Category: News

Investment market update: March 2025

Trade wars and fears that tariffs could spark recessions meant investment market volatility continued in March 2025 and the start of April 2025. Read on to find out more about some of the factors that may have affected the value of your investments recently.

Tariffs imposed by US President Donald Trump affected markets negatively and, as other countries react to the measures, there continues to be uncertainty.

While market volatility and periods of downturn can be worrisome, remember it’s part of investing. Historically, markets have delivered returns over long-term time frames, even after periods of downturn, and often sticking to your investment plan makes financial sense. So, if you’re tempted to react to the news, reviewing your long-term plan and goals could be useful.

UK

Chancellor Rachel Reeves delivered the Spring Statement at the end of March, setting out the government’s spending plans, against a challenging backdrop.

The UK economy contracted by 0.1% in January 2025 when compared to a month earlier following a decline in factory output. In addition, while the rate of inflation is declining, at 2.8% in the 12 months to February 2025, it’s still above the Bank of England’s (BoE) 2% target.

The news prompted the BoE to hold its base interest rate at 4.5%, which will have disappointed households and businesses that were hoping for a cut to ease the cost of borrowing.

Data from Purchasing Managers’ Indices (PMI) was pessimistic too.

According to S&P Global, the manufacturing sector continues to face tough conditions. The headline figure was 46.9 in February. It’s the fifth consecutive month that the reading has been below the 50 mark which indicates growth. There were declines in output, new orders, and employment.

The construction data was similar, with the headline figure falling to 46.6, the biggest downturn since 2009 aside from the 2020 pandemic. There were steep declines in housebuilding and civil engineering activity.

Despite speculation that Reeves would increase taxes and reduce tax thresholds or exemptions, the Spring Statement focused on cutting the welfare budget. Indeed, the announcements made in the 2024 Autumn Budget remain intact.

Investment markets were affected by US trade wars and the war in Ukraine.

On 3 March, European leaders met in London for a summit to draw up a Ukraine peace plan. The meeting led to the pound and European stock market soaring as investors hoped for a resolution. Perhaps unsurprisingly, defence stocks saw the biggest gains, including the UK’s BAE Systems, which jumped by more than 14%.

However, the boost was short-lived. On 4 March, trade wars between the US and Canada, Mexico, and China triggered a drop of 1.27% on the FTSE 100 – an index of the 100 biggest companies on the London Stock Exchange.

There was an uptick in optimism towards the end of the month.

On 24 March, investors hoped that President Donald Trump would show flexibility ahead of the unveiling of new global tariffs in April. The FTSE 100 opened 0.5% up, with mining stocks leading the rally – winners included Anglo American (3.9%), Antofagasta (3.3%), Glencore (3%), and Rio Tinto (2.5%).

However, in early April, Trump unveiled tariffs on many countries, including the UK, which led to markets falling.

However, in early April, Trump unveiled tariffs on many countries, including the UK, which led to markets falling.

Europe

Data from the European Central Bank (ECB) shows inflation is moving closer to the 2% target. It was 2.4% in the 12 months to February 2025 across the eurozone.

The news prompted the ECB to cut the base interest rate by a quarter of a percentage point to 2.25%.

Data suggests the wider European economy is facing similar challenges to the UK.

Indeed, S&P Global PMI figures show a factory downturn. In addition, the headline PMI figure fell from 45.5 in January to 42.7 in February. Worryingly, the two largest economies in the EU, Germany and France, experienced the sharpest downturns.

The Euro Stoxx Volatility index, which tracks investor uncertainty, found stock market volatility hit a seven-month high in February and has more than doubled since mid-December 2024 due to investors feeling nervous about the global outlook.

So, it’s not surprising that there have been ups and downs for investors.

The 3 March summit in London benefited wider European stock markets. Again, defence stocks saw the biggest gains – Germany’s Rheinmetall, France’s Thales, and Italy’s Leonardo all saw an increase of at least 14%.

Expectations that US tariffs will hit the automaker industry led to stocks in the sector falling on 4 March. Among the shares affected were tiremakers Continental, which saw a 9% drop, as well as Daimler Truck (-6.6%), BMW (-5.5%), and Mercedes-Benz (-4.5%).

Similar to the UK, European markets were negatively affected by US tariffs at the start of April.

Similar to the UK, European markets were negatively affected by US tariffs at the start of April.

US

US inflation is nearing the Federal Reserve’s 2% target after a rate of 2.8% was recorded in the 12 months to February 2025.

However, there was negative news from the labour market. According to the Bureau of Labor Statistics, the unemployment rate edged up to 4.1% in February.

PMI readings for the manufacturing sector also reflected this trend. New orders fell in February and companies continued to lay off staff, which may suggest they don’t feel confident in the future. Yet, the sector has grown for two consecutive months.

On 3 March, in contrast to Europe, Wall Street dipped slightly. The technology-focused Nasdaq index was down 0.8% and the broader market indices Dow Jones and S&P 500 both fell 0.3%.

The following day, Trump declared 25% tariffs on imports from Canada and Mexico and 10% tariffs on imports from China. The news led to the dollar weakening, and indices tumbling further – the Nasdaq fell 2.6% and S&P 500 was down 1.7% – and the declines continued into the next week.

Technology stocks in particular have been hit hard by the market volatility. AJ Bell warned since the start of 2025, $1.57 trillion (£1.21 trillion) had been wiped off the value of the Magnificent Seven – seven influential and high-performing US technology stocks – as of 4 March.

Carmaker Tesla is among the biggest losers. As of mid-March, its share price had halved since it benefited from a post-election rally at the end of 2024, which has partly been driven by sales in the EU falling by almost 50%.

Once again, the uncertainty caused by trade wars led to volatility in the US markets.

Once again, the uncertainty caused by trade wars led to volatility in the US markets.

Asia

As a country with a trade surplus and a large US market, tariffs are expected to hamper growth in China.

