Author: Richard Gross

Landlords: How to make your property more energy-efficient

Landlords could be banned from renting out properties that don’t meet energy efficiency rules after 2030. While the deadline might seem a long way off, it could mean some landlords need to carry out substantial work. So, reviewing your options now may be useful.

The previous Conservative government proposed rules that would set a minimum Energy Performance Certificate (EPC) rating for properties that were let out. Ed Miliband, secretary of state for energy security and net zero, has indicated that the Labour government will take these plans forward.

It’s thought that landlords will need to upgrade properties that have an EPC rating below C.

The plans are likely to have a significant effect on landlords as the Office for National Statistics (ONS) estimates that around 58% of homes in England and 62% in Wales are rated below C – the equivalent of more than 8.4 million properties.

So, where should you start when assessing how to make your property more energy-efficient?

Reviewing your property’s Energy Performance Certificate

All properties in England and Wales must have an EPC, and it’s a good place to start when assessing how to boost the EPC rating of your property. If you’ve completed work on your property recently, you might want to have a new assessment carried out.

Several sections could be useful when you’re reviewing how to upgrade your property.

Your current and potential EPC rating

The EPC not only lists the property’s current rating but also its potential. So, you could see if your property can achieve a C rating and how wide the gap is between the two.

The top actions

Next, look at the top actions of your EPC. This will list the steps you can take to make your property more energy efficient, it might include large projects, such as adding external wall insulation, or relatively simple ones, like switching to lower energy lighting.

As well as listing the steps, the EPC will also provide a cost outline. Of course, this cannot be guaranteed, but it can be useful when you’re calculating a budget and want to understand which projects could fit into your plan.

You can also check out the recommendations section for areas that need further improvement. Helpfully, this shows how the recommended measures would affect your EPC rating. So, if you’re deciding which measures to pursue and want to understand which would deliver the biggest impact, this section is useful.

The energy performance of your home

Finally, look at the energy performance of your home section – this provides a breakdown of how different elements of your property are performing. It gives a rating out of five for energy performance so it’s simple to compare the different areas.

For example, you might notice that while your windows and doors are efficient, a lack of insulation in the loft is pulling down your overall EPC rating.

Use your EPC to guide your energy efficiency decisions

Using the information on your EPC, you’re in a good position to target areas that could help boost your EPC rating to a C or above and comply with regulations that Labour proposes to introduce.

The indicative cost is also valuable when you’re reviewing quotes you receive for carrying out work. However, keep in mind that the cost of work can vary significantly across the country and is a guideline only.

Landlords could benefit from making their properties greener

While updating homes to comply with new regulations could be difficult and costly, there are benefits for landlords.

Energy-efficient homes will reduce utility bills for tenants, who may be willing to pay a higher rate of rent as a result. So, while you need to consider the initial cost of updating your property, it could deliver higher returns overall.

In addition, if you own a property with an EPC rating of A or B, you might be eligible for a green mortgage. In some cases, a green mortgage could mean you’re able to access a lower rate of interest, so your mortgage repayments may fall.

Contact us to talk about your buy-to-let mortgage

If you have a buy-to-let mortgage and would like to discuss the different options or want the support of a mortgage adviser when searching for a deal, please get in touch.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

How would soaring property prices affect a 2024 Monopoly board?

Classic board game Monopoly hit shelves in 1935 and has been causing family arguments ever since. As the real estate game was loosely based on property values at the time it was launched it provides some interesting insights into how the market has changed over the last nine decades.

The original Monopoly game was based on Atlantic City, US, but it didn’t take long for the game to be adapted to new locations. Indeed, a London version of the game was available within months.

Since its launch, the game has sold more than 275 million copies worldwide and there are hundreds of different editions to choose from. So, if the game was updated to reflect 2024 prices, how would it be different?

Mayfair would continue to hold the top spot but prices have soared

Unsurprisingly, if you updated the property prices to reflect today’s figures, they would be much higher than they were in 1935, and some locations have fared better than others.

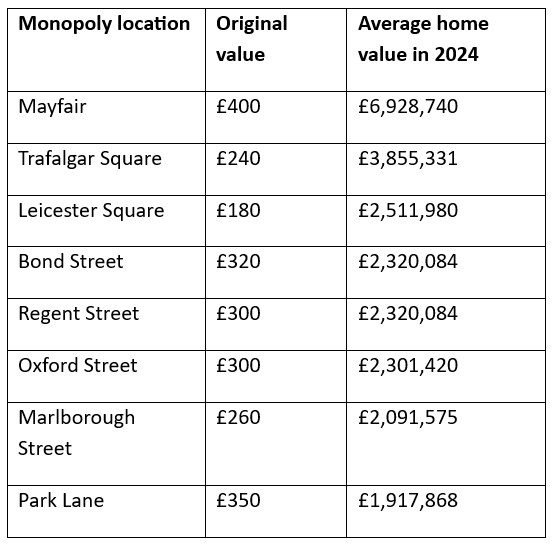

According to a report in IFA Magazine, using today’s prices, the top locations on the Monopoly board would be:

You might notice that the top properties don’t appear in the same order as they do on the board as some areas have seen prices rise far more rapidly than others.

