Category: News

Investment market update: March 2024

While inflation continues to be a challenge for many economies, there are positive signs in the UK and around the world. Read on to find out what may have affected stock markets and your investment portfolio in March 2024.

Remember, volatility is part of investing and most people should invest with a long-term outlook. If you have any questions about your investment strategy or performance, please contact us.

UK

In March, chancellor Jeremy Hunt delivered the 2024 Budget and set out the government’s spending and changes to taxation. One of the big announcements was a 2% cut to employee National Insurance, which follows a previous cut made in the 2023 Autumn Statement.

The Resolution Foundation, a thinktank, said pensioners were among the biggest losers in the Budget, as National Insurance is paid by workers but not people who are retired.

Investment bank Citigroup responded to the Budget by saying the Office for Budget Responsibility (OBR) was being too optimistic when it assumed productivity would grow by 0.9%. The organisation predicts a more modest 0.5% and said it means the UK could be “fiscally offside by around £50 – £60 billion”.

The OBR recognised that productivity has been poor since the 2008 financial crisis. In fact, growth has fallen from 2.5% a year to 0.5% – the economy would have been around 30% bigger today if the pre-2008 trend had continued.

David Miles, a member of the OBR, said the last 15 years have been so bad, that the next 5 to 10 years are likely to be a “bit better”. He particularly noted that AI could help boost productivity.

Inflation continued to fall in the 12 months to February 2024, with a rate of 3.4% – the lowest since September 2021.

Despite the positive news, the Bank of England (BoE) held its base interest rate at 5.25%. Huw Pill, chief economist at the BoE, said he believed more compelling evidence was needed before a cut would be made and it could be “some way off”.

The UK fell into a technical recession at the end of 2023, but the BoE said signs suggest it is already over.

Figures from the S&P Global Purchasing Managers’ Index (PMI) also support this. Private sector growth hit a nine-month high in February, indicating that the recession was shallow. However, the manufacturing sector continued to face challenges, with PMI data showing weak demand and supply chain disruption are contributing to a downturn.

Despite figures from the Insolvency Service indicating businesses are struggling, as insolvencies hit a 30-year high in 2023, there is some good news for investors.

The FTSE 100 – an index of the 100 largest companies listed on the London Stock Exchange – hit a 10-month high on 21 March when it increased by around 1.1%. Mining stocks were among the main risers amid expectations that the US Federal Reserve will cut its base interest rate soon.

Greggs also saw its stock rise during March. The bakery chain revealed like-for-like sales increased by 13.7% in 2023, while pre-tax profits jumped 27% to £188.3 million. The firm added it expected another year of good progress in 2024.

Europe

According to data from Eurostat, inflation across the eurozone continued to fall in February 2024, when it was 2.6% compared to 2.8% a month earlier.

While many countries in Europe are battling high inflation, Turkey’s rate of inflation has consistently been in double digits since the end of 2019. In February, it hit a 15-month high of 67%. In a bid to cool the soaring cost of living, Turkey’s central bank increased its interest rate to 50%; this compares to a rate of 8.5% just a year ago.

The pan-European Stoxx 600 index reached a record high on 13 March boosted by upbeat company results from the likes of energy supplier E.ON and retailer Zalando. Buoyant company forecasts indicate that businesses are feeling optimistic about the future.

US

Inflation in the US unexpectedly increased to 3.2% in the 12 months to February 2024. The news dampened hopes that an interest rate cut would be announced soon.

A consumer sentiment index from the University of Michigan suggests Americans have a gloomy outlook about economic conditions and prospects for the future. Pessimistic consumers might be more likely to curb their spending, which could harm businesses.

Data from the US Federal Reserve also indicates that businesses are taking a more cautious approach. Average hourly earnings increased by just 0.1% in February 2024, while unemployment reached 3.9% – the highest figure since January 2022.

Technology giant Apple saw its shares fall by around 2.5%, wiping around $70 billion (£55 billion) off the value of the company, on 4 March following an EU-issued fine. The EU fined the company €1.8 billion (£1.54 billion) after it was found to have broken competition laws by imposing curbs on app developers.

Asia

Japan’s main index, the Nikkei, hit 40,000 points for the first time on 4 March after it increased by 0.5%, partly thanks to a weak Japanese Yen helping exporting businesses. The milestone follows a strong start to the year – the Nikkei has gained almost 20% since the start of 2024 thanks to booming technology firms.

The Bank of Japan also made its first interest rate hike in 17 years and ended eight years of negative interest rates, which sought to encourage lending. The bank’s base rate increased from -0.1% to 0.1% after board members said they expected to achieve 2% inflation in the coming year after decades of deflation and stagflation.

China continues to face a property crisis, which is affecting consumer spending and lending, as well as economic growth.

The Chinese government previously cracked down on property speculation that sent prices soaring. However, the property market peaked in 2020 and has faced a downturn ever since.

According to the country’s National Bureau of Statistics, house prices continued to fall in major cities in February. The organisation said it expects real estate to remain the main drag on economic growth in 2024.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

How financial protection could offer security to parents

As a parent, your child facing an illness could affect your finances just as much as becoming ill yourself. Appropriate financial protection could offer you a safety net when you need it most, including if you need to take a long period off work to care for your child.