China’s GDP target is 5% for 2025, the same target it hit in 2024. However, economists believe replicating this in 2025 will be difficult. China succeeded in reaching the 2024 target thanks to an export boom at the end of the year – exports increased by 10.7%, as some businesses tried to beat the expected tariffs.

In contrast, between January and February 2025, Chinese imports fell by 8.4% year-on-year after economists had expected growth of 1%. The data might suggest that Chinese manufacturers are cutting back on buying raw materials and parts due to trade concerns.

Tariffs imposed by the US led to China unveiling similarly high tariffs at the start of April. The trade war is likely to affect China’s economy and its ability to reach GDP goals in 2025.

Tariffs imposed by the US led to China unveiling similarly high tariffs at the start of April. The trade war is likely to affect China’s economy and its ability to reach GDP goals in 2025.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

4 reasons to remain calm amid market volatility and uncertainty

Geopolitical tensions have led to a bumpy start to 2025 for investors. If you’re worried about volatility and what it might mean for your long-term finances, there are reasons to remain calm despite the uncertainty.

The ongoing war in Ukraine has resulted in some anxiety in Europe, with the UK and other countries committing to increasing defence spending. In addition, the new Trump administration in the US has imposed several trade tariffs on partners and suggested more will follow.

As a result, many companies and sectors have seen share prices rise and fall more sharply than usual.

Indeed, according to the Guardian, the euro STOXX equity volatility index, which tracks market expectations of short- and long-term volatility, reached a seven-month high at the start of March 2025. The index has almost doubled since mid-December 2024, suggesting investors are feeling nervous.

As an investor, these external factors are likely to have affected the value of your investments over the last few months.

Investment markets don’t like uncertainty

Uncertainty is one of the key factors that contributes to volatility in investment markets.

Unknown policies or other events can make it difficult to understand how a company will perform financially over the long term. This uncertainty can affect the emotions of investors, who may be more likely to make knee-jerk decisions as a result.

Imagine you hold investments in an electronic goods company based in China. In the news, you read the US will impose a 10% tariff on all Chinese goods. As a major export market, this decision by the US could significantly affect the profitability of the company.

After hearing the news, you might worry about your finances and whether you should still invest in the company. If enough investors act on these concerns, it may result in the value of the shares in the company falling.

With so much global uncertainty at the moment, your investments and the wider market could experience more volatility than usual in the coming months.

Level-headed investors could improve investment outcomes over the long term

While it may be difficult, remaining level-headed during times of uncertainty could make financial sense. Here are four reasons to remain calm.

1. Periods of volatility have happened before

When markets are volatile, it may feel unusual or unexpected. However, market volatility is a normal part of investing.

While investment returns cannot be guaranteed, historically, markets have delivered returns over a long-term time frame. Even after downturns, markets have bounced back.

Remembering this could help put your mind at ease and allow you to focus on the bigger picture rather than short-term market movements.

2. Diversified investments could smooth out volatility

Newspaper headlines are designed to grab your attention, and they’re likely to focus on the parts of the market that are experiencing the greatest volatility. For example, you might read that “technology stocks have plunged 10%” or “markets in Japan are booming”.

While these headlines aren’t inaccurate, they don’t tell you the whole story.

In reality, a balanced investment portfolio will typically include investments across a range of assets, sectors and geographical locations.

So, while a fall in technology stocks might affect you, it may not have as large of an effect as you expect if you only read the headlines. Gains or stability in other areas of your investment portfolio could balance out the dip.

3. Market volatility may present an opportunity to buy low

If you’d previously planned to invest a lump sum or you invest regularly, market volatility may cause you to rethink. However, halting your investments might mean you miss an opportunity.

When markets fall, you might have a chance to invest when the price of stocks and shares is lower, allowing you to buy more units for your money. Over the long term, this could lead to better yields.

While investing during a low period could result in higher returns over the long term, you should ensure investments are appropriate. You may want to consider your financial risk profile and wider circumstances when deciding how to invest your money.

4. Trying to time the market can prove costly

Finally, if you’re focused on what the market is doing today, it can become tempting to try and time the market – to buy low and sell high.

However, with so many external factors affecting markets, it’s impossible to consistently time it right. Even professionals, who have a team and resources, don’t always get it right.

Rather than trying to time the market, remaining calm and sticking to your long-term investment strategy is often a better course of action.

Contact us to talk about your investments

If you have any questions about how your investments are performing or would like to review your investment strategy, please get in touch. We’re here to answer your questions and help you feel confident about your financial future.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Half of adults reconsidering their retirement plans ahead of 2027 Inheritance Tax changes

An incoming change to the way pensions will be taxed when they’re inherited might mean you’re rethinking how you use your pension. Before you dive into updating your retirement plan, it’s important to understand what the changes could mean for you and how to balance passing on wealth with your retirement aspirations.

During the Autumn Budget in October 2024, chancellor Rachel Reeves announced that from April 2027 unspent pensions are likely to be included in Inheritance Tax (IHT) calculations. The government predicts the move will affect around 8% of estates each year.

In 2025/26, if the value of your entire estate is below £325,000, no IHT will be due. This is known as the “nil-rate band”. In addition, if you leave your main home to direct descendants, you may also benefit from the residence nil-rate band, which is £175,000 in 2025/26. Both thresholds are frozen until April 2030.

Your estate covers all your assets, such as property, savings, and material items. Currently, pensions fall outside of your estate, but you may want to consider how the value might change once pensions are included ahead of the new rule in 2027. Reviewing your retirement and estate plan could help you identify ways to improve long-term tax efficiency.

According to a February 2025 survey from interactive investor, 54% of UK adults are already planning to adjust their retirement or estate plan in response to IHT changes.

3 ways you might adjust your retirement plan to reflect Inheritance Tax changes

If the inclusion of your pension in your estate could increase the amount of IHT due, you might decide to update your retirement plan. Here are three options you could consider.

1. Spend more in retirement

The IHT changes could provide an excellent opportunity to update your retirement plan and consider what’s possible. Spending more of your pension during your life may bring the value of your estate under IHT thresholds or reduce a potential bill.

