Category: News

The healthy living lessons you could learn from blue zones

Embracing lessons from so-called “blue zones” could boost your health and longevity, according to an expert. Read on to find out more about these areas and how you could make changes to your life.

In 2004, two professors identified Sardinia’s Nuoro Province in Italy as having a high concentration of male centenarians. They referred to the area as a “blue zone”.

Dan Buettner, a longevity expert, has built on their work. He has identified a further four healthy living hotspots:

- Ikaria, an island in Greece

- Okinawa, an island in Japan

- Loma Linda, a small city in California, USA

- The Nicoya peninsula in Costa Rica.

While blue zones are associated with longevity, a lower rate of chronic health, and higher rates of wellbeing, Buettner says it’s not just about living a longer life but being able to enjoy it too.

The five locations dubbed blue zones are diverse and spread across the globe. Yet, they share some similarities that have been explored in the documentary Live to 100: Secrets of the Blue Zones.

Here are four lessons you could take from blue zones and make part of your life.

Lesson 1: Change how you think about healthy eating

When you think about improving your diet, you might focus on restricting calories or cutting out certain foods. Yet, a more holistic approach to healthy eating could lead to longer-lasting results.

According to Buettner, the average person makes around 220 food decisions every single day. However, only around 10% of them are conscious.

As a result, he argues that trying to govern the 22 conscious decisions isn’t that effective. Instead, setting up your kitchen so the far more unconscious decisions are slightly healthier is better.

The research indicates that plant-based food options with plenty of spices and herbs and smaller portions of meat or fish could lead to longer lives.

Lesson 2: Maintain healthy relationships with family and friends

Busy modern lives mean that relationships can suffer. You might not spend as much time with family or friends as you’d like to.

Buettner believes relationships play a vital role in longevity and health. He says they could provide a strong sense of purpose that leads to people living for longer. In fact, in the blue zones, familial ties are often important.

Making relationships a priority and dedicating time to them could boost your wellbeing. It may seem simple but placing spending time with the people that are important to you in your diary, the same way you would with work or appointments, can help you maintain bonds.

It’s not just the relationships with immediate family and friends that are useful. Playing a role in your community can further enhance your health by providing new connections and a sense of place.

Lesson 3: Define your purpose

In Okinawa, Japan, residents are three times more likely to reach their 100th birthday than other regions, and their sense of purpose could play a role.

During Live to 100, Buettner introduces centenarians who are still enjoying and living a full life. The research indicates that having something that drives you and helps you get up in the morning can be beneficial to your wellbeing. Locals from Okinawa call this purpose “ikigai”.

So, defining what you’re passionate about, whether that’s travelling, art, or supporting your family, could help you feel more fulfilled. It’s a step that could improve your mental health and even your overall wellbeing.

Lesson 4: Make light exercise part of your daily routine

Everyone knows that exercise is part of maintaining your health. Yet, the blue zones suggest you don’t need to regularly hit the gym or train for a marathon. In fact, you could do away with exercise classes and strict plans altogether if you don’t enjoy them.

Making light exercise part of your routine could be just as useful if remaining healthy in your later years is your goal. You might ditch the car to walk to the local shops or get outdoors to garden. Regular low-intensity exercise can help keep you active and mobile.

Buettner refers to this approach as “moving naturally”, where you live in an environment that encourages you to move without thinking about it.

Inflation has cost savers £113 billion in real terms in the last year

High inflation over the last year has collectively cost savers billions of pounds in real terms, according to an Independent report. Have you considered the effect the rising cost of living could have on your wealth?

While inflation may not reduce how much you have in your savings account, in real terms, the value may fall.

As the cost of goods and services rises, what you could purchase with your savings falls. Usually, this happens at a gradual pace. However, as inflation has been higher than the Bank of England’s (BoE) 2% target for two years, the effect has been more noticeable.

If the interest rate your savings earn doesn’t keep pace with inflation, the value of your money decreases.

Inflation could reduce the value of your savings in real terms, but cash may still be useful

The BoE calculations suggest £10,000 in 2021 would have to have grown to £11,774 in August 2023 just to have the same spending power. So, your savings would need to have earned £1,774 in interest during that time.