Read on to find out how financial protection could offer parents peace of mind and financial security if the worst should happen.

Financial protection could pay out a lump sum if your child is diagnosed with a critical illness

No parent wants to think about their child being diagnosed with a serious illness, but, while rare, it does happen.

Reviewing whether critical illness cover could provide security for your family now means that if your child suffers an illness you can focus on them, rather than worrying about your finances.

Critical illness cover pays out a lump sum if you’re diagnosed with a covered illness. If your child is diagnosed, it will usually pay out a proportion of the full amount, such as 50%. This financial safety net could mean you’re able to take time off work to care for your child or spend it enjoying time with your family.

Critical illness cover might also come with other benefits that would be valuable for your family, such as:

- Lump sum payout if your child is hospitalised following an accident

- Accommodation payments so you’re able to stay close to your child if they’re in hospital

- Childcare costs if you’re diagnosed with a critical illness.

The cost of critical illness cover will depend on the potential payout you want, as well as factors like your age and health. If you don’t pay the premiums, your cover will lapse.

Often, children will be added to your critical illness cover automatically. However, for some providers, you may need to contact them, and your premiums could rise as a result.

Your children will typically be covered from when they are a few weeks old until they’re 18, or 21 if they’re in full-time education. This can vary between providers, so it’s important to check the details when comparing options.

There might be other restrictions you need to be aware of. For example, some forms of cover will allow only one claim per child or may exclude conditions that are present at birth.

Private medical insurance could also put your mind at ease

While you’re considering taking out financial protection that would pay out if your child is diagnosed with a serious illness, you might also want to think about private medical insurance.

According to a BBC report, waiting times and staff shortages have led to public satisfaction in the NHS falling. In fact, just 24% of people polled said they were satisfied with the NHS in 2023.

If you’re worried about accessing services through the NHS, private medical insurance could offer you peace of mind. It could cut down waiting times for a range of services, such as tests and consultations, as well as more choice when deciding where your family receives treatment.

If you or your child needed to stay in a hospital, private medical insurance could also cover the cost of a private room to give you more privacy.

It’s not just physical illnesses that private medical insurance might cover either. Some providers could also give you access to mental health services, which may be valuable for your child.

Indeed, Aviva reported that the number of children and young people seeking support for their mental health increased by 25% in 2023 when compared to just a year earlier.

The cost of private medical insurance will depend on a range of factors, including who is covered, your lifestyle, and family medical history. The level of cover can vary. So, taking the time to understand how comprehensive cover is and any exclusions that might affect your family could help you choose an option that’s right for you.

Contact us if you’d like to discuss how you could prepare for the unexpected

Taking out appropriate financial protection is just one way you could prepare for the unexpected and protect your family. If you’d like to talk to us about how you could update your financial plan to reflect your priorities, please contact us.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Note that financial protection plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Cover is subject to terms and conditions and may have exclusions. Definitions of illnesses vary from product provider and will be explained within the policy documentation.

3 valuable ways business owners could extract profits

As a business owner, deciding how to extract profits from your firm could be a crucial decision. It may affect your tax liability and that of your company. Read on to understand three essential ways you could take money from your business and potential tax implications you might want to weigh up before deciding which is the right route for you.

Many business owners will use a combination of the three options below to extract profit from their business to fund their day-to-day expenses and create long-term financial security.

1. Taking a salary

An obvious way to access profit from your business is to pay yourself a salary.

Paying yourself a salary from your business could help ensure you have a regular income to cover day-to-day expenses. A reliable income source could also make some situations more straightforward, such as applying for a mortgage. So, you might want to consider your short- and medium-term plans when deciding your salary.

In addition, you may also factor in how your salary could affect your tax liability. Your salary could be liable for Income Tax in the same way as other employees.

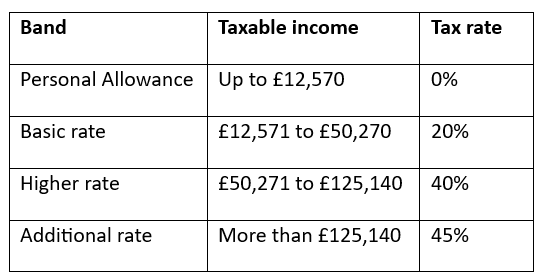

For the 2024/25 tax year, the Income Tax bands and rates are:

Income Tax allowances and rates are different in Scotland

Being mindful of the Income Tax thresholds might help you to manage your finances and avoid an unexpected bill.

As well as Income Tax, there could be other taxes and allowances you factor in. For instance, moving into a higher tax bracket could reduce your Personal Savings Allowance and lead to you paying tax on the interest your savings earn. In addition, high earners could be affected by the Tapered Annual Allowance, which reduces the amount you can tax-efficiently contribute to your pension.

If you would like to talk about the implications of your Income Tax bracket when setting your salary, please contact us.

2. Supplementing your income with dividends

Dividends could be a tax-efficient way to boost your salary. They provide a way to distribute company profits among its shareholders. So, when your business is doing well, dividends could supplement your other sources of income.

In 2024/25, the Dividend Allowance means you can take dividends up to £500 before tax is due. This allowance has fallen in recent years – it was £2,000 in 2022/23. So, if you’re a business owner who uses dividends to extract profits and haven’t reviewed your tax liability recently it could be a worthwhile task.