In the interactive investor survey, 19% of respondents said they plan to withdraw more money from their pension and gifting it (more on this later). What’s more, 6% are thinking about retiring earlier than previously planned.

So, if you want to deplete your pension during your lifetime, rather than leaving it as an inheritance, what would you do? You might start to think about a once-in-a-lifetime trip or how an income boost could allow you to do more of the things you enjoy, whether that’s visiting the theatre, supporting good causes, or keeping active.

Of course, spending more often needs to be balanced with long-term sustainability. A financial plan could help you understand if increasing pension withdrawals in retirement may lead to you running out of money later in life.

One thing to keep in mind is how increasing pension withdrawals could increase your Income Tax liability in retirement.

Your pension withdrawals will be added to other sources of income when calculating your Income Tax bill. As a result, taking a higher income from your pension could unexpectedly push you into a higher tax bracket.

2. Use your pension to gift wealth to your loved ones

If you’d previously planned to leave your pension to loved ones as an inheritance, gifting during your lifetime could provide a solution. You might withdraw a regular income or a lump sum to pass on to your beneficiaries.

A gift during your lifetime could be more beneficial to your loved ones than an inheritance later in life. It may allow them to purchase their first home, get married, pay education fees, or simply improve their day-to-day finances.

When gifting wealth, you may need to consider the “seven-year rule”. If you pass on assets and die within seven years of the gift being given, the asset could be included in your estate for IHT purposes. So, gifting during your early years of retirement could make sense if your goal is to reduce a potential IHT bill.

Again, keep in mind that withdrawing lump sums from your pension might increase your Income Tax liability and that gifting could affect your long-term financial security.

3. Reduce your pension contributions

8% of participants in the interactive investor survey suggested they planned to cut pension contributions due to the IHT changes.

For some people, this might be the right decision. For example, if you’ve already built up enough pension wealth to support yourself throughout retirement and you’d like to divert your money to other assets you could pass on tax-efficiently. However, it’s important to carefully assess your options to prevent knee-jerk decisions.

While your unspent retirement savings could become liable for IHT when you pass away, pensions are often tax-efficient in other ways. For instance:

- Your pension contributions will typically benefit from tax relief

- You can normally withdraw 25% of your pension (up to £268,275) tax-free

- Returns generated from investments held in your pension are not usually liable for Capital Gains Tax.

So, while your pension’s value may affect your estate’s IHT liability, maintaining, or even increasing, pension contributions could be tax-efficient when you look at them in the context of your wider financial plan.

Get in touch to talk about your pension and estate plan

If the incoming changes mean you’re unsure how to manage your pension or pass on wealth to loved ones, please get in touch. We can work with you to create or adjust a tailored financial plan that considers your circumstances and goals as well as regulation.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

The Financial Conduct Authority does not regulate estate planning or Inheritance Tax planning.

5 strategies that could help you avoid running out of money in retirement

Worrying about your finances in retirement could dampen your excitement as you start the next chapter of your life. As you’ll often be responsible for generating your own income once you give up work, it’s not surprising that a February 2025 report from Which? revealed half of over-55s are worried about running out of money.

Indeed, just 27% of those who have retired or are nearing the milestone said they weren’t concerned about draining their pension or other assets in retirement.

Some apprehension about your finances as you retire is normal.

Retirement is likely to represent a significant shift in how you create an income. No longer will you receive a regular wage for your work. Instead, you’ll often start depleting your assets, such as your pension, savings, or investments. As you can’t predict how long your assets need to last, it may be difficult to assess if the income you create is sustainable.

Here are five strategies that could give you confidence in your retirement finances, so you’re able to focus on what’s most important – enjoying this next stage of your life.

1. Consider inflation before you retire

A key obstacle when planning your finances in retirement is that inflation often means your outgoings will increase.

According to the Bank of England, between 2014 and 2024, average annual inflation was 3%. So, an income of £35,000 in 2014 would need to have grown to almost £47,000 to maintain your spending power in 2024.

As a result, if you planned to take a static income throughout retirement, you could face a growing income gap in your later years or deplete assets at a faster rate than you anticipated.

As part of your retirement plan, a cashflow model could help you visualise how your income needs might change, and the effect this would have on the value of your assets. While the outcomes cannot be guaranteed, it could highlight where you might face potential shortfalls and allow you to take steps to improve your long-term financial security.

2. Keep an eye on retirement lifestyle creep

It’s not just inflation that could affect your outgoings. Lifestyle creep, where you spend more on luxuries, could have an effect too.

As you may be in control of how much you withdraw from your pension, it can be easy to slowly increase the amount so you can indulge in an exotic holiday, new car, or regular days out. Over time, these luxuries can become new necessities in your mind and part of your normal budget.

Spending more in retirement isn’t necessarily negative. However, increasing your spending without considering the long-term consequences might mean you face an unexpected shortfall in the future. Regular financial reviews during your retirement could help you keep an eye on lifestyle creep that may be harmful.

3. Assess if investing in retirement is right for you

In the past, it wasn’t uncommon for retirees to take their money out of investments to reduce exposure to market volatility. However, keeping some of your money, including what’s held in your pension, invested might make financial sense for you.

Retirements are getting longer. With the average life expectancy of a 65-year-old now in the 80s for both men and women, you could spend three decades or more in retirement. So, continuing to invest with a long-term time frame during retirement could help grow your wealth and mean you’re at less risk of running out of money.

It’s important to choose investments that are appropriate for you and recognise that investment returns cannot be guaranteed. If you’d like to talk about investing in retirement, please get in touch.

4. Be proactive about retirement tax planning

While you might no longer be working, you’re very likely to still pay Income Tax in retirement. Indeed, according to the Independent, in March 2025, retired baby boomers were paying more Income Tax than working people under 30.

If your total income exceeds the Personal Allowance, which is £12,570 in 2025/26, Income Tax will usually be due. With the full new State Pension providing an income of £11,973 in 2025/26, most retirees will pay some Income Tax even if they’re only taking small sums from their personal pension.