Even though interest rates have started to rise as the BoE has increased its base rate to tackle high inflation, it’s unlikely your savings have grown at the same pace.

The analysis published in the Independent suggests up to £113 billion has been wiped off the value of savings in the last year in real terms.

While the value of your money may fall in real terms in a savings or current account, there are still times when they might be the right option for you, including these three:

- Handling your day-to-day finances: If you’re using money held in your account to pay for utility bills or other regular expenses, inflation will have little effect.

- Saving for short-term goals: Investing could make sense when you’re saving for a long-term goal. However, if you’ll be saving over a shorter period, volatility might mean investing isn’t the right option. So, when you’re saving for a holiday next year or home improvements for example, a cash account could be right for you.

- Creating an emergency fund: While you may not want to access your emergency fund now, you want to be able to easily make a withdrawal if the unexpected happens. As a result, a cash savings account could make sense.

So, it’s important to set out what you want to use your money for. It can help you select an appropriate place for your wealth that aligns with your goals.

Inflation is starting to fall, which could ease the burden for some savers. However, the value of the money held in a savings account could still fall in real terms. Meanwhile, investing might provide a way to grow your wealth.

Investment returns may outstrip inflation

It’s impossible to guarantee investment returns. Yet, investing does present an opportunity to potentially grow your wealth in real terms.

Historically, markets have delivered returns over long time frames. If you’re saving for a goal that’s more than five years away, from buying a property to retiring, investing might be an option you want to consider.

Market volatility is a normal part of investing. The value of your investments will rise and fall at different points. So, it’s often not appropriate if you’re investing with a short-term time frame, as a dip in the market could mean you lose money.

If you want to invest, considering risk is important.

All investments carry some risk. However, investment risk varies significantly and you can choose options that are appropriate for you.

There are many factors you may want to weigh up when deciding how much investment risk to take, including the reason you’re investing and the other assets you hold. We can help you create a risk profile and an investment portfolio that reflects your wider financial plan.

Get in touch to talk about how to make the most of your money

Getting the most out of your money is about understanding your goals and how to use your assets to reach them. If you’d like to talk about your tailored financial plan, including whether investing is right for you, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

5 common mistakes when writing a will that a solicitor could help you avoid

A will provides a way to state who you’d like to receive your assets when you pass away. While you don’t need to work with a solicitor when writing a will, doing so could help you avoid mistakes.

Will Aid is taking place in November and may be the perfect time to write your will while supporting good causes.

Every year, participating solicitors volunteer to waive their usual fee for writing a basic will. Instead, they invite clients to make a voluntary donation to Will Aid. The donations support a variety of charities, including Age UK, the British Red Cross, and Save the Children.

Choosing to work with a solicitor when you’re writing your will could help you avoid mistakes that may mean your estate isn’t distributed how you want or could lead to probate taking longer.

Here are five mistakes that affect some wills.

1. Your wishes aren’t clear enough

Using ambiguous language in a will can make distributing your estate much more difficult. Vague or contradictory wishes may lead to confusion about your intentions. In some cases, it may mean your wishes aren’t carried out.

You should ensure your will clearly specifies the assets you’re referring to and sets out your wishes in a way that’s easy to understand.

You may also want to consider what would happen if an asset changes. For example, if you intended to leave a property to one beneficiary but have since sold it, should they receive the cash equivalent?

As a will may cover a lot of assets and beneficiaries, it can be difficult to write a will that’s precise if you’re not a professional, especially if your wishes are complex.

2. You don’t consider all your assets

Estates can be complex and it’s easy to overlook some of your assets. Many people will include their main assets, like property or a savings account, but other items may go unnoticed when writing your will. Perhaps you have some Premium Bonds or artwork you’ve forgotten about.

Carrying out a financial review before you write your will may help you better understand the assets that make up your estate.

Financial planning could also forecast how the value of assets may change during your lifetime, which might affect how you want to distribute assets to loved ones.

3. You don’t account for beneficiaries passing away

One of the challenges of writing a will is that you need to consider what may happen in the future. If a beneficiary passes away before your estate is settled, who would you want to inherit your assets?