In fact, the iconic dark blue set – the most expensive on the board – has changed. Mayfair continues to hold the top spot, with a value that’s significantly higher than other locations. However, Park Lane, once the second most expensive property, has fallen six places.

Even the cheapest properties on the board have seen huge increases in value.

Indeed, the first property on the board, Old Kent Road, was priced at an affordable £60. At today’s prices, a home on the same street would set you back around £342,000.

While property prices in London remain the highest in the UK, the trend is reflected across the country.

Land Registry data doesn’t go back to 1935, but the average property price in the UK was £3,595 in April 1968. By July 2024, the average price has increased to £289,723 – an increase of almost 8,000%.

Property prices have increased at a quicker pace than inflation

In the classic rules of Monopoly, you start with £1,500 and receive £200 every time you pass “GO”. According to the Bank of England, inflation would mean these figures rise to £89,644 and £11,952 respectively in August 2024.

Yet, they wouldn’t have the same spending power as rising property prices have outstripped average inflation over the last 90 years.

With your initial £1,500, you’d be able to buy several properties on the Monopoly board, even if you’re lucky enough to land on the more expensive tiles. Yet, with 2024 prices, you would still be some way short of being able to afford even the cheapest property – Old Kent Road at £342,000 – with your starting sum after it’s been adjusted for inflation.

Relying on the money you receive when passing GO would mean you’d need to go around the board more than 1,260 times to build up enough cash to buy Old Kent Road, which would be sure to lead to a long and tedious game.

The gap between rent and mortgage repayments is much closer

In Monopoly you make money and try to bankrupt others by charging players rent when they land on a tile you own.

Before you start adding houses and hotels to your tiles, the rent is usually half the purchase price. So, when you buy Old Kent Road for £60, you charge £30 rent. In reality, the cost of rent and mortgage repayments are far closer.

Indeed, according to Zoopla, between 2011 and 2022, renting a home was more expensive than paying a mortgage. Even with rising interest rates leading to mortgages becoming more expensive for the first time in 13 years, rent is only around 9.5% lower.

Contact us to talk about your mortgage

If you need a mortgage to buy your new home, whether the location is on the Monopoly board or not, we could help you find a lender that’s right for you and may be able to save you money. Please get in touch to talk about your needs.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

How to balance philanthropy with your long-term financial security

Using your wealth to support good causes might be one of your priorities. Yet, the challenges of balancing philanthropy with your long-term financial security and that of your loved ones might mean you’re hesitant to give back during your lifetime. Read on to find out how a financial plan could give you confidence.

Philanthropic giving is something many people already make part of their financial plan, and research suggests it could grow as it’s increasingly popular among younger generations.

Indeed, according to a report from UK Fundraising, 90% of wealthy young people express a strong desire to have a positive impact with their money, and 88% already donate to charity. Around 63% of those under 35 said they would consider increasing their charitable donations despite the difficult economic climate, compared to 13% of over-55s.

Whether you already have a charitable cause in mind or not, making philanthropy part of your overall financial plan could give you confidence. Read on to discover three questions you might want to consider to help balance your priorities.

1. How would philanthropic giving affect your finances?

To understand how supporting a good cause might affect your long-term financial security, it may be helpful to set out what you’d like to give. For instance, would you prefer to give regular financial gifts or a one-off lump sum?

With this information, you can start to incorporate your philanthropic goals into your financial plan.

Cashflow modelling could be useful here as it provides a way to visualise the effect your decisions could have on your long-term wealth. For example, you might model how giving away £10,000 each year may affect your disposable income in the short term, and the effect it would have on wealth accumulation. You could then see what may happen if you increase or decrease the figure.

By making donations part of your financial plan, you might be in a better position to strike a balance that suits you. If you’ve put off donating because you’re worried you could run out of money in retirement or be unable to cover other expenses, it could give you the confidence to proceed.

2. Do you want to consider the effect it’ll have on your estate and beneficiaries?

As well as your own long-term finances, you might want to consider the effect gifting to charity could have on your estate and beneficiaries.

Giving away some of your wealth during your lifetime or through a will could mean passing on less than you expect to loved ones. So, if supporting your family is a priority for you, it might also play an important role in your philanthropic decisions.