It’s not just Income Tax you might be liable for either. You might need to pay Capital Gains Tax if you sell assets and make a profit or Dividend Tax if you hold shares in dividend-paying companies.

An effective retirement plan could identify ways to reduce your tax bill, so you have more money to spend how you wish and are less likely to run out during your lifetime.

5. Maintain an emergency fund throughout retirement

During your working life, you may have had an emergency fund in case your income stopped or you faced an unexpected expense. In retirement, a financial safety net might still be important.

Having a fund you can fall back on in case you need to pay a large, unforeseen cost, like property repairs, could be essential for keeping your retirement finances on track.

In addition, it may be prudent to contemplate how you’d fund the cost of care if it were needed. According to an August 2024 report from the Joseph Rowntree Foundation, the number of older people unable to perform at least one instrumental activity of daily living without help will increase by 69% between 2015 and 2040.

This rise is partly linked to a growing population of elderly people and rising life expectancies leading to more people relying on informal care, such as family members, or formal care, like a nursing home.

Whether you need to pay for care will depend on a variety of factors, such as the value of your assets and where you live. However, in most cases, you’ll often need to pay for at least a portion of the costs if you require formal care.

So, considering care when you assess your emergency fund could be essential. Knowing you have the savings to pay for care could provide you with peace of mind and mean that should it be required, you have more options to explore, such as choosing a care home with facilities you’d enjoy or one that’s easily accessible for loved ones.

Get in touch to discuss your retirement finances

As your financial planner, we could work with you to build a retirement plan that reflects your circumstances and goals. Whether you’re worried about running out of money or you have other concerns, we’re here to listen and discuss your options. Please get in touch to arrange a meeting.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

The Financial Conduct Authority does not regulate cashflow planning.

Why an effective financial plan might involve spending more

When people think about financial wellbeing, they often link it to frugality or building wealth. Yet, an effective financial plan isn’t always about that, sometimes, it might make sense to spend more.

It can be difficult to get your head around. After all, as a child, you’re often taught that being sensible with money means putting it in a savings account rather than spending it. Yet, this approach only focuses on growing your wealth, rather than using it in a way that helps you reach your goals.

So, here are three scenarios where your financial plan might involve increasing your outgoings.

Spending more could help you reach lifestyle goals

At the heart of your financial plan should be your lifestyle goals – how do you want to use your time and what makes you happy?

To reach these goals, you might need to spend more. Perhaps you enjoy getting creative and want to attend regular art classes, or maybe you love to attend gigs across the country so want to boost your disposable income to see more of your favourite bands.

Of course, simply increasing your spending could lead to a shortfall later in life. This is why making it part of an effective financial plan is important.

Working with a financial planner could help you assess how the decisions you make today, including spending more to reach your lifestyle goals, could affect your future income.

You might find that you’re in a position to boost your disposable income to spend more on the things you enjoy.

If spending more to reach lifestyle goals could affect your long-term security, a financial plan may help you assess where compromises might be made so you can strike the right balance between enjoying your life now and being secure in the future.

Higher outgoings now could boost your future income

There might be times when spending more money now could boost your finances in the long run.

For instance, if you’re thinking about returning to education to pursue a career change, you might need to fund the costs yourself. Or, if you’re an aspiring entrepreneur, you may choose to increase spending to get your idea off the ground.

In both of these scenarios, you might hope that the initial outgoing will lead to a higher income and greater financial security in the future.

Making this decision part of your financial plan could help you assess if it’s the right option for you and understand the potential short- and long-term implications it may have on your finances.

You want to create a legacy during your lifetime

Often, when people speak of a legacy, it’s what they’ll leave behind when they pass away, but it might also be something you do during your lifetime. Indeed, there could be benefits to creating a living legacy.

Your loved ones might have a greater need for financial support now than they will in the future. For example, a helping hand to purchase a home when they want to start a family could be more useful in terms of creating long-term financial security than an inheritance later in life.

Alternatively, you might want to leave a legacy to a charitable cause during your lifetime.

Again, a benefit is that you have the potential to see the impact your gift will have. You might choose to support the charity in other ways too, such as acting as a trustee or organising a fundraiser.

If your estate could be liable for Inheritance Tax (IHT), creating a living legacy might be one way to reduce the potential bill. As well as reducing the value of your estate through gifting, if you leave more than 10% of your entire estate to charitable causes on your death, the IHT rate your estate is liable for would fall from 40% to 36%.

When gifting to reduce IHT, it’s important to note that not all gifts are immediately outside of your estate for IHT purposes. Indeed, some may be included in calculations for up to seven years after they were gifted. If you’d like to discuss how to pass on wealth tax-efficiently, please get in touch.

Contact us to talk about your financial plan

If you’d like to create a financial plan that’s tailored to your goals and circumstances, please get in touch. We could help you balance short-term spending with long-term aspirations so you can have confidence in your future.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate tax planning or estate planning.

How past efforts and losses might affect your decisions today

Have you ever made a decision to continue with a course of action based on what you’ve already put into it? This bias, known as “sunk cost fallacy”, might mean you don’t make rational decisions and stick to a path that’s no longer right for you.

If you’ve been affected by the sunk cost fallacy, it doesn’t automatically mean you made a wrong decision. In fact, factors outside of your control could mean that what was once an excellent decision for you, no longer makes sense. However, by basing your next decision on what you’ve already done, you could hinder your ability to make the “right” choice now.

Feeling like you’ve already invested resources may mean you don’t want to turn away

The sunk cost fallacy refers to the resources you’ve lost and can’t get back. This loss might mean you’re less likely to assess alternative options, as you don’t want it to be in vain.

So, your past effort affects the decisions you’re making about the future.

The sunk cost fallacy is more likely to occur if you’ve already invested heavily in something. It doesn’t have to be a financial investment. The time you’ve poured into a project or the emotional energy you’ve dedicated to it could cloud your judgement too.

It’s often linked to other types of cognitive bias.