Usually, if a beneficiary passes away, the assets they were due to inherit will be kept within your estate and distributed to surviving beneficiaries, which may not align with your wishes.

4. You don’t appoint an executor

An executor is the person who will deal with the administration of your estate when you pass away. Their duties will include carrying out your wishes in accordance with your will.

It’s an important role, but some people overlook naming an executor. Your will would still be valid in this case, but someone will need to apply to become the administrator or a court may ask someone to take on the role. It could delay the probate process.

You can choose someone you know personally to be the executor. It’s often a good idea to speak to the person first to ensure they’re happy to take on the responsibility and understand what’s involved. You may also choose a professional executor, such as your solicitor.

5. Your will isn’t signed or witnessed correctly

A common error when writing a will without support is that it isn’t signed or witnessed correctly. It may mean your will is invalid and, rather than being distributed according to your wishes, intestacy rules would apply.

Your two witnesses must be over the age of 18 and shouldn’t be family members. They and their spouse also shouldn’t benefit from your will in any way. You must sign your will in the presence of your witnesses, who should also sign it, as well as write their full names, addresses, and occupations. Finally, you should date your will.

Regular reviews of your will may be just as important as writing one

Once you’ve written your will, don’t simply put it to one side and forget about it.

During your life, your wishes and circumstances may change, which might mean you need to update your will. Whether you want to make provisions for a new grandchild, or the value of your assets has increased, regular reviews may help ensure your will continues to reflect your wishes.

It’s often a good idea to review your will after major life events or every five years.

If you need to make changes, there are two options:

- A codicil is added to your existing will. It must be signed and witnessed. While there are no limits to how many codicils you can add or what they can cover, significant changes or several small alterations can make your will complicated. Codicils may mean your will is more likely to contain contradictions, so they are often best used for straightforward changes.

- If a codicil isn’t appropriate, you can write a new will. This is usually a good option if you would like to make major changes. Your new will should state it revokes all previous wills and codicils, which should be destroyed.

You can add a codicil or write a new will without professional support, but, again, a solicitor could help you avoid mistakes.

An estate plan could help you distribute your assets effectively

Writing your will is an essential step to take to ensure your assets are distributed how you wish. Before you put a will in place, understanding your assets and how their value could change over time may help you set out wishes that reflect your goals.

In addition, estate planning might highlight if you want to consider things like Inheritance Tax, how to pass on your pension, or gifting during your lifetime.

Please contact us to talk about your estate plan and how you may want to pass on assets through your will.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate estate planning, tax planning, or legal services.

How to make happiness part of your financial plan

People often think of their financial plan as a way to grow their wealth and provide financial security. You might consider areas like your pension or financial protection to be core parts of your financial plan. Yet, while they’re important, your happiness is essential too.

Financial planning is about helping you reach your financial goals, but it goes further than that.

It’s about making your money work in a way that aligns with your lifestyle aspirations and understanding how it could improve your wellbeing.

After all, you might want the money in your pension to grow, but your money will often be linked to other aspirations you may have. For example, you might want investments to perform well so you can travel more in retirement, or to allow you to retire early so you can spend more time with grandchildren while they’re young.

As a result, recognising what makes you happy now or could improve your life in the future should be at the centre of your financial plan.

Here are three steps you can take to make your happiness the focus of your financial plan.

1. Set out what makes you happy

Think about your day-to-day life. What gives you purpose and makes you happy? Setting out what is important to you can help you make conscious money decisions that reflect your wellbeing.

Without a clear focus, it can be easy to make decisions that aren’t necessarily right for you. For example, you might spend money on impulsive purchases that give you a brief serotonin boost, but you then have to compromise on something that would bring you longer-lasting happiness.

It’s also worth thinking about the one-off experiences you’ve had that brought you joy. Which memories do you look back on fondly with a smile? You might want to make other similar experiences part of your long-term plan.

2. Create clear objectives

Often, your happiness goals will be linked to finances in some way. So, setting out financial objectives with your wellbeing at the centre is useful.