Dividends could prove valuable even if you exceed the Dividend Allowance due to the tax rate likely being lower than the rate of Income Tax.

The rate of tax you pay will depend on which Income Tax band(s) the dividends that exceed the allowance fall within once your other income is considered. For 2024/25, the Dividend Tax rates are:

- Basic rate: 8.75%

- Higher rate: 33.75%

- Additional rate: 39.35%

It’s not possible to carry forward your Dividend Allowance if you don’t use it in the current tax year. So, making dividends a regular part of your income could be useful.

3. Making pension contributions

Making pension contributions could help secure your long-term finances. This is because a pension is a tax-efficient way to save for your retirement – the investment returns held in a pension aren’t liable for Capital Gains Tax.

In addition, your contributions benefit from tax relief at the highest rate of Income Tax you pay. So, if you’re a basic-rate taxpayer who wants to top-up your pension by £1,000, you’d only need to deposit £800.

Usually, your pension provider will automatically claim tax relief at the basic rate on your behalf. However, if you’re a higher- or additional-rate taxpayer, you’ll need to complete a self-assessment tax return to claim the full amount you’re eligible for.

As well as contributions from your salary, you can set up employer contributions from your business to support your retirement goals.

In 2024/25, the pension Annual Allowance is £60,000. This is the maximum you can pay into your pension while retaining tax relief. However, you can only claim tax relief on 100% of your annual earnings. All contributions count towards your Annual Allowance, including employer contributions and those made by other third parties.

Remember, you can’t usually access your pension until you’re 55 (rising to 57 in 2028). So, if you’re using pension contributions to extract profits from your business you may want to consider when you’ll want to access the money and your long-term plans.

Extracting profits tax-efficiently could reduce your business’s Corporation Tax bill

As well as your personal finances, you may want to incorporate your business’s tax liability when deciding how to extract profits.

Corporation Tax is paid on the profits you make, and some outgoings are allowable expenses that could be deducted during your calculations. Allowable expenses may cover employee salaries, including your own, and pension contributions. In addition, employer pension contributions are deducted before employer National Insurance is calculated.

If your company makes more than £250,000 profit during a tax year, you’ll usually pay the main rate of Corporation Tax, which is 25% in 2024/25. If your company made a profit of £50,000 or less, then you’ll pay the “small profits rate”, which is 19% in 2024/25.

You may be entitled to “marginal relief” if your profits are between £50,000 and £250,000. The relief provides a gradual increase in the Corporation Tax rate between the small profits rate and the main rate.

Keeping these thresholds in mind when you’re extracting profits from your business could help you make decisions that are tax-efficient for both you and your company.

Contact us to talk about your personal finances

As a business owner, your personal finances might be more complex. We could offer support and create a tax-efficient financial plan that reflects your circumstances and long-term goals, including your business exit strategy. Please contact us to arrange a meeting to discuss how we can help you.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Could you face an unexpected bill now the Capital Gains Tax allowance has halved?

The gains you can make before potentially paying Capital Gains Tax (CGT) have halved for the 2024/25 tax year. If you plan to dispose of assets, the change could affect you. Read on to find out when you could be liable for CGT and some steps you might take to manage a bill.

CGT is a tax on the profit you make when you sell certain assets that have increased in value. CGT could be due when disposing of a range of assets, including:

- Shares that aren’t held in a tax-efficient wrapper

- Property that isn’t your main home

- Personal possessions that are worth £6,000 or more, excluding your car.

The amount of profit you can make during the year before CGT is due has fallen significantly over the last couple of years.

The Annual Exempt Amount has fallen to £3,000 in 2024/25

According to research from the University of Warwick, less than 3% of UK adults paid CGT in the decade to 2020. In fact, in any given year, just 0.5% of adults were liable for CGT. Yet, the total amount paid through CGT tripled between 2010 and 2020 to £65 billion.

The government has substantially reduced the amount of profit you can make before CGT is due, so the number of people paying the tax could soar over the coming years.

In 2022/23, the amount you could make before CGT was due, known as the “Annual Exempt Amount”, was £12,300. This was reduced to £6,000 in 2023/24, and from 6 April 2024, it is reduced further to just £3,000.

If your total profits during the tax year exceed the Annual Exempt Amount, your CGT bill will depend on which tax band(s) the taxable gains fall into when added to your other income. In 2024/25, if you’re a:

- Higher- or additional-rate taxpayer, your CGT rate will be 20% (24% on gains from residential property)

- Basic-rate taxpayer, you may benefit from a lower CGT rate of 10% (18% on gains on residential property) if the taxable amount falls within the basic-rate Income Tax band.

So, if you have assets to sell, considering how to mitigate a potential bill could be valuable.

6 practical ways you could reduce your Capital Gains Tax bill

1. Time the sale of your assets

The Annual Exempt Amount cannot be carried forward to a new tax year if you don’t use it. Timing the disposal of your assets could help you make use of the allowance to minimise your bill. For instance, you might hold off selling an asset until a new tax year starts if you’ve already exceeded the Annual Exempt Amount in the current year.