For example, loss aversion theory suggests you feel emotions connected with loss more keenly than those associated with winning. So, if you feel like you’ve lost resources, you might be more emotional, and less likely to focus on logic than you usually would.

Another bias sunk cost fallacy is often linked to is confirmation bias – where you seek out information that supports your preconceived idea. If you’ve already decided you want to proceed with a plan because you’ve invested in it already, you might start to prioritise data that suggests this is the right thing to do.

There are plenty of examples of the way sunk cost fallacy might affect you.

If you’re taking the lead on a project at work, you might be reluctant to change course, even if it’s clear it isn’t going to work as well as alternatives, because of the time you’ve already invested.

With your finances, you might refrain from selling an investment that no longer aligns with your financial plan because the share price has fallen recently so you feel like you’ll be “losing”.

4 useful steps that could help you avoid sunk costs affecting your decisions

1. Imagine it’s a new decision

While it’s difficult, try to look at the decision with a fresh perspective – if you hadn’t already sunk costs, how would you view the decision today?

Doing this could highlight where your past efforts might be influencing the decisions you’re making now.

2. Focus on the future

When you’re reassessing your decisions, look forward as well. For example, if you’re reviewing an investment, what are the expected returns and how much risk would you be taking? Looking forward, rather than back, could help focus your mind so you’re not dwelling on perceived losses.

3. Set goals

One effective way of avoiding the sunk cost fallacy is to set goals from the start. If you have a clear idea about what you want to achieve, you’re more likely to be able to evaluate whether sticking to a plan continues to be the right decision.

Taking an objective-based approach means you’re less likely to focus on the emotional side of decision-making, and, instead, pay attention to the expected outcomes. Understanding how decisions might support long-term goals could mean you feel more confident when the evidence suggests a different course of action could be better suited to you.

4. Get an outside view

Sometimes it’s impossible to look at a decision you’ve made objectively, as you may be emotionally attached to it. This is where an outside perspective could be useful.

A person who isn’t thinking about the “losses” could help you see why you’re holding on to a decision that might no longer be right for you.

As a financial planner, we could act as an alternative perspective when you’re assessing financial decisions. If you’d like to talk to us, please get in touch.

Please note: This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Your Spring Statement update – the key news from the chancellor’s speech

After Rachel Reeves’ impactful first Budget in autumn 2024, you might have been concerned about the announcements that would be included in her Spring Statement on 26 March 2025.

Reassuringly, the major headline from this year’s springtime fiscal event is that Reeves made few announcements that are likely to affect you and your personal finances directly. Although, it did reveal that none of the changes made in the Autumn Budget would be overturned. However, one significant change has been made to the High Income Child Benefit Charge, which could affect you or your family.

The chancellor did announce that, due to global uncertainty and after the economy declined in January, the Office for Budget Responsibility (OBR) has downgraded its 2025 forecast for UK growth from 2% in October 2024 to 1% as of March 2025. She also noted the OBR’s long-term forecast, indicating that growth would increase for each year remaining in this parliament.

In addition to growth figures, the chancellor’s Statement introduced a range of measures designed to increase economic activity in the UK, as well as cost-saving initiatives, predominantly at state level, to reduce government debt.

Read on for your summary of the chancellor’s 2025 Spring Statement.

Personal tax thresholds and allowances are set to remain unchanged

Those who were concerned the chancellor would announce sweeping changes that might affect their personal finances will be breathing a sigh of relief as many worries didn’t materialise.

Personal tax

Reeves stuck to a pre-Spring Statement commitment to not increase personal taxes.

So, Income Tax thresholds and rates will remain unchanged, and thresholds are frozen until April 2028. As a result, your Income Tax liability is likely to rise in real terms.

Similarly, the rates and thresholds for paying Capital Gains Tax (CGT) and Dividend Tax will remain the same.

Individual Savings Accounts (ISAs)

Before the Spring Statement, the government was reportedly considering reducing the amount you can tax-efficiently place in a Cash ISA each tax year to £4,000 in a bid to encourage greater investment.

The good news is the ISA subscription limit will remain at the current level (£20,000) in the 2025/26 tax year. The ISA subscription limit is frozen until 2030.

The Junior ISA (JISA) allowance will remain at £9,000 in 2025/26.

However, the government did note it will continue reviewing ISA reform options to improve the balance between cash and equities to earn better returns for savers, boost the culture of retail investment, and support its growth mission.

Pensions

Last year, the government announced a new Pension Schemes Bill, which will legislate several areas of pension policy. However, further reforms weren’t announced in the Spring Statement.

The Annual Allowance will remain at £60,000 in 2025/26. Your Annual Allowance may be lower if your income exceeds certain thresholds or you have already flexibly accessed your pension.

As usual, there was also speculation that the amount you could withdraw from your pension tax-free would be reduced, but this has remained unchanged. So, when you reach the normal minimum pension age (55, rising to 57 in 2028), you may withdraw up to 25% of your pension (up to a maximum of £268,275) before paying Income Tax.

State Pension

As expected, there were no announcements relating to the State Pension or the triple lock, which guarantees the State Pension will increase every tax year by either the rate of inflation, average earnings growth, or 2.5%, whichever is higher.

As a result, the full new State Pension will pay a weekly income of £230.25 in 2025/26.

High Income Child Benefit Charge reforms will come into place this summer

Although the chancellor did not explicitly announce the change, the Spring Statement document revealed that those who pay the High Income Child Benefit Charge will be able to do so through PAYE from summer 2025.

As it stands, those who pay the charge need to register for self-assessment to do so, even if they do not otherwise need to self-assess. But this year, the government is making it easier for families to pay the charge without needing to submit a tax return.

Inflation is forecast to meet the Bank of England’s 2% target by 2027

After reaching a 40-year high of 11.1% in October 2022, inflation, as measured by the Consumer Prices Index (CPI), has gradually fallen, bringing it closer to the Bank of England’s (BoE) target of 2%.