These could be both short- and long-term objectives. Perhaps you have a hobby that brightens up your day, so you want to make the associated costs part of your regular budget. Or maybe you’re really looking forward to the freedom that retirement will bring, so you have a pension goal you want to achieve that would allow you to give up work sooner.

Consider what money or assets you’d need to make your life happier. You can then turn your attention to how to reach these objectives with your circumstances in mind.

3. Form a financial plan around your objectives

With your objectives set out, you can start to think about how to achieve them through your financial plan.

For example, if you want to retire early so you can indulge your passions, what is a tax-efficient way of saving the money you need? Or what steps can you take to create long-term financial security once you give up work?

By starting with what makes you happy you can make conscious financial decisions that support your wellbeing now and over the long term.

A financial planner can help identify how to use your money to reach the goals you’ve set out. Having a plan that’s tailored to you may also improve how confident you feel about your finances, so you may focus on enjoying other parts of your life.

Contact us to create a financial plan that focuses on your happiness

As a financial planner, we may help you get more out of your money with your lifestyle goals in mind. We’ll work with you to not only understand how you could grow your wealth, if that’s your goal and appropriate for you, but also understand how to use your assets to enhance your life.

Please contact us to arrange a meeting to discuss your life goals and how we could offer support in creating a financial plan for you.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

3 essential factors to consider if you plan to gift wealth to avoid Inheritance Tax

Figures suggest more families are gifting to avoid Inheritance Tax (IHT). While passing on assets to loved ones may seem like a clear solution, it isn’t always so simple.

More estates are becoming liable for IHT as thresholds for paying the tax are frozen. The Office for Budget Responsibility predicts HMRC will collect £8.4 billion from IHT receipts in 2027/28, compared to £7 billion in 2022/23.

The portion of your estate that exceeds IHT thresholds could be taxed at a standard rate of 40%. So, it’s not surprising that families are looking for ways to mitigate a potential bill.

According to a Telegraph report, the number of people who have gifted assets that would become exempt from IHT if they survived a further seven years increased by 48% between 2009/10 and 2019/20.

If the value of your estate exceeds the nil-rate band, which is £325,000 in 2023/24, your estate may be liable for IHT. You might also be able to use the residence nil-rate band, which is £175,000 in 2023/24, if you leave your main home to direct descendants.

You can pass on unused allowances to your spouse or civil partner.

Both the nil-rate band and residence nil-rate band are frozen until April 2028. So, if the value of your estate is nearing the threshold, you may find your estate could become liable for IHT as the value of your assets could rise.

Gifting assets to your beneficiaries now can be advantageous. It may allow you to help loved ones reach life milestones.

However, if you’re gifting for IHT purposes, there are some things you may want to keep in mind.

1. Gifting may affect your financial security later in life

Before you hand over a gift, assessing the effect it could have on your later life may provide peace of mind. Could gifting leave you financially vulnerable in your later years? Could it affect your ability to overcome a financial shock?

Making gifts part of your wider financial plan means you can understand how your decision may affect your wealth over the short and long term.

Understanding the potential implications before you make a gift might help you to feel more confident about your finances.

2. Not all gifts are considered immediately outside of your estate for Inheritance Tax purposes

When you’re gifting to minimise an IHT bill, considering longevity may be important.

Gifts might be considered “potentially exempt transfers” (PETs) and included as part of your estate when calculating IHT for up to seven years after they were given.

As a result, if the entire value of your estate exceeds IHT thresholds, your estate could be liable for IHT on assets you’ve already passed on.

Once seven years have passed, gifts will not be included when calculating IHT liability.

3. There are gifting allowances you may want to make use of

If you want to gift assets to reduce an IHT bill, there are some allowances you could make use of.

These gifts would be considered immediately outside of your estate for IHT purposes:

- The annual exemption, which is £3,000 in 2023/24

- £1,000 to someone getting married, rising to £5,000 for your children and £2,500 for grandchildren

- Unlimited gifts of up to £250 to any individual who has not received a gift using another allowance.

Regular gifts that are made from your income may also be exempt from IHT. These gifts must be made regularly. For instance, you may pay the rent on your child’s home or your grandchild’s school fees.

Making use of these allowances and exemptions could provide a tax-efficient way to pass on wealth during your lifetime.