2. Pass assets to your spouse or civil partner

The Annual Exempt Amount is an individual allowance, and you can pass assets to your spouse or civil partner without tax implications. So, if you’ve used your Annual Exempt Amount, transferring an asset to your partner before you dispose of it to use their allowance might be an option you want to consider.

3. Use your ISA to invest tax-efficiently

An ISA is a tax-efficient wrapper for saving or investing. Returns and profits made on investments held in an ISA are not liable for CGT. So, if you want to invest, choosing an ISA may help you mitigate a tax bill.

If you already hold investments outside of an ISA, you could sell the investments and immediately buy them back within your ISA. This strategy of moving your investments to a tax-efficient account is known as “Bed and ISA”.

In the 2024/25 tax year, you can add up to £20,000 to ISAs.

4. Use a pension for long-term investments

Like ISAs, pensions offer a tax-efficient way to invest – investments held in a pension are not liable for CGT.

In the 2024/25 tax year, the pension Annual Allowance is £60,000 for most people. This is the maximum amount you can pay into your pension during the tax year while still benefiting from tax relief. However, you can only claim tax relief on up to 100% of your annual earnings.

If you’ve already taken an income from your pension or are a high earner, your Annual Allowance could be as low as £10,000. If you’re not sure what your Annual Allowance is, please contact us.

The Annual Allowance can be carried forward for up to three tax years. So, if you’ve used all your Annual Allowance in 2024/25, you may want to review your pension contribution in previous tax years.

Before you boost your pension, considering your investment goals and time frame might be essential. You cannot usually access the money in your pension until you’re 55, rising to 57 in 2028, so it isn’t the right option for everyone.

5. Manage your taxable income

As mentioned above, basic-rate taxpayers may benefit from a lower rate of CGT if the gains fall within the basic-rate tax band. As a result, managing your taxable income to stay below Income Tax thresholds once expected profits are included could slash a CGT bill.

6. Deduct losses from your gains

It is possible to deduct losses from the profits you make. You must report the losses to HMRC by including them on your tax return. When you report a loss, the amount is deducted from the gains you make in the same tax year.

If your total taxable gain is still above the tax-free allowance, you can deduct unused losses from previous tax years. If the losses reduce your gain to the tax-free allowance, you can carry forward the remaining losses to a future tax year.

Contact us to talk about your tax liability

Whether you’d like to understand how you could reduce a potential CGT bill or you want to review your financial plan with tax efficiency in mind, please contact us. We could help you identify ways to cut your tax bill in 2024/25 and beyond.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

The Financial Conduct Authority does not regulate tax planning.

More retirees may need to consider tax liability as State Pension nears the Personal Allowance

Pensioners have benefited from an 8.5% increase in the State Pension. While the boost is likely to be welcomed by many, the full new State Pension is nearing the Personal Allowance threshold. As a result, some retirees might need to consider their Income Tax liability for the first time or could be pushed into a higher tax bracket.

The full new State Pension is £221.20 a week in 2024/25

Under the triple lock, the State Pension increases each tax year by the highest of the following three measures:

- Average wage growth

- Inflation

- 2.5%

The triple lock plays an important role in preserving the spending power of pensioners. If your State Pension income remained the same throughout retirement, it would gradually buy less as the cost of goods and services increased. As you could claim the State Pension for several decades, the triple lock might play an essential role in maintaining your lifestyle.

For 2024/25, the full new State Pension increased by 8.5% (the average wage growth measure) to £221.20 a week, or £11,502 a year.

To be entitled to the new full State Pension, you need at least 35 qualifying years of National Insurance contributions or credits. If you have fewer qualifying years, you’ll usually receive a portion of the full State Pension but you still benefit from the triple lock.

If you reached the State Pension Age before 6 April 2016, your State Pension is based on the old rules that existed at that time. You might receive a lower amount if you were contracted out of the Additional State Pension.

You can use the government’s State Pension forecast if you’d like to understand how much you could receive through the State Pension and when you can claim it.

Frozen allowances could mean your tax bill increases in retirement

The government has frozen key Income Tax thresholds at 2021/22 levels until April 2028. As a result, more people are expected to pay Income Tax in the coming years as wages and the value of benefits such as the State Pension rise.

Indeed, the Office for Budget Responsibility (OBR) predicts the freeze will lead to 3.2 million new taxpayers and 2.1 million new higher-rate taxpayers by 2027/28. It’s not just an issue for workers – it could affect retirees too.

The Personal Allowance – the amount of income you can earn before tax is usually due – is £12,570 in the 2024/25 tax year, and it’s expected to remain at this level until 2028.

The latest rise under the triple lock means most of your Personal Allowance could be used by the State Pension if you’re entitled to the full amount. You’d only need to receive around £90 a month from other sources before you become liable for Income Tax. As a result, some people who haven’t paid Income Tax since retiring could now face an unexpected bill.

Similarly, the tax thresholds for paying the higher and additional rate of Income Tax are frozen until 2028. So, even if your income from other sources doesn’t increase, you could find yourself in a higher tax bracket due to the State Pension rise.