The chancellor announced in her Statement that in the 12 months to February 2025, inflation rose by 2.8%, down from 3% in January. Now that inflation is better under control, the BoE has cut its base rate three times since the general election, bringing the rate down from 5.25% to 4.5%. These cuts mean borrowers will likely pay less while savers may see their interest payments fall.

It was then announced that, according to the OBR’s forecast, inflation will average:

- 3.2% in 2025

- 2.1% in 2026

- 2% in 2027, 2028, and 2029 – the BoE’s target rate.

The key fiscal announcements from the 2025 Spring Statement

The chancellor’s speech largely revolved around changes to government spending and investment. Some of the key measures and announcements included in the Statement were to:

- Increase defence spending to 2.5% of GDP by 2027, including providing an additional £2.2 billion to the Ministry of Defence next year

- Rebalance payment levels in Universal Credit to incentivise people into work, and review the assessment for Personal Independence Payments, with the OBR stating these changes will save £4.8 billion from the welfare budget in 2029/30

- Crack down on promoters of tax avoidance schemes, as initially announced in the Autumn Budget in October 2024

- Invest £2 billion in social and affordable housing, so housebuilding reaches a 40-year high that helps put the government on track to reach its target of building 1.5 million homes by the end of this parliament

- Introduce a £3.25 billion Transformation Fund to streamline public services using technology and Artificial Intelligence, making the government “leaner and more efficient”. Additionally, government departments will reduce their administrative budgets by 15% by the end of the decade.

2024 Autumn Budget changes remain intact

In October 2024, the chancellor announced a series of tax-raising measures during the Autumn Budget, some of which could have affected your personal finances. These included:

- Inheritance Tax (IHT) will be levied on unused pension benefits from April 2027.

- Agricultural Property Relief and Business Property Relief will be reduced from April 2026.

- CGT rates for non-property gains were raised in line with property rates with immediate effect, and Business Asset Disposal Relief and Investors’ Relief were both reduced.

- Employer National Insurance contributions (NICs) will rise from April 2025, from 13.8% to 15%, and the threshold at which employers start paying NICs will also fall.

- Income Tax thresholds will remain frozen until 2028.

- The IHT nil-rate bands will remain fixed for a further two years, until 2030.

- VAT was levied on fee-paying schools, effective from 1 January 2025.

- The non-dom tax regime is set to be abolished from April 2025.

- The Stamp Duty Land Tax surcharge on second home purchases rose from 3% to 5% from 31 October 2024.

- Corporation Tax is now capped at 25% for the duration of the parliament.

While many hoped the chancellor would row back on some or all of these measures, all remain intact.

Please note

All information is from the Spring Statement documents on this page.

The content of this Spring Statement summary is intended for general information purposes only. The content should not be relied upon in its entirety and shall not be deemed to be or constitute advice.

While we believe this interpretation to be correct, it cannot be guaranteed and we cannot accept any responsibility for any action taken or refrained from being taken as a result of the information contained within this summary. Please obtain professional advice before entering into or altering any new arrangement.

Investment market update: December 2024

Political instability in Europe and further afield affected investment markets in December. Read on to find out what other factors may have influenced your investment returns at the end of 2024.

Remember to focus on your long-term goals when assessing the performance of your investments. The value of your assets rising and falling is part of investing. What’s important is that the risk profile is appropriate for you and that your decisions align with your circumstances and aspirations.

UK

Hopes that the Bank of England (BoE) would cut its base interest rate before the end of 2024 were dashed when data showed inflation had increased.

Figures from the Office for National Statistics show inflation was 2.6% in the 12 months to November 2024, which was up from the 2.3% recorded a month earlier.

This led to the BoE deciding to hold interest rates despite speculation that a cut was on the horizon. The central bank also said it expects GDP growth to be weaker at the end of 2024 than it had previously predicted.

Data paints a gloomy picture for the manufacturing sector.

According to S&P Global’s Purchasing Managers’ Index (PMI), UK manufacturing hit a nine-month low as output fell for the first time in seven months in November 2024. The decline was driven by new orders falling. Notably, manufacturers are struggling to export their goods, with new orders contracting for 31 consecutive months. Demand has fallen in key markets, including the US, China, the EU, and Middle East.

A survey from the Confederation of British Industry (CBI) indicates that manufacturers aren’t optimistic about the future either. The organisation said orders at UK factories “collapsed” in December to their lowest level since the height of the pandemic in 2020. The slump was linked to political instability in some European markets and uncertainty over US trade policy when Donald Trump becomes president.

Chancellor Rachel Reeves wants to reduce UK trade barriers with the US, stating she wanted to end the “fractious” post-Brexit accord as she went to meet eurozone finance ministers at the start of the month. Closer ties with the EU may benefit some firms that are struggling with exports.

Retailers are also experiencing challenges.

The festive period is often crucial for retailers. Yet, data from Rendle Intelligence and Insights are “bleak” with footfall in the first two weeks of December down 3.1% when compared to 2023. A slew of high street names entered administration in 2024, including Homebase, The Body Shop, and Ted Baker, and the research suggests more could follow suit in the year ahead.

December was a month of ups and downs for investors in the UK stock market.

The month started strong when stock markets increased across Europe on 3 December – dubbed a “Santa rally” in the media. The FTSE 100 – an index of the 100 largest firms on the London Stock Exchange – was up 0.7% despite worries about the economic outlook. EasyJet led the way with a 4% boost.

Yet, just mere weeks later, on 17 December, the FTSE 100 hit a three-week low and lost 0.7%. The biggest faller was Bunzl, a distribution and outsourcing company, which fell 4.6% when it warned persistent deflation would weigh on profits in 2024.

While it might have felt like a bumpy year as an investor, research shows the FTSE 100 has performed well. Indeed, according to AJ Bell, the index had its best year since 2021 and delivered a return of 11.4%. The top performers were NatWest and Rolls-Royce, while JD Sports and B&M were at the bottom of the pack.