Again, cashflow modelling could help you understand the effect of giving away some of your assets for your beneficiaries. In some cases, it might be worthwhile to talk to your beneficiary so you understand how best to support them and ensure you’re on the same page.

3. How could you make philanthropic donations tax-efficiently?

It might seem strange to consider tax when you’re making a philanthropic donation. However, doing so could reduce your overall tax bill or mean that the charity benefits.

For example, gifting directly from your salary, before tax is deducted, could be a useful way to reduce your Income Tax bill. Similarly, you could pass on assets that might be liable for Capital Gains Tax if you sold them and made a profit.

If you’re a UK taxpayer, charities can also reclaim the basic rate of Income Tax you’ve already paid on your donation through Gift Aid. So, if you donate £100 to charity, they’d receive £125. In addition, if you’re a higher- or additional-rate taxpayer, you may be able to claim tax relief.

Alternatively, if you want to support a good cause when you pass away, it could reduce the Inheritance Tax (IHT) bill your estate is liable for.

If the total value of your estate exceeds the nil-rate band, which is £325,000 in 2024/25, it may be liable for IHT at a standard rate of 40%. However, if you leave more than 10% of your estate to charity when you pass away, the IHT rate may fall to 36%. In some circumstances, this could help you leave a charitable legacy and pass on more wealth to your loved ones.

Contact us to make philanthropy part of your financial plan

If you’re keen to make philanthropy part of your financial plan, please get in touch. We can work with you to understand your philanthropic goals and how to balance them with your personal aspirations.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate cashflow planning or tax planning.

5 reassuring ways a financial plan could help you deal with life’s scares

Halloween is just around the corner, but there’s more than ghouls and ghosts to be scared of. Sometimes, daily life can be just as frightful as the latest horror film.

Here are five reassuring ways a financial plan could help you next time you encounter one of life’s scares.

1. A financial plan could help you build financial resilience to overcome obstacles

Even the best-laid plans can be knocked off course by events outside of your control. Dealing with obstacles like long-term illness or losing your job can be scary, especially if low financial resilience means you’re also facing additional pressure.

For example, if you’re diagnosed with a serious illness, you may want to focus on your recovery, spending time with your loved ones, or adapting to a new lifestyle. But if your income has stopped and you don’t have a plan in place, you could find you’re more worried about how to meet bills or support your family.

So, as part of your financial plan, we’ll work with you to assess your financial resilience and the steps you might take to improve it.

Depending on your circumstances, that could include building an emergency fund, taking out appropriate financial protection, and assessing how you might use your other assets to provide a regular income if necessary.

A financial plan can’t remove unexpected obstacles, but it could provide you with a way to overcome them and mean they’re less scary to face.

2. A financial plan could help you prepare for the future

Effective financial planning often involves considering the future. In some cases, you might need to consider what you want your life to look like in several decades.

It can be exciting to set out your life goals, but, at the same time, it may be frightening too. There might be many different factors you need to weigh up and, for some goals, the steps you need to take to achieve them can seem impossible.

Take retirement planning, for example. The figure you want to save into your pension to secure the retirement you want may seem dauntingly high. Even as you near the milestone, you might still have retirement worries. Indeed, according to a report in IFA Magazine, almost half of pension savers are worried they won’t have enough to last their lifetime.

A financial plan could help you prepare for the future and break down large goals so you can see how to reach them.

3. A financial plan could provide answers to questions that keep you up at night

It’s not just the memories of a horror film that might keep you up at night, wondering “what if?” could be just as harmful to your wellbeing.

Dealing with uncertainty can be terrifying. If you’re kept up at night by wondering what would happen in different scenarios, a financial plan could offer some reassurance.

A financial plan doesn’t just consider how your finances will change if everything goes according to plan. It also looks at how factors outside of your control could affect your wealth and lifestyle. As a result, it could help you answer the questions you’re worried about.

You might want to understand:

- If your partner and children would be financially secure if you passed away

- Whether you could afford the cost of care if you needed support later in life

- How your finances would be affected if you’re no longer able to work due to an illness

- If your retirement would still be secure if investments underperformed or the pace of inflation increased.

Often “what if” scenarios are scary because of the unknown. It’s impossible to know what’s around the corner, but we could help you understand the potential impact and then take steps to keep your long-term plans on track.

4. A financial plan could help you tackle conversations you’re dreading

There might be times when you need to have a difficult conversation with your loved ones about your finances or long-term plans. For some, the nerves around talking about certain subjects could lead to anxiety or putting them off altogether.

Indeed, according to a Canada Life survey, 5.1 million UK adults who received an inheritance in the last five years did not discuss the value of it with the benefactor beforehand.

It’s easy to see why some benefactors choose not to discuss inheritances. Talking about passing away may be difficult or they might not feel comfortable divulging the value of their estate. However, doing so could help beneficiaries better manage an inheritance when they receive it.