There are others steps you could take to reduce a potential Inheritance Tax bill

Gifting isn’t the only option if you want to reduce a potential IHT bill. Other solutions might include:

- Leaving 10% or more of your estate to charity, which would reduce the IHT rate from 40% to 36%

- Passing on wealth through your pension, which is usually considered outside of your estate

- Using a trust to pass on assets tax-efficiently.

It’s important to weigh up the pros and cons of these options. It may also be useful to take both financial and legal advice in some cases, as estate planning can be complex.

You might also want to consider taking out a whole of life insurance policy. This wouldn’t reduce the amount of IHT your estate is liable for, but loved ones could use the money it pays out to settle the bill.

It’s essential that life insurance is written in trust. Otherwise, the payout could be considered part of your estate and result in a higher IHT bill.

An estate plan can help you set your affairs in order and minimise Inheritance Tax

An estate plan can help you set out what you’d like to happen in your later years and how you’d like to pass on assets when you die. Setting your affairs in order can be emotional, but it’s an important task.

We can help you create an estate plan that reflects your wishes and considers concerns you may have, such as whether IHT will affect the assets you leave behind. Please contact us to arrange a meeting.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate estate or tax planning.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

Investment market update: July 2023

Data from economies around the world indicate business output and confidence could be slowing. Read on to find out what influenced the investment market in July 2023.

Despite some data suggesting there could be a downturn in some areas, the International Monetary Fund (IMF) has lifted its global growth forecast for 2023. The organisation now expects the global economy to grow by 3%, up from its previous prediction of 2.8%.

Globally, both households and businesses could face pressure as energy prices may rise in the colder months. The International Energy Agency warned that, if China’s economy rebounds this year, energy prices may spike in winter.

UK

The pace of inflation in the UK is slowing. Yet, it remains stubbornly high and above many other economies at 7.9% in the 12 months to June 2023. The latest inflation figures prompted the Bank of England (BoE) to hike its base interest rate again – as of July 2023, it stands at 5%.

The IMF predicts the BoE will need to keep interest rates high for longer than expected due to economic challenges.

Further rises could cause market volatility – the FTSE 100 hit its lowest closing level of 2023 ahead of the July BoE announcement at the start of the month.

The interest rate increases have led to mortgage rates soaring. In July, the average five-year fixed-rate mortgage deal exceeded 6% for the first time since 2008. In fact, by the end of 2026, the BoE predicts that 1 million households will see their monthly mortgage repayments increase by £500.

While many borrowers have been affected by interest rates increasing almost immediately, saving rates have been lagging. The Financial Conduct Authority set out expectations for “fair and competitive savings” during the month, and savers may have started to see the earnings on their savings rise as a result.

The latest release from the Office for National Statistics shows that between February and April 2023, the average wage increased by 7.2%. While growth is good news, the figure is below inflation and so wages are falling in real terms.

As well as soaring mortgage costs, food inflation has significantly affected household budgets. So, it may be of little surprise that a survey for i newspaper found 67% of consumers would back the idea of a price cap on essential goods.

Data suggests many businesses are struggling too.

According to a Purchasing Managers’ Index (PMI) UK factories shrank at their fastest pace in six months in June. Output, new orders, and employment levels all fell and could signal the challenges will continue into the medium term.

As businesses struggle with rising costs, insolvencies are expected to rise. Figures released by the Insolvency Service show business bankruptcies were 27% higher in June when compared to the same period in 2022.

Begbies Traynor, a business recovery and financial consultancy, believes insolvencies will rise over the next 18 months due to interest rate hikes. The firm added that “zombie” businesses have been able to continue operating due to cheap borrowing costs but will now struggle to service debts.

While there have been ups and downs in the market throughout July, the pound hit a 15-month high after all major UK banks passed BoE stress tests.

Europe

Inflation in the Eurozone fell to 5.5% in the 12 months to June 2023. While still above the long-term average, it’s lower than the 8.6% recorded in June 2022.

In response, the European Central Bank increased interest rates to its highest level in more than 20 years. The deposit rate is 3.75% as of July 2023.