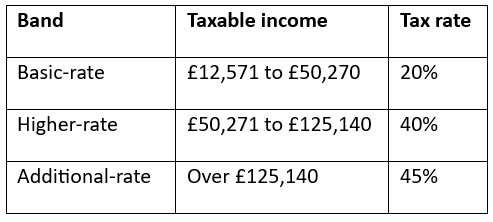

For 2024/25, the Income Tax bands are:

How to manage your tax liability in retirement

To manage your tax liability in retirement, one of the first steps is to track your income – are you nearing any thresholds that could lead to a higher bill than expected?

You might have several different income streams you need to consider, such as the State Pension, annuities, or flexible withdrawals from your pension.

Once you’ve set out your income, you can start to create a tax strategy that suits your needs.

For instance, you can usually take up to 25% of your pension as a tax-free lump sum (for most people this will be capped at a maximum of £268,275 in 2024/25), which you may spread across multiple withdrawals. This could be a useful way to access large amounts without increasing your tax bill. However, once you exceed the tax-free amount, the money you withdraw as a lump sum would usually be added to your other taxable income and could be taxed.

As a retiree, you may be in control of your income sources and could adjust them to reduce your tax liability. For example, if you take an income from your pension using flexi-access drawdown, you might choose to lower the amount so you remain below an Income Tax threshold.

You might also choose to supplement your income from other tax-efficient sources, like an ISA. An ISA offers a tax-efficient way to save and invest, so you might make withdrawals to support your day-to-day costs without increasing your tax liability.

Contact us to talk about how to improve your tax efficiency in retirement

If you’d like to understand what steps you could take to improve tax efficiency in retirement, we could help. We’ll take the time to understand your goals, lifestyle, and assets and then work with you to create a retirement plan that’s tailored to you. Please contact us to arrange a meeting.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

What you need to know about taking your pension tax-free lump sum in 2024/25

Taking a tax-free lump sum from your pension could be a fantastic way to kickstart your retirement plans. If it’s something you’re thinking about, it’s important to consider the long-term implications and understand how much you could withdraw from your pension before facing a tax bill, as the rules have changed in 2024/25.

Previously, you could take up to 25% of your pension as a tax-free lump sum. This could be through a single withdrawal or spread across several. However, following the removal of the pension Lifetime Allowance, there is now a cap.

The “Lump Sum Allowance” is £268,275 in 2024/25

In 2023, chancellor Jeremy Hunt announced the pension Lifetime Allowance (LTA) would be scrapped in the 2024/25 tax year. The LTA limited the amount of pension benefits you could build up during your lifetime without incurring an additional tax charge.

With workers now able to save more into their pension tax-efficiently during their careers, the government has frozen the limit on tax-free withdrawals from your pension.

In 2024/25, you can still usually take up to 25% of your pension tax-free – although now there is a cap on the total tax-free cash you can take. This is the new Lump Sum Allowance (LSA) of £268,275.

Your LSA may be higher if you benefit from one of the various types of LTA “protection”, such as “individual” or “fixed” protection.

Withdrawing a tax-free lump sum could harm your long-term finances

If you want to take a lump sum from your pension, the new rules aren’t the only area you might want to consider. You may also want to weigh up the effect it could have on your long-term finances.

There are plenty of reasons why you may want to take a lump sum from your pension, and some could improve your financial position in retirement. For example, you could use the lump sum to clear your mortgage or other debt, which may significantly reduce your outgoings in retirement and lead to a more comfortable and secure lifestyle.

Alternatively, you might plan to use the money to reach aspirations, like travelling the world once you stop working.

It could be a great way to fund your early retirement plans. However, taking a lump sum from your pension could have a significant effect on your long-term financial security and income. Not only will you be reducing the size of your pension but, as your pension is usually invested, you may have a smaller pot left to invest, reducing your potential for further growth.

Understanding the potential implications of taking a lump sum at the start or during your retirement could help you make a decision that’s right for you.

You may find that after taking a lump sum from your pension you’ll still be financially secure and able to reach long-term goals. If this is the result, you might feel more confident taking a lump sum and more able to enjoy your retirement.

On the other hand, if you find taking a lump sum could harm your long-term finances, you may decide to halt your plans or make adjustments to improve your financial security throughout retirement.

As a financial planner, we can help you understand what the consequences of taking a lump sum could mean for you.

On average, over-55s spend a third of their tax-free lump sum within 6 months

A 2023 survey from Standard Life found that over-55s who have taken a tax-free lump sum, on average, spend or expect to spend a third of their withdrawal within six months.

While having some cash to fall back on in retirement could be useful, withdrawing a lump sum to hold the money outside of your pension might not be financially savvy.

The money held in your pension is usually invested, so it has the potential to deliver returns during your retirement. In addition, investments held in your pension are not liable for Capital Gains Tax, so it provides a tax-efficient way to invest. If you withdraw money from your pension to hold in cash, its value could fall in real terms and you might miss out on potential long-term growth.

Of course, investment returns cannot be guaranteed and they could experience volatility. As a result, it’s important to consider your risk profile and circumstances when deciding how to manage your pension.

Setting out how you plan to use your tax-free lump sum and making it part of your wider financial plan could help you assess if withdrawing it now or in the future is right for you.

Contact us to talk about your pension withdrawals

When you’re accessing your pension, whether to take a lump sum or a regular income, you might worry about what’s right for you. Working with a financial planner could give you confidence in retirement. Please contact us to talk to one of our team about how to access your pension in a way that’s tax-efficient and aligns with your goals.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Investment market update: December 2023

Many markets rallied during December based on the expectation that interest rates will start to fall in 2024. Read on to discover what else may have affected your investment portfolio in the final month of 2023.