Other difficult conversations could include how you’d like someone to handle your affairs if they become your Power of Attorney or your preferences for a funeral.

Setting out your goals and taking steps to improve your financial wellbeing could mean you feel more confident tackling difficult conversations around money and your life.

In some cases, you might decide to have your financial planner be part of the conversation too. Having a third party who understands the financial aspect could help you all get on the same page.

5. You’ll have someone to turn to for support

By working with a financial planner, you don’t have to tackle life’s scares alone – you’ll have someone to turn to who understands your goals, worries, and financial circumstances. Knowing that a professional has reviewed your plan and is there to answer questions could make the intimidating far less daunting.

If you’d like to arrange a meeting to talk about your aspirations and worries, please get in touch.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

3 insightful pieces of data that could help you remain calm during market volatility

When you read that investment markets have fallen you might feel nervous or scared about the effect it could have on your future. Emotions like these sometimes lead to impulsive decisions that aren’t always in your best interest when you consider the long term. So, read on to discover some insightful pieces of data that could help you remain calm.

Volatility is part of investing – a huge range of factors might influence whether a stock market rises or falls. However, history shows that, over the long term, markets typically go on to deliver returns.

Recently, markets experienced volatility amid fears that the US was on track for a recession. Indeed, on 2 August 2024, US technology-focused index Nasdaq fell 10% from its peak. Just a few days later, the market rallied, and it was technology firms that led the way.

Concerns about the US economy weren’t confined to the US indices either. Markets fell in Europe and Asia too. In fact, Japan’s Nikkei index suffered its worst day since 1987 following the news. Again, it didn’t take long for the markets to bounce back.

Returns cannot be guaranteed and recoveries may be over longer periods. Yet, the above example highlights how making a knee-jerk decision due to volatility could harm your long-term wealth. If you’d responded by selling your investments when you saw markets were falling, you’d have missed out on the recovery.

So, if volatility is part of your experience when investing, how can you remain calm? These pieces of data could help you hold your nerve.

1. Investment risk falls over a longer time frame

It’s important to note that all investments carry some risk. There is a chance that you could receive less than the original amount you invested. However, the level of risk varies between investments, so you could invest in a way that reflects your risk profile and financial circumstances.

Usually, it’s a good idea to invest with a five-year minimum time frame. By investing for longer, you’re giving your investments a chance to recover if they fall due to short-term volatility.

Research supports this too. Using almost 100 years of data on the US stock market, Schroders found that if you invested for a month, you would have lost 40% of the time. Interestingly, when you invest for longer, your odds of losing money start to fall.

When invested for five years, the odds of losing money fall to 22%, and at 10 years it falls to 13%. The research shows there have been no 20-year periods during the time analysed where stocks lost money overall.

You can’t rule out risk entirely, but by investing for a long-term goal, you could minimise the chance of losing money.

2. Sharp drops in the market occur more often than you think

One of the reasons investors react to market movements is that sharp falls may feel like they’re unprecedented and that you should act as a result. Yet, the Schroders research suggests that sharp falls are more common than you might think.

Analysing the MSCI World Index, which captures large and mid-cap representations across 23 developed countries, the study found that 10% falls happen in more years than they don’t. Indeed, in the 52 calendar years to 2024, investors experienced a 10% fall in 30 of them.

Even significant falls of 20% may occur more than you expect – roughly every six years.

Despite these dips, markets have delivered returns over the 50 years analysed. So, holding your nerve during these sharp falls often makes sense when you take a long-term view.

3. Periods of “heightened fear” could be more lucrative

The Vix Index measures expected volatility in the US market– it’s often referred to as the market’s “fear gauge”. It can highlight when investors perceive there is a greater risk of losing money. For example, it last reached a significant peak in May 2022 in the aftermath of the invasion of Ukraine.

Schroders has assessed how your investments would fare if you sold assets during periods of “heightened fear” to hold your wealth in cash, and then shifted back to investments when the fear receded. Taking this approach when invested in the S&P 500 – an index of the 500 largest public companies in the US – would have yielded average returns of 7.4% a year between 1990 and 2024.

However, if you didn’t let fear affect your investment decisions and remained invested, you may have benefited from average annual returns of 9.9%.

So, even when it seems like investing isn’t a good idea because of the economic environment or geopolitical tensions, it could be worthwhile taking a step back to consider what’s driving your decision.

Contact us to talk about your investments

If you have questions about investing and how it could support your financial goals, please get in touch.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Guide: Your retirement choices: How to generate an income in later life

Retirement on your terms is likely to be one of the key elements of your financial plan.

So, as you approach or reach retirement, now is the time for you to start thinking about enjoying a comfortable life when you stop working.