Europe

Much like the UK, the manufacturing sector in the eurozone is struggling. Indeed, PMI data shows the sector continued to contract in November 2024 as new factory orders fell. Germany recorded the fastest drop in output and, as the bloc’s largest economy, could drag economic data down.

Dr Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, told the Guardian: “These numbers look terrible. It’s like the eurozone’s manufacturing recession is never going to end.”

Credit ratings firm Moody’s unexpectedly downgraded French government bonds, which are now rated Aa3 – the fourth highest rating – following the collapse of Michel Barnier’s government. MPs had refused to accept tax hikes and spending cuts in Barnier’s Budget.

Moody’s said: “Looking ahead, there is now very low probability that the next government will sustainably reduce the size of fiscal deficits beyond next year. As a result, we forecast that France’s public finances will be materially weaker over the next three years compared to our October 2024 baseline scenario.”

The news, unsurprisingly, led to French bonds weakening.

European markets also benefited from the so-called Santa rally on 3 December.

Germany’s DAX, a stock index of the 30 largest German companies on the Frankfurt Exchange, broke the 20,000-point barrier for the first time, despite a new election being called after the government collapsed. The recent boost means the DAX increased by around 3,000 points during 2024.

Similarly, Paris’s stock market index, the CAC, gained 0.6%. Luxury goods makers, like Hermes and LVMH, were among the biggest risers.

US

Unlike Europe, US manufacturing could give investors something to be optimistic about.

The PMI reading for November 2024 was 49.7, up from 48.5. While this means the sector is still below the 50-mark indicating growth, the signs suggest it’s stabilising and could move into more positive territory in the new year.

The service sector paints an even better picture. The PMI indicated the sector is growing at its fastest pace since the Covid-19 pandemic. Expectations of higher output linked to growing optimism about business conditions under the Trump administration led to a flash PMI reading of 56.6 for December, comfortably placing the sector in growth territory.

The job market also bounced back after disappointing figures in October. According to the US Bureau of Labor Statistics, 227,000 jobs were added to the economy in November, compared to just 36,000 a month earlier.

Yet, inflation continues to weigh on the US. In the 12 months to November 2024, inflation increased slightly to 2.7%.

While the Federal Reserve went ahead with an interest rate cut, taking the base rate to 4.25%, it also suggested it would make fewer cuts than expected in 2025 if inflation remains stubborn. The comments led to the S&P 500 index closing almost 3% down, while the tech-focused Nasdaq fell 3.6% on 19 December.

President-elect Trump is set to take office on 20 January 2025, but his plans are already influencing markets. Indeed, on 2 December, the dollar rallied after Trump warned countries in the BRICS bloc that he would impose 100% tariffs if they challenged the US dollar by creating a new rival currency.

The BRICS bloc was originally composed of Brazil, Russia, India, China, and South Africa, which led to the acronym. They have since been joined by Iran, Egypt, Ethiopia, Saudi Arabia and the United Arab Emirates.

Asia

In a move that shocked citizens, South Korea’s president declared martial law on 3 December, which led to political chaos. The uncertainty led to South Korea’s currency dropping to a two-year low and exchange-traded funds (ETFs), which track the country’s shares, fell sharply. Indeed, the MSCI South Korea EFT dropped by more than 5% in the immediate aftermath.

Outside of South Korea, stock market performances were more positive in Asia.

On 9 December, Hong Kong’s Hang Seng was up by 2% after China said it would implement a more proactive fiscal policy and planned to loosen monetary policy in 2025. The market was also aided by consumer inflation in China falling to a five-month low in November to 0.2%.

On the same day, Japan revised its economic growth upwards, leading to a 0.3% boost to the Nikkei 225 index.

Please note:

This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

3 insightful property market predictions for 2025

Key changes, like interest rates falling and Stamp Duty thresholds changing, are likely to affect the property market in 2025.

Whether you’re buying, selling, or simply interested in how the value of your home might change over the next 12 months, read on to discover three insightful property market predictions for the year ahead.

1. Stamp Duty changes are expected to boost property transactions at the start of the year

In the Autumn Budget, chancellor Rachel Reeves announced the temporary higher thresholds for paying Stamp Duty would end in April 2025.

Stamp Duty is a type of tax you pay when you purchase property or land. The higher threshold has meant many families have benefited from paying a lower rate or even avoiding the tax completely. With the threshold lowering in April 2025, the number of property transactions concluded during the first quarter of the year is expected to be high.

In fact, Zoopla predicts there will be a 5% increase in sales across 2025 to 1.15 million.

One of the key reasons driving this boost is the changes to Stamp Duty, which will encourage first-time buyers and home movers to purchase property before the deadline.

It could be good news for sellers, as you may find interest in your property rises and buyers are more motivated to complete transactions quickly.

2. Interest rates are predicted to fall but at a slower pace than earlier forecasts

When inflation was high, the Bank of England (BoE) increased its base interest rate throughout 2022 and 2023 in a bid to slow it down.

For many families with a mortgage, this meant their mortgage repayments increased. In 2024, the central bank started to reduce the interest rate as inflation stabilised. As of December 2024, the base interest rate was 4.75%.

Previously, many experts were predicting the BoE would make regular cuts to the base interest rate toward the end of 2024 and throughout 2025.

However, statistics from the Office for National Statistics (ONS) show the rate of inflation increased in the 12 months to November 2024 to 2.6%, compared to 2.3% a month earlier. This partly led to the BoE choosing to hold the base interest rate in December 2024.

So, will interest rates fall in 2025 as predicted?

It’s good news for mortgage holders as many experts still agree that interest rates will fall in 2025, but perhaps at a slower pace than earlier predictions suggested.

Indeed, according to MoneyWeek, BoE governor Andrew Bailey suggested the bank could cut interest rates four times in 2025. Recently, when changing the base rate, the bank has made an increase or decrease of 25 basis points. If it continued to follow this pattern, that would lead to an interest rate of 3.75% by the end of 2025.

3. Improving conditions for households could lead to property prices rising

Interest rates falling would make mortgage repayments more affordable for many families. In turn, this could lead to property prices rising.

