion by 2047. With the average individual born after 1980 set to receive between £200,000 and £400,000, a holistic financial plan that considers things like Inheritance Tax, trusts, or provides advice for beneficiaries is important.

In addition, the report found that longer life expectancy means younger generations will inherit wealth later in their life, with an average age of 61. As a result, you may want to explore gifting during your lifetime to help younger members of your family to reach milestones sooner.

5. It can help you provide support to vulnerable family members

A financial plan that considers your whole family can provide vital support to vulnerable people, such as elderly relatives.

34% of people said supporting parents and grandparents was a key reason for using the same financial planner. Not only does it mean their finances are being handled by a professional, but it can also provide you with an opportunity to better understand their wishes and needs.

If you may need to make decisions on their behalf, you’re in a better position to act in line with their goals and it can take some of the pressure off you.

Contact us to discuss your family’s needs

We understand that discussing your finances with loved ones can be difficult, and there isn’t a one-size-fits-all solution for every family.

The survey found that 59% of families that share a financial adviser meet with their financial planner separately and a third have boundaries about what they want to share. Using the same financial planner doesn’t have to mean that you disclose everything, but it can help you and your family plan more effectively.

If you’d like to discuss working with your family to put in place a long-term financial plan that considers all your aspirations, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

How to protect vulnerable family members from financial abuse

Sadly, vulnerable people are more likely to be a victim of financial abuse. However, if you think a family member may be at risk, keeping an eye out for signs of financial abuse could prevent it from happening.

Financial abuse is when someone in a position of trust interferes in another’s ability to acquire, use or maintain their finances. It could be someone they know well or someone that is in a position of authority, such as a carer.

The elderly are more likely to be affected. According to charity Hourglass, at least £13 million was reported as stolen, defrauded, or coerced from older victims in 2020 alone.

People that are lonely, isolated, or in poor health are also more likely to be affected by financial abuse. AgeUK suggests that there are 1.4 million older people in the UK that are often lonely.

While financial abuse is a crime, it often goes unreported and isn’t always prosecuted. This is because it can be difficult to spot and prove.

7 signs of financial abuse to watch out for

Financial abuse can come in many forms and the signs can vary, but these seven could be red flags:

- Signatures on documents that don’t resemble previous signatures

- Sudden changes in bank account behaviour, such as the withdrawal of large sums

- The inclusion of additional names on financial accounts

- Sudden changes made to a will

- Numerous unpaid bills if someone is supposed to be handling payments on their behalf

- Unexplained transfer of assets, including material items, to a family member or someone outside of the family

- Deliberate isolation of a person from their family or friends.

Changes in behaviour and wishes don’t automatically mean that financial abuse is occurring. However, it can be a sign that you should speak to your family member and be aware of other changes that may happen.

4 useful steps you can take to reduce the risk of financial abuse in your family

1. Encourage them to name a Lasting Power of Attorney

A Lasting Power of Attorney (LPA) gives someone the ability to make decisions on their behalf if they’re unable or unwilling to do so. An LPA must be made while they have the mental capacity to make the decisions.

So, it means they can name someone they trust in case something happens. This can prevent other people from taking advantage of a situation by taking money for their own gain.

An attorney must act in the best interest of the donor.

However, iIf you suspect an attorney is trying to act beyond their powers or against the best interests of the donor, you can make a report to the Office for Public Guardian (OPG). The OPG will investigate and, if necessary, can remove the attorney by applying to the Court of Protection.

2. Speak to a solicitor to write their will

A will is the only way to set out your wishes about how you’d like assets to be passed on when you pass away. It can help reduce the risk of financial abuse as it gives a person a chance to clearly set out and record what they want.

Once a will is written, you should keep it in a safe place. This may be at home or with a solicitor.

There may be times when a person wants to make changes to their will or rewrite it. While this isn’t uncommon, if it’s unexpected it can be a sign of financial abuse.

If you have concerns that your loved one is being pressured into making changes to their will, you should contact their solicitor.

3. Help them track their income and outgoings

Regularly reviewing the income and outgoings of vulnerable loved ones can help you flag up unusual payments or suspicious activity. For example, has their regular spending suddenly increased or is their income being paid into a different account?

If your loved one is still able to make their own decisions, this is a good option as they’ll remain in control and you can sense-check their finances.