Many people see retirement as the start of their “second life” – the time when you have the chance to do all the things you want to do. You may have been planning this moment for many decades and have grand plans for what you might like to do in the years ahead.

If you haven’t already done so, now is also the time to start thinking about your income in retirement, and how long it may need to last.

Aside from taking all your fund in one go – or not taking it at all and leaving it to pass to your heirs – there are four main options:

- Buy an income for a fixed period or for life, known as an “annuity”.

- Take an adjustable income, known as “flexi-access drawdown” (or sometimes just “drawdown”).

- Take lump sums from your pension fund, sometimes known as “uncrystallised funds pension lump sums” (UFPLS).

- Mix and match different options.

This useful guide explains the advantages and disadvantages of each option, as well as some other areas you might want to consider when planning for retirement.

Download your copy of ‘Your retirement choices: How to generate an income in later life’ to find out more now.

If you’d like to talk about your retirement plan, please contact us to arrange a meeting.

Investment market update: June 2024

2024 is a historic election year – elections will take place in 50 countries. More than 2 billion voters will head to the polls in countries including the UK, US, France, and South Africa throughout the year. Political uncertainty can affect investment markets and there was evidence of this in June.

During market volatility, remember that markets have, historically, recovered in the longer term. And, for most investors, sticking to their long-term investment strategy makes financial sense.

Read on to find out what affected investment markets around the world in June 2024.

UK

Despite hopes that the UK economy had turned a corner when it exited a recession in the first quarter of 2024, GDP figures were disappointing in April. Official figures show the economy flatlined when compared to a month earlier.

Yet, the Bank of England (BoE) remains optimistic. The central bank raised its second-quarter growth forecast to 0.5% after it revised upwards its May 2024 prediction of 0.2%.

There was further good news for the BoE too – UK inflation fell to its official target of 2% in the 12 months to May 2024 for the first time since 2021. The news led to speculation that the bank would cut its base interest rate, but the Monetary Policy Committee opted to hold it at 5.25%.

The positive inflation data sets the stage for a rate cut later this year, with the BoE saying it will keep interest rates “under review”.

As inflation pressures started to ease, figures from the Insolvency Service suggest fewer businesses are failing. The number of firms that became insolvent fell by 4% in May when compared to a month earlier. Even so, the number is 3% higher when compared to the same period in 2023.

Readings from the S&P Global Purchasing Managers’ Index (PMI), which measures business conditions, are also positive. In May:

- UK factories returned to growth with the most rapid expansion of output in two years. The boost was mainly supported by domestic demand, as new export orders fell.

- The service sector lost momentum but still posted growth. The slower pace is partly due to new orders easing when compared to the 11-month high recorded in April.

Uncertainty as UK political leaders campaigned ahead of the 4 July 2024 general election was partly linked to the FTSE 100 index, which includes the largest 100 companies listed on the London Stock Exchange, falling by 0.4% on 4 June.

Amid political turmoil in France, London regained its crown as Europe’s biggest stock market, which Paris has held for the last two years. According to Bloomberg, as of 17 June, stocks in the UK were collectively worth $3.18 trillion (£2.52 trillion) compared to France’s $3.13 trillion (£2.48 trillion) valuation.

Europe

At the start of the month, the European Central Bank (ECB) slashed its three key interest rates by 25 basis points in the first cut since the start of the Covid-19 pandemic.

Yet, figures released by Eurostat just two weeks later showed inflation was 2.6% in the year to May 2024 across the eurozone, up from 2.4% in April. The news prompted some commentators to speculate the cut to interest rates had been made too soon.

PMI data was positive in the eurozone as business activity grew at the fastest rate this year. Of the top four economies in the bloc, only France contracted slightly, while Germany, Spain, and Italy posted growth.

President of France Emmanuel Macron called a snap election, which is set to be held between 30 June and 7 July. The election has added to the political uncertainty affecting markets.

Indeed, on 10 June, France’s CAC index, which is comprised of 40 of the most prominent listed companies in the country, was down 2%. The effects were felt in other stock markets too, with Germany’s DAX falling 0.9% and Italy’s FTSE MIB losing 0.95%.

In response to the snap election, credit ratings agency Moody’s issued France with a credit warning, stating there was an increased risk to “fiscal consolidation”. Citigroup also downgraded its rating for European stocks to neutral from overweight due to “heightened political risks”.

US

The New York Stock Exchange got off to a rocky start in June. On 3 June, a technical issue led to large fluctuations in the listed prices of certain stocks. Warren Buffett’s Berkshire Hathaway was affected by the glitch, which suggested shares had fallen in value by 99%. Fortunately, the issue was resolved within an hour.

The rate of inflation fell to 3.3% in May 2024 but remains above the Federal Reserve’s target of 2%.