On 27 December, the MSCI World Stock Index, which comprises stock from nearly 3,000 companies to track global equity-market performance, was up 4.5% when compared to the start of the month. It was driven by expectations that interest rates will start to fall in early 2024.

The price of gold has also been affected by hopes that interest rates have peaked. In December, the price of gold reached a record high of $2,111.39 (£1,650.08) an ounce.

So, what else affected markets as 2023 drew to a close?

UK

Official figures from the UK paint a gloomy picture for the economy.

According to the Office for National Statistics (ONS), the economy unexpectedly shrank by 0.3% in October as both households and businesses faced pressure amid the cost of living crisis.

Chancellor Jeremy Hunt said it was “inevitable” that GDP would be subdued while interest rates are high to bring down inflation. He added that announcements made in the Autumn Statement in November mean the economy is now “well-placed to start growing again”.

However, revised figures for the third quarter of 2023 provided a further blow. Previously, the ONS said the UK posted no growth between July and September 2023, but an update reveals the economy shrank by 0.1%. Despite this, Hunt said the medium-term outlook is “far more optimistic” than GDP data suggests.

There was some positive news when it came to inflation. In the 12 months to November 2023, inflation was 3.9%, down from 4.6% in October.

Yet, the Bank of England’s (BoE) Monetary Policy Committee voted to hold interest rates at 5.25% rather than cut them. BoE governor Andrew Bailey said he was willing to do “what it takes” to bring inflation down to 2%.

While interest rates haven’t fallen yet, there are signs they could in the coming months.

The yield, or interest rate, on 2-, 10-, and 30-year UK bonds fell mid-month. Yields often fall when bond prices rise, which indicates that markets expect the BoE to start cutting borrowing costs in 2024.

Falling interest rates could provide some much-needed relief for both businesses and households that have been affected by the rising cost of borrowing. The government has also been affected.

According to the Treasury, public sector borrowing was higher than expected in November at £14.3 billion and the interest payable on central government debt hit £7.7 billion. While slightly lower than October’s figure of £8.1 billion, it’s the highest since records began in 1997 for a November.

Data indicated that businesses continue to face headwinds. The CBI reported that retail sales fell at a fast pace in the year to December, which is expected to continue into January, as consumers watched their spending.

Purchasing Managers’ Index (PMI) figures also found both the construction and manufacturing sectors are contracting. Dr John Glen, chief economist at the Chartered Institute of Procurement & Supply said the UK continued along a “fragile path” following news that manufacturing export orders fell for the 22nd consecutive month.

The FTSE 100 started the month with a 0.9% rise to 7520 points on 1 December. Mining stocks were leading risers, and homebuilders also benefited from a boost on the news that house prices could start rising again in 2024.

However, there’s no clear consensus about property prices. Indeed, Halifax predicts property prices could fall by up to 4% next year.

Europe

Data indicates that many European countries are in a similar position to the UK.

In the 12 months to November 2023, inflation across the eurozone fell to 2.4% – in the 12 months to November 2022, it was 10.1%.

However, the European Central Bank (ECB) opted to hold interest rates. The ECB’s Governing Council said: “While inflation has dropped in recent months, it is likely to pick up again temporarily in the near term.”

Nonetheless, anticipation of an interest rate cut in early 2024 led to stock markets in France and Germany rallying. France’s CAC-40 climbed as much as 0.4% to set a new record on 12 December, while Germany’s Dax also reached a new high.

PMI data for the eurozone show business activity fell sharply in December. Output fell at the fastest pace in 11 years if the early 2020 pandemic months are excluded.

As Europe’s largest economy, Germany is often used as an indicator for the area. The Ifo Institute measure of German business morale worsened in December – companies were less happy about current economic conditions and pessimistic about the future. Energy-intensive industries were found to be particularly gloomy.

US

US inflation fell to 3.1% in the 12 months to November 2023. Treasury secretary Janet Yellen said inflation is coming down “meaningfully” and she believes the current path will lead to inflation gradually declining to the Federal Reserve’s 2% target.

Employment figures suggest businesses are optimistic about the future. Federal Reserve data shows 199,000 jobs were added in November to indicate a strong labour market.

However, other figures paint a different picture. According to the Census Bureau, US factory orders fell by 3.6% month-on-month in October. In addition, a PMI reading suggests that the manufacturing sector is contracting.

Asia

Credit ratings agency Moody’s cut China’s credit outlook from “stable” to “negative”. The agency said it was due to concerns about rising debt and economic growth slowing. While the country’s credit rating remained the same at A1, the fifth highest rating, lowering the outlook suggests Moody’s could cut it in the future.

While many other developed countries are battling inflation, China has the opposite problem. Its inflation index fell 0.5% in November, showing prices are declining. Deflation could indicate that demand is low and may negatively affect businesses.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

4 insightful property market predictions for 2024

The property market experienced challenges in 2023, which may have affected your outgoings. But what could affect house prices and mortgages in 2024?