In addition, strong wage growth could support the market too. According to the ONS, annual growth in employee’s average earnings was 5.2% for the period from August to October 2024. With wages now growing at a faster pace than inflation, more families might feel financially secure enough to move up the property ladder or aspiring homeowners could find they’re now in a better position to secure a mortgage.

Property firm Savills now predicts that property prices will rise by 3.5% in 2025, leading to an average property price of £302,500. It expects the boom to continue over the next few years too.

Between 2024 and 2028, it predicts that property prices will increase by 21.6%, leading to an average property price of £346,500 by the end of the forecast period.

Will you be taking out a mortgage in 2025?

If you’ll be taking out a new mortgage deal in 2025, we could help you find one that’s right for you. Whether you’re moving home or your current deal is set to expire, finding a competitive deal could save you money.

Get in touch with us to find out how we may help you find a mortgage.

Please note:

This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Fiscal drag: How threshold and allowance freezes affect you

Despite intense speculation that the Labour government would slash tax allowances and exemptions, many are set to remain the same in the 2025/26 tax year. While that might seem like something to celebrate, fiscal drag could mean your tax liability increases in real terms.

To maintain allowances and exemptions in real terms, the government would need to increase them by the rate of inflation.

So, when they are frozen instead, your taxable income is likely to increase as you might be “dragged” into paying tax or paying tax at a higher rate. This generates higher revenues for the government without increasing tax rates. For this reason, freezes are sometimes called “stealth taxes”.

Several tax thresholds have been frozen since April 2022 and aren’t expected to rise until April 2028. When you consider the period of high inflation experienced recently, the effect of fiscal drag could mean you’ve paid a significantly higher proportion of tax, relative to your income, than you did previously.

Income Tax: Thresholds are frozen until April 2028

The previous Conservative government froze Income Tax thresholds in 2022 until April 2028. The current Labour government has said it will continue the freeze.

During the freeze, it’s likely that your income will rise, which would maintain your spending power. However, as the thresholds will not increase, your tax liability might also rise. It may seem like a small increase initially, but it can add up over the years.

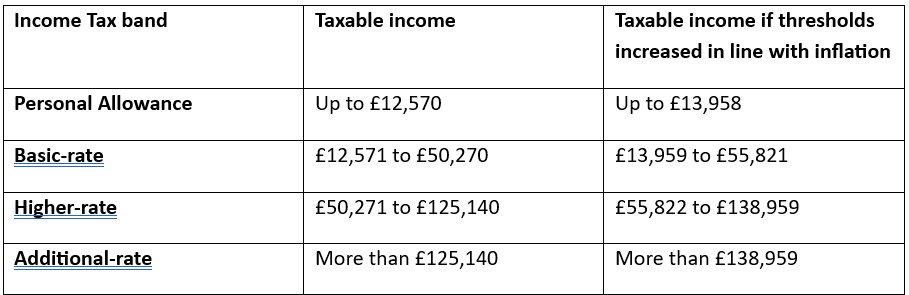

The table below shows how the value of Income Tax thresholds would have changed if they had increased in line with inflation between January 2022 and November 2024.

Source: Bank of England

With the freeze expected to remain in place for another three years, the effects of fiscal drag will become more evident.

According to the Office of Budget Responsibility (OBR), freezing Income Tax thresholds mean that between 2022/23 and 2028/29, an extra 4 million people will pay Income Tax. In addition, 3 million will be dragged into the higher-rate tax band and 400,000 will pay the additional-rate of Income Tax for the first time.

The fiscal drag is estimated to raise £42.9 billion in tax by 2027/28.

The OBR noted frozen thresholds are the largest contributor to the rising overall economy-wide tax burden. The freeze will be responsible for almost a third of the 4.5% GDP increase in taxes from 2019/20 to 2028/29.

Freezes to Inheritance Tax thresholds and ISA limits could affect your finances too

It’s not just freezes to Income Tax you may need to be mindful of either. Frozen allowances include the:

- Inheritance Tax thresholds: The nil-rate band is frozen at £325,000 – it has been at this level since 2009/10 and will remain the same until April 2028. The residence nil-rate band last increased to £175,000 in 2020/21 and is also frozen until the start of the 2028/29 tax year.

- ISA allowance: The amount you can add to your ISA each tax year is frozen at £20,000 for adults and £9,000 for children until 5 April 2030. The amount you can pay into an adult ISA hasn’t increased since 2018/19, and the Junior ISA subscription limit last increased in 2020/21.

There are other allowances and exemptions that, while not frozen, haven’t increased in line with inflation either.

For example, the amount you can gift in a tax year that will be immediately outside of your estate for Inheritance Tax purposes is known as the “annual exemption”. In 2024/25, the annual exemption is £3,000 and it’s been at this level since 1981.

If the annual exemption had increased in line with inflation between 1981 and November 2024, it’d stand at £11,314.

A financial plan could help you minimise the effects of fiscal drag

While you can’t change tax thresholds or allowances, there might be steps you can incorporate into your financial plan to reduce your overall tax bill.

For instance, increasing your pension contributions could reduce your taxable income and mean you avoid being dragged into a higher Income Tax bracket. While it may mean your take-home pay is lower, it could support long-term retirement goals and may be right for you as a result.

In addition, while the ISA allowance is frozen, if you’re not already depositing the full amount, increasing how much you add to your ISA may reduce your Income Tax bill.

Interest earned on savings that aren’t held in a tax-efficient wrapper, like an ISA, could become liable for Income Tax if they exceed your Personal Savings Allowance (PSA). The PSA is £1,000 if you’re a basic-rate taxpayer, £500 if you’re a higher-rate taxpayer, and £0 if you’re an additional-rate taxpayer.

If you’d like to talk about how fiscal drag may affect your finances and the steps you might take to mitigate the effects, please get in touch.

Please note:

This blog is for general information only and does not constitute financial advice, which should be based on your individual circumstances. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Recent Comments