The drop in inflation led to a boost for Wall Street. On 12 June, both the S&P 500 index, which includes 500 of the largest companies listed in stock exchanges in the US, and tech-focused index Nasdaq opened at all-time highs.

Figures from the US Bureau of Labor Statistics indicated that businesses are feeling confident about their future. 272,000 jobs were added in May, far higher than the 185,000 Wall Street has forecast. Yet, unemployment also increased slightly to 4%.

Tesla shareholders voted in favour of CEO Elon Musk’s huge $56 billion (£44 billion) pay package – the largest corporate pay package in US history by a substantial margin. The results of the annual general meeting led to Tesla shares rising by around 6.6%, which helped recover some of the 28% losses they’ve suffered so far this year.

Asia

Moody’s raised China’s growth forecast to 4.5%, up from 4%. While growth of 4.5% would be great news in many developed countries, it would mark a slowdown for China, which saw its GDP rise by 5.2% in 2023.

However, signs of a trade war starting between China and the EU loomed and could dampen growth expectations.

The EU notified China that it intended to impose tariffs of up to 38% on imports of Chinese electric vehicles. The move would trigger duties of more than €2 billion (£1.69 billion) a year. The announcement followed an investigation into alleged unfair state subsidies and similar tariff increases from the US earlier this year.

In retaliation, China opened an anti-dumping investigation into imported pork and its by-products from the EU. China is the EU’s largest overseas market for pork, which was worth $1.8 billion (£1.42 billion) in 2023.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

3 fun ways you can pass on essential money lessons to children

As a parent or grandparent, you want the young children in your life to grow up to be happy and successful adults. A solid grasp of finances could set them off on the right track when they get older, but alarmingly, many children don’t receive any lessons on the subject during their formal education.

A Nationwide survey found that 84% of parents say their children haven’t received any financial education at school despite 96% believing it’s important for young people to learn about money.

In light of data such as this, it might be prudent to take on some of the responsibility and start educating your children or grandchildren about personal finances yourself.

Making the experience as enjoyable as possible could help to engage kids in money conversations. So, read on for three fun ways to pass on essential finance lessons to children as they grow up.

1. Use games to teach kids about money in an interactive way

According to a report from UNICEF, play is one of the most important ways in which young children gain essential knowledge and skills. So, integrating financial lessons into playtime through games could be an effective way to teach them about money.

Games let kids role-play everyday financial scenarios and learn money fundamentals without any risk.

There are several fun games you can play with young children using items you have at home:

- The desert island game – get your children or grandchildren to imagine they’re stranded on a desert island and can only bring six items. Through discussing their options, they’ll soon realise it’s sensible to prioritise essentials over fun items when they have limited choice, giving them an introduction to the basics of budgeting.

- Setting up shop – encourage your child to set up a shop selling household objects. Can they set accurate prices and give correct change? Next, flip the game and let them be the customer. Can they buy everything they need without going over budget?

Alternatively, there’s a plethora of fun financial board games you can buy for kids of all ages:

- Money Bags – in this game for ages five and above, players learn to recognise coins and develop their maths skills by completing chores and earning money as they move around the board.

- Pay Day – suitable for children aged eight and older, Pay Day simulates something most people are familiar with – the monthly payday cycle. Players must ensure their pay packet lasts the month and whoever has the most at the end of day 31 wins.

- The Game of Life – this classic board game takes players through an entire lifetime. It can teach children the financial implications of saving, further education, retiring and more, all in a family-friendly package.

The best money games reward kids for making decisions that would also benefit them in the real world, teaching them valuable lessons in a fun, interactive way. Playing these games is also a lovely chance for quality time together, so it’s a win-win all around.

2. Let them be in charge of money on a day out

As your children or grandchildren grow up, it’s important that they begin to understand the value of money.

While you will no doubt enjoy treating your loved ones, it can be hard for children to grasp how far money goes when adults buy things for them. Finding interesting ways for youngsters to practise spending money helps them understand exactly how much items and activities cost.

One fun way to do this is to let them be in charge of the family budget on a day out.

For example, say you’re visiting a castle. Before you arrive, give them £100 and explain that this money must pay for everything you do that day.

When you arrive, they’ll have to pay for entry. This might leave them with, say, £50.

After exploring the castle, your child might be tempted to buy something from the gift shop. However, if they buy a toy or book, they might not have enough money to pay for lunch.

They’ll need to carefully consider what’s more important. Hopefully, they’ll realise that food takes priority over souvenirs. If not, they’ll have to face the consequences of their actions and skip lunch.

Perhaps it would be wise to have backup sandwiches in the car to avoid any tantrums on the way home!