Last year, rising interest rates as the Bank of England (BoE) sought to tackle high inflation led to millions of homeowners facing soaring mortgage costs. This had a knock-on effect, with some people struggling to secure a mortgage due to affordability tests and property sales falling in some areas as a result.

Some of the key trends in 2023 are set to continue into the new year. Here are four property market predictions for the 12 months ahead.

1. The Bank of England expects to lower its base interest rate towards the end of 2024

In November 2021, the BoE’s base rate was at a historic low of 0.1%. With several factors, including the war in Ukraine and the after-effects of the Covid-19 pandemic, leading to soaring inflation, the base rate was increased throughout 2022 and 2023. As of December 2023, the BoE’s base rate is 5.25%.

The rising base rate has a direct effect on the outgoings of many mortgage holders. Even a seemingly small difference in the interest rate you pay can add up.

If you have a £200,000 repayment mortgage with a 25-year term, assuming the interest rate remained the same, you’d pay:

- £1,002 a month and around £100,477 in interest over the full term if the rate was 3.5%

- £1,228 a month and around £168,424 in interest over the full term if the rate increased to 5.5%.

The good news is that inflation is starting to fall. Data from the Office for National Statistics show inflation was 3.9% in the 12 months to November 2023.

In a report, the BoE’s Monetary Policy Committee said it expects the base rate to remain at 5.25% until the third quarter of 2024. It then anticipates that it will gradually fall to 4.25% by the end of 2026.

2. Halifax predicts house prices will fall by up to 4% in 2024

According to data from Halifax, house prices “held up better than expected” in 2023. Property prices fell by just 1% last year and the average home was valued at more than £280,000.

The lender noted this resilience was linked to a shortage of available properties, rather than strong demand from buyers.

Halifax expects house prices to fall by between 2% and 4% over the next 12 months due to “economic challenges”. However, it notes that as interest rates ease and affordability improves, the market could partially recover.

3. Short shelf-life of mortgages could continue to affect borrowers

Changes to interest rates and competition meant that lenders vigorously reviewed their deals in 2023. In fact, in December, the average mortgage deal had a shelf-life of just 17 days, according to Moneyfacts.

With interest rates expected to start falling, it’s a trend that could continue into 2024.

While new mortgages on the market could provide you with more choices, it can be difficult to navigate. There’s also the risk that a deal you were interested in is pulled from the market before you have a chance to apply.

Working with a mortgage broker could help you find deals that are right for you, even if they’re changing quickly.

4. A survey suggests a significant proportion of landlords plan to reduce their portfolio

Soaring interest rates over the last two years have affected buy-to-let mortgage holders.

In addition, the Renters Reform Bill is expected to progress in parliament in the coming months. The bill represents a significant piece of legislation that proposes to abolish section 21, also known as “no-fault evictions”. Other proposals in the bill include doubling the notice period for rent increases to two months, giving tenants more rights to keep pets in properties, and a requirement for private landlords to join a government-approved ombudsman.

As a result, some landlords are reassessing if the property market is right for them.

According to a report in IFA Magazine, 1 in 4 landlords plan to reduce their portfolio in 2024. The survey also highlighted other struggles that may lead to landlords selling their properties, including maintenance requests (28%), tenant conflicts (20%) and finding suitable tenants (17%).

Get in touch if you’ll be searching for a mortgage in 2024

If you’ll be taking out a new mortgage this year, whether you’re moving into a new property or could benefit from remortgaging, please contact us. We’ll help you search the mortgage market to find a deal that suits your needs.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Fraudsters used “social engineering” to steal £580 million in the first half of 2023

While the amount stolen by fraudsters fell slightly in the first six months of 2023 when compared to the same period in 2022, a staggering amount was still lost to scams. The latest figures from UK Finance show £580 million was stolen by criminals.

Advanced security systems used by banks prevented £651 million from being stolen in the first half of 2023. Yet, despite these efforts, thousands of people are still falling victim to scams that could have a devastating effect on their emotional and financial wellbeing.

Indeed, the Great British Retirement Survey 2023 found that 1 in 12 people have lost money due to financial scams in the past three years. Interestingly, the findings suggest younger generations could be more likely to fall for a scam – 15% of respondents aged under 40 said they’d lost money due to fraud.

Fraudsters are using authorised push payments to scam victims

According to the UK Finance report, criminals often focus their attempts on “socially engineering personal information” to commit authorised push payment (APP) fraud in which the victim is encouraged to make the payment themselves.

Usually, APP fraudsters use online platforms, mobile phone networks, or social media to trick victims into transferring their money. Two common scenarios UK Finance highlighted were:

- Purchase scams where people make a payment for goods they believe are genuine. The amount of money lost is typically lower than other forms of scams – purchase scams represent around 66% of APP fraud but account for 17% of total losses.

- Investment scams may be encouraged to transfer substantial amounts to secure “high returns”. As a result, they account for nearly a quarter of all APP losses reported – the largest proportion of all APP scam types. In the first half of 2023, £57.2 million was lost to investment scams.

Fraudsters might also claim to be from legitimate organisations, such as HMRC or the police, in an attempt to gain personal information or your trust.

Even if APP fraud is not successful, the scammer may have obtained enough personal details to impersonate their victim. It may allow them to take control of existing accounts or open new lines of credit.