As well as current accounts that are used frequently, you should also review paperwork for pensions, investment accounts, property and so on.

4. Stay in touch with vulnerable family members

Scheduling regular calls or visits to a vulnerable family member means you’re more likely to spot signs of financial abuse. You may notice small changes in their behaviour, or they could mention something in passing that is a red flag.

What should you do if you suspect financial abuse is happening?

If you believe financial abuse is occurring, keep track of your suspicions and any evidence that you may have. You can report your concerns to the police or the adult social care team at your local council. There are also charities, including AgeUK and Hourglass, that may be able to support you if you have concerns.

You may also want to get in touch with trusted professionals that know the individual, such as their GP, solicitor, or financial planner.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Income Tax freeze means 1 in 5 could pay the higher rate by 2024/25. Here’s how you could reduce your liability

Last year, former chancellor Rishi Sunak announced that he would freeze Income Tax thresholds until 2026, and it means far more people will be paying the higher- or additional-rate tax in the future.

Coupled with the freeze, it’s anticipated that wages will rise at a faster pace than expected thanks to high levels of inflation and low levels of unemployment.

These factors could mean that you pay a higher rate of Income Tax than you expect.

According to an FTAdviser report, 1 in 10 taxpayers paid the higher rate of Income Tax in 2010/11. It’s estimated that by 2024/25, this will rise to 1 in 5.

You pay Income Tax on all your income that is above the Personal Allowance, which is £12,570 for the 2022/23 tax year. It covers most types of income you may receive, including a salary and pension. So, even if you’re no longer working, you still need to consider how much Income Tax you will be liable for and the effect your decisions will have.

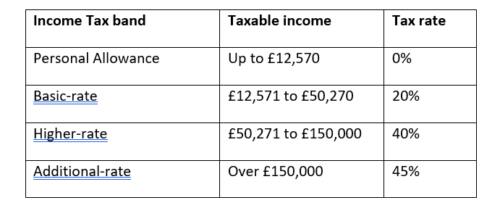

The below table shows the Income Tax thresholds and rates for 2022/23, which are expected to remain the same until 2026.

The tax rates and thresholds are different in Scotland, but inflation could still mean you’re pushed into a higher tax bracket.

5 ways you could reduce how much Income Tax you pay

Making use of allowances and managing your income can help you reduce how much Income Tax you pay, and could keep you in a lower tax bracket. Here are five options that may be right for you.

1. Take advantage of salary sacrifice schemes

If your employer offers salary sacrifice schemes, they can help to reduce your Income Tax liability.

As an employee, you give up part of your salary in exchange for other benefits, such as higher pension contributions from your employer or employer-provided childcare. As your income will be lower, salary sacrifice schemes can be used to reduce how much tax you pay and ensure your income remains below certain thresholds.

If you’re considering salary sacrifice, you should weigh up how valuable the benefits you’d receive in return are. In some cases, they may not be right for you.

2. Benefit from the Marriage Allowance

If you’re married or in a civil partnership, you may be able to take advantage of the Marriage Allowance to reduce the amount of Income Tax you pay overall as a couple.

The Marriage Allowance lets one person transfer up to £1,260 of their Personal Allowance to their partner if they don’t use it. During a tax year, this can save you up to £252.

3. Increase your pension contributions

A pension offers you a tax-efficient way to save for your future.

Contributions you make to your pension will benefit from tax relief; this effectively means the money you’ve paid in tax is added to your retirement savings. As your pension is typically invested, the tax relief could grow further.

Tax relief is available at the highest rate of Income Tax you pay. If you’re a basic-rate taxpayer, it will usually be claimed automatically on your behalf. If you’re a higher- or additional-rate taxpayer, you will need to complete a self-assessment tax form to claim the full amount you’re entitled to.

Keep in mind that you cannot access your pension savings until you reach pension age, which is 55, rising to 57 in 2028.

4. Save in a tax-efficient way

Most people don’t pay tax on the interest they earn on savings.

The personal savings allowance (PSA) is the amount you can earn in interest without paying tax on it. How much the allowance is depends on what rate of Income Tax you pay:

- Basic-rate taxpayers: £1,000

- Higher-rate taxpayers: £500

- Additional-rate taxpayers: £0

It’s estimated that the PSA means 95% of people don’t pay tax on their savings. If you’re among the 5% that could be liable, moving your savings to a tax-efficient wrapper makes sense. Each year you can add up to £20,000 to an ISA. You do not pay Income or Capital Gains Tax on interest or returns from investments held in an ISA.