3. Books are a fun way to learn for kids of all ages

If your grandchild loves story time, or your bleary-eyed teenager stays up reading until the early hours, you could introduce them to books about money.

You might think personal finance is too dry a topic for children’s literature, but there’s an excellent range of entertaining books on the subject for children of all ages.

The Four Money Bears by Mac Gardner is a wonderful option for younger children.

Through beautiful illustrations and accessible storytelling, Gardner uses the tale of Spender Bear, Saver Bear, Investor Bear, and Giver Bear to teach kids about the functions of money and instil lessons such as spending cautiously, saving diligently, investing wisely, and giving generously.

For kids aged 8 to 12, Finance 101 for Kids: Money Lessons Children Cannot Afford to Miss by Walter Andal is a fun-to-read crash course on essential topics like earning, saving, investing, and credit. It even touches on more advanced subjects like the stock market, foreign exchanges, and basic economics.

Reality TV-loving teenagers might enjoy Deborah Meaden Talks Money. This insightful book from entrepreneur and TV personality Deborah Meaden features podcast-style interviews with stars including Gary Neville, Sophie Ellis-Bextor, and Joe Lycett. It’s designed to demystify the world of finance and help your children build good money habits in an exciting, relatable way.

Teaching your children and grandchildren about money may seem like a challenge now, but when they reach adulthood, all your patience and effort should pay off. You never know, you may even get a belated thank you!

Contact us to support your children in other ways

Sharing financial knowledge with children is important, but there are other ways you can support their financial future.

We can help you craft a financial plan that supports your children or grandchildren, laying the foundations for the next generation. Contact us to arrange a meeting.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

How to use life insurance to cover a future Inheritance Tax bill for your family

The amount the government collects through Inheritance Tax (IHT) is on the rise, and freezes to allowances mean it’s expected to increase further. If your family could face a bill when you pass away, life insurance could provide a valuable way to cover the expense.

According to MoneyAge, the amount collected through IHT hit a record £7.5 billion in 2023/24.

An IHT bill could not only mean passing on less wealth to your loved ones, but it may be stressful too. The portion of your estate that exceeds thresholds could be liable for IHT at a standard rate of 40%, and your family might need to consider which assets to sell to cover the expense.

Understanding whether IHT may be due on your estate could help you make provisions that will ease the burden for your family.

If the value of your estate exceeds £325,000, it could be liable for Inheritance Tax

IHT is paid if the value of your estate exceeds thresholds when you pass away.

In 2024/25, the nil-rate band is £325,000 – if the value of all your assets is below this threshold, no IHT will be due. In addition, many estates can use the residence nil-rate band, which is £175,000 in 2024/25 if your main home is passed on to direct descendants.

So, you can often pass on up to £500,000 before you need to consider IHT. If you’re planning with your spouse or civil partner, you can also pass on unused allowances to them.

Importantly, the nil-rate band and residence nil-rate band are frozen until 2028, which is predicted to lead to more estates becoming liable for IHT.

Indeed, the Institute for Fiscal Studies estimates that by 2032/33, 1 in 8 people will have IHT due either on their death or that of their partner. As a result, IHT revenues are predicted to double over the next decade.

Life insurance can provide a useful way to pay Inheritance Tax

Life insurance won’t reduce how much IHT your estate is liable for. However, it could provide a straightforward way for your loved ones to pay the bill.

When you take out whole of life insurance, you’ll need to pay regular premiums to maintain the cover. When you pass away, a lump sum will be paid to your beneficiaries, which they can then use to pay IHT. It could mean your family doesn’t need to break up your estate or sell assets to settle the bill.

The cost of the premiums will depend on a variety of factors, including your age, health, and lifestyle. In addition, the level of cover you require will also affect the cost.

You can select the level of cover that suits your needs, so understanding the size of a potential IHT bill is important.

A good place to start is by assessing the value of your estate now. Your estate covers all your assets, from property and investments to material items.

You’ll then want to consider how the value of each asset could change during your lifetime. For example, the value of your property will likely rise.

If you’re not using savings and investments to supplement your retirement income, they could also increase in value over the long term. On the other hand, there may be assets you’ll deplete during your lifetime, such as your pension.

As a result, the potential size of an IHT bill could be difficult to calculate. A financial planner could help you get to grips with how the value of your estate might change in different scenarios so you can choose the right level of life insurance for you.

You may want to place life insurance in a trust if it’s for Inheritance Tax purposes

If you’re considering using life insurance to provide your family with a way to pay a potential IHT bill, it’s sensible to place the life insurance in trust.

Using a trust means it sits outside of your estate and won’t be included when calculating how much IHT is due. If you didn’t take this step, the lump sum that the life insurance pays out might be included in your estate, which would lead to a larger IHT bill.