While your bank may compensate you if you fall victim to a scam, this isn’t guaranteed. So, it’s important to take precautions to protect your wealth when you’re making payments.

3 useful steps to take that could help you avoid authorised push payments

1. Be cautious of unsolicited contact

If you’re contacted out of the blue, be cautious. Fraudsters may contact you via phone, email, or social media in an attempt to build a rapport.

Scammers may offer attractive opportunities, such as investments with “guaranteed returns” or a way to access your pension early or without paying tax. Remember, if it sounds too good to be true, it probably is.

If an individual or organisation that you don’t know contacts you about investments, pensions, or another financial area, it could be a red flag.

Genuine financial service providers will understand why you’re taking precautions if you request additional information, so don’t be afraid to ask. You can also use the Financial Conduct Authority’s register to check the credentials of regulated individuals or firms, as well as their contact information.

2. Clarify payment details with service providers

Large transactions may attract fraudsters who might intercept communications or send you misinformation.

For example, if you’re buying a property, criminals may pose as your solicitor and inform you that their payment details have changed. It could lead to you sending large sums of money to the wrong account.

While verifying details might seem like a task you can skip, it could prevent you from falling for a scam. A quick phone call could put your mind at ease and mean you’re less at risk.

3. Don’t rush financial decisions

A common tactic fraudsters use is to put pressure on you to make a quick decision. If you’re feeling rushed, you’re less likely to spot red flags or review financial opportunities objectively.

So, if you’re weighing up an investment opportunity and your contact tells you it is a time-limited offer or sends a courier to your home with paperwork to sign immediately, take a step back.

Legitimate financial professionals will understand the importance of reviewing your options and deciding if an opportunity is right for you.

Contact us if you’re concerned about scams

If you’ve been targeted by a scam, you can contact Action Fraud to report it. You may also want to get in touch with your bank or other financial provider, as they may be able to halt or trace a transaction.

You can contact us if you’re considering an opportunity and aren’t sure if it’s a scam or right for you. Sometimes a different perspective may highlight potential red flags you might overlook initially.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Why the numbers are essential for successful financial planning

When creating a financial plan, you often start with your goals. After all, setting out your aspirations first lets you create a plan that’s tailored to you. Yet, understanding your numbers is just as crucial for successful financial planning and they could help you understand the effect of your decisions.

So, which numbers are the key ones you should know?

Which numbers you may want to track will depend on your goals

To keep your financial plan on track, monitoring key numbers can help you assess your progress and identify potential gaps. Read on to discover which numbers could be important in two different scenarios.

Ensuring your family’s financial security

If you have a family, a key priority might be to ensure their long-term financial security. You might want to set money aside to pay for milestones, like helping children go to university. You may also be worried about what would happen if you faced a financial shock.

So, questions like those below could help you highlight the key numbers that will allow you to create a financial plan that reflects your circumstances.

- What are your household’s day-to-day expenses?

- What is the value of your family’s large financial commitments, such as a mortgage?

- What is the value of planned one-off costs?

- How much do you have saved in an emergency fund?

- What percentage of your income is protected?

The answers to these questions may highlight things like a gap in your financial safety net that could mean your family is vulnerable to a shock. Or that you may benefit from putting money aside to pay for one-off costs, like supporting your child’s homeownership goals.

Planning for your retirement

When you’re planning for retirement, there are several key numbers you might need to consider. For example, the answers to these questions could be important:

- How many years or months until you hope to retire?

- What percentage of your income are you contributing to your pension?

- How much income do you need in retirement, and how much will it need to increase to maintain your spending power?

- How long will you spend in retirement?

With these numbers you may be able to start creating a plan that provides you with financial stability and peace of mind throughout retirement. Again, the results could help you identify potential gaps or indicate where you may need to compromise.

Key numbers could help you forecast how your wealth will change

Cashflow modelling could help you see how your wealth and assets may change over the long term.

To start, you input key information, such as your income, the value of your assets, or how much you are contributing to your pension each month. You can then see how your wealth might change over the years.

This is where knowing your numbers is important. Cashflow modelling is only as good as the data you input. So, taking time to understand the value of your assets and financial needs could be essential.

Once you’ve added the figures, you can use cashflow modelling to see the outcome of different scenarios. For instance, how would:

- Your retirement income change if you increase your pension contributions?

- Different investment returns affect your long-term wealth?

- Gifting a lump sum to a loved one affect your long-term financial security?

So, it can be used as a way to understand how the decisions you make now could affect long-term plans.

The results of cashflow modelling cannot be guaranteed as the outcomes will be based on some assumptions, such as investment returns. However, it can provide a useful way to visualise how your financial decisions could affect your long-term wealth.

Regular reviews to update your numbers could be valuable. It also presents an opportunity to ensure your financial plan continues to reflect your goals. Over time, your aspirations might change, and, as a result, you may want to adjust your financial plan or the data used in your cashflow model.

Contact us to talk about your key numbers and how they could help you reach your goals

We can work with you to create a tailored financial plan that reflects your aspirations. Taking a bespoke approach could mean you feel more confident about your current finances and how they’ll change in the medium and long term.

With regular financial reviews to track key numbers, you can focus on what’s most important to you. Please contact us to arrange a meeting.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate cashflow planning.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

Recent Comments