5. Use dividends to create an income

If you hold dividend-paying investments or are a business owner, you may be able to use dividends to boost your income without having to pay Income Tax.

The Dividend Allowance means you can receive up to £2,000 in dividends in the 2022/23 tax year before tax is due. If you exceed this threshold, you will be liable for Dividend Tax, and the rate may be lower than your Income Tax rate.

A bespoke financial plan can help you reduce tax liability

Depending on your circumstances, there may be other steps that you can take to reduce your tax liability. For example, if you’re self-employed, you may be able to deduct some expenses from your tax bill.

Please contact us to discuss your options and create a plan that will help you get the most out of your income and assets.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Should you voluntarily pay National Insurance contributions to boost your State Pension?

The State Pension is often an important part of your retirement income, so should you top up your National Insurance contributions (NICs) to increase it?

Even if you have other pensions or income in retirement, your State Pension can be valuable. As it’ll be paid from when you reach State Pension Age for the rest of your life, it can provide some financial security that you can build on and so may affect other decisions you make.

For the 2022/23 tax year, the full State Pension is £185.15 a week

Before you consider whether you should top up your NICs, understanding how the State Pension works is important.

The State Pension is paid when you reach State Pension Age, which is currently 66 but is gradually rising. It’s expected to reach 68 by 2039.

If you’re entitled to the full State Pension, you’d receive £185.15 a week during the 2022/23 tax year.

However, this isn’t the amount everyone will receive. How many years you have on your National Insurance (NI) record will influence your State Pension.

To qualify for the full State Pension, you need to have at least 35 years on your NI record. To qualify for any State Pension, you need 10 years. If you have between 10 and 35 years on your NI record, you will receive a proportion of the full amount.

There are many reasons why you may have gaps in your NI record. You may have taken time away from work to care for an elderly relative, have a period of low earnings, or simply taken a career break to pursue other things.

As a result, you may have fewer than 35 years of NICs and won’t receive the full amount. In turn, this could mean your reliable income is less than expected.

The government’s State Pension forecast can be used to find out how much you could receive from the State Pension and when you can claim it.

If you do have a gap in your NI record, you may be able to top up your contributions and receive a greater income from the State Pension in retirement.

How to boost your State Pension income with voluntary contributions

You can usually pay voluntary NICs for the past six tax years. So, if you have a gap from the 2016/17 tax year that you want to fill in, you will need to contribute by 5 April 2023.

The standard rate of buying Class 3 NICs is £15.85 a week, adding up to £824 for a year. However, some years may cost less to top up than others as you would pay the rate from those years.

As you can usually only pay voluntary NICs for the past six years, it may be something to think about before you near retirement if you want to receive the full State Pension.

You should consider how your circumstances and plans before you retire could affect how much you will receive. For example, if you plan to retire early, could it affect how much State Pension you’d be entitled to?

If you are considering making voluntary NICs to increase your pension, you should check how much you will benefit first.

2 reasons why the State Pension is important for your retirement income

While you may be taking other steps to secure your retirement, the State Pension is often still an important part of your overall plan for two key reasons.

1. The State Pension is guaranteed

The State Pension can be paid from when you reach State Pension Age and will continue to provide an income for the rest of your life. This can provide a valuable foundation to build the rest of your decisions on.

It means that even if other forms of income stop or assets are depleted, you know you’ll at least have a basic income to fall back on.

2. The State Pension rises each tax year

Inflation means the cost of living rises, so your income will also need to increase during retirement to maintain the same standard of living.

Under the pension triple lock, the State Pension increases every tax year by either wage growth, inflation, or 2.5%, whichever is higher. This annual increase can help to maintain your spending power.

While the triple lock was temporarily suspended last year, as the pandemic affected data, pensioners could see a huge rise for the 2023/24 tax year. As the inflation rate is high and expected to keep on rising, the State Pension could benefit from a double-digit increase.

If you have any questions about retirement, from whether you should pay NICs to boost your State Pension to how to access your defined contribution pension, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Recent Comments