You can set up a trust yourself but they can be complex and there are several different types. Seeking the services of a legal professional could minimise the chance of mistakes occurring and ensure the trust you set up suits your purposes.

Get in touch to talk about your estate plan

Life insurance could provide your loved ones with a simple way to pay an IHT bill, but there may be other steps you can take as well. As part of an estate plan a financial planner would review your circumstances and goals to understand how you could pass on assets effectively, including steps that may reduce an IHT bill.

Please contact us to arrange a meeting to talk about your estate.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate estate planning.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Cover is subject to terms and conditions and may have exclusions. Definitions of illnesses vary from product provider and will be explained within the policy documentation.

Higher-rate taxpayers: Beware of the 60% tax trap

The tapering of the Personal Allowance means some higher-rate taxpayers effectively pay an Income Tax rate of 60%, sometimes without realising. Fortunately, if you’re affected, there could be ways to reduce your tax bill.

A report in the Telegraph suggests 1.35 million workers were affected by the 60% tax trap in 2023/24. Collectively, they paid an extra £4.7 billion to the Treasury. Read on to find out if you could unwittingly be paying a higher rate of Income Tax than you expect.

The tax trap affects those earning more than £100,000

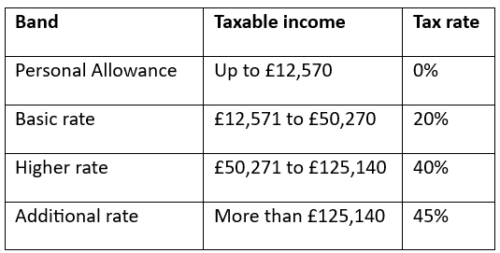

You might think the highest rate of Income Tax is 45%, and officially you’d be correct. Most people pay the standard rates of Income Tax. In 2024/25, Income Tax rates and bands are:

Please note, that different Income Tax bands and rates apply in Scotland.

However, the Personal Allowance is reduced by £1 for every £2 you earn over £100,000. If you earn more than £125,140, you don’t have a Personal Allowance and pay tax on all your income.

For example, if you earn £101,000, on the £1,000 above the threshold, you’d pay £400 of Income Tax at the higher rate. In addition, you’d lose £500 of your Personal Allowance, so this portion of your income would also be subject to Income Tax at 40%, adding up to £200.

So, out of the £1,000 you’ve earned above the tapered Personal Allowance threshold, you’d only take home £400 – a 60% effective tax rate. It’s led to the tapering being dubbed a “stealth tax” in the media.

Further compounding the issue is the fact that the Personal Allowance and Income Tax bands are frozen until 2028.

While the thresholds are frozen, many people are likely to receive wage increases. As a result, more people are expected to be caught in the 60% tax trap in the coming years.

Don’t forget your salary might not be your only income that’s considered when calculating your Income Tax bill. For example, you could be liable for interest earned on savings that aren’t held in a tax-efficient wrapper.

Contact us if you’re unsure which of your assets could be liable for Income Tax.

3 legal ways to avoid falling into the 60% tax trap

If you’re affected by the tapered Personal Allowance, thinking about how you structure your earnings may provide an opportunity to reduce how much you’re giving to the taxman. Here are three excellent options you might want to consider.

1. Boost your pension contributions

One of the simplest ways to avoid paying 60% tax if you could be affected is to increase your pension contributions.

Your taxable income is calculated after pension contributions have been deducted. As a result, boosting pension contributions could be used to reduce your adjusted net income so you retain the full Personal Allowance or reduce the proportion you lose.

Increasing pension contributions could help you secure a more comfortable retirement too. However, keep in mind that you cannot usually access your pension savings until you’re 55 (rising to 57 in 2028).

2. Use a salary sacrifice scheme

If your workplace has a salary sacrifice scheme, it could also provide a useful way to reduce your overall tax liability.

Salary sacrifice enables you to exchange a part of your salary for non-cash benefits from your employer. This could include higher pension contributions, childcare vouchers, or the ability to lease a car.

By essentially giving up part of your income, you might be able to bring your taxable income below the threshold for the tapered Personal Allowance.

You should note that salary sacrifice options vary between employers, so it may be worthwhile to check your employee handbook to see if any options could suit you.

3. Make charitable donations from your income

If you’d like to reduce your Income Tax bill and support good causes, you could make a charitable donation. Again, by deducting donations from your salary before tax is calculated, you could manage how much of the Personal Allowance you lose.

Contact us to talk about how to manage your tax bill effectively

There may be other steps you could take to reduce your overall tax bill. A tailored financial plan will consider your tax liabilities, including from other sources, such as your savings and investments, to highlight potential ways to cut the amount you pay to the taxman.

If you’d like to arrange a meeting, please get in touch.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Recent Comments