PMI data indicates businesses in the Eurozone are facing similar challenges to the UK. Overall business activity fell and moved into negative territory. Factory output was also weak in June, particularly in Austria, Germany and Italy, and employment fell for the first time since January 2021.

US

Steps taken by the Federal Reserve have successfully slowed inflation in the US. In the 12 months to June, it was 3% – a two-year low.

According to PMI data, the US factory sector took a “sharp turn for the worse” in June. The results mirror the situation in Europe, with new orders falling. It’s increased concerns that the country could slip into a recession in the second half of the year.

While there may be worries about the US economy, official data indicates businesses are still confident about their future. American companies added half a million jobs to the economy in June and US wages increased by 4.4%.

In company news, Twitter’s rebrand to X is estimated to have wiped billions off the company’s value.

Since Tesla owner Elon Musk took over the social media platform in October 2022, he’s made a raft of changes. In July, Musk revealed a new name and logo for the platform, which have drawn criticism. According to Fortune, changing the name has wiped out between $4 billion and $20 billion in brand value.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Why emotional decision-making could be costing you investment returns

It can be difficult not to let your emotions influence the decisions you make. When investing, emotional decision-making could be harming your portfolio’s performance and your ability to reach your goals.

While you try to make investment decisions based on logic and facts, it can be easy for emotions, from fear to excitement, to play a role at times. And a survey of financial advisers reveals it could be costing you more than you think.

According to a report in FTAdviser, financial advisers believe emotional decision-making costs investors at least 2% each year in foregone returns. They believe two of the biggest mistakes investors make are:

- Being too influenced by the news (47%)

- Taking too little risk (44%).

If you’ve been guilty of these mistakes in the past, you’re certainly not alone. The good news is that there are things you can do to reduce the effect emotions have on your investments. Read on to find out how you could tackle these two mistakes.

1. Tuning out the news to focus on your long-term plan

Market volatility is part of investing. Unfortunately, sensational headlines about markets “soaring” or “plunging” sell. However, they often don’t show the bigger picture – that even after volatility, markets have, historically, smoothed out over the long term and delivered returns.

On top of providing a snapshot, rather than an in-depth look at markets, remember that the news isn’t tailored to you. An investment opportunity that is perfect for one person, may not be right for another.

If you read about markets falling sharply or the latest “must invest” tip in the newspaper, it’s natural to think about what it means for your investment portfolio. Perhaps you’re scared that volatility could mean the value of your assets will fall and you won’t be able to retire when you intend? Or maybe you feel a thrill at the thought of investing in the next big technology firm?

Tuning out the noise can be difficult, but it may reduce the chance of emotions affecting your decisions.

Working with a financial planner may help you reduce the effect the news has on your mindset. It means you have someone to turn to if you have concerns or would like to pursue an opportunity. Speaking to a professional about your options could prevent knee-jerk decisions you might regret later.

Creating an investment strategy that’s tailored to your goals and circumstances with a financial planner may also give you the confidence to dismiss the news.

At times, your portfolio may dip but understanding why investments have been selected and how it fits into your overall plan could put your mind at ease.

2. Balancing how much investment risk you should take

It’s common to hear that investors are worried about taking too much risk. After all, too much risk could mean you’re more likely to lose your money, and it could affect your progress towards your life goals. Yet, nervous investors can take too little risk.

While you may feel comfortable taking less risk as your money is “safer”, you could miss out on potential growth. Taking too little risk for your circumstances may mean falling short of your goals, even though you had an opportunity to achieve them.

Setting out a risk profile is an essential part of understanding which investments are right for you.

It can be difficult to understand how much risk is appropriate. A financial planner could help you here. By considering a range of areas, from what assets you hold to your investment goals, we can create a risk profile that suits you.

By understanding risk and what’s appropriate for your circumstances, you could reduce the effect emotions like fear have on your decisions. You may feel confident enough to take greater investment risk if it’s right for you and find yourself in a better position to reach your goals.

Want to review your investments? Contact us

Tailored investment advice may help you reduce the effect emotions have on your decisions so you can focus on what’s right for your circumstances.

Whether you want to start investing or would like a portfolio review, please contact us. We can work with you to create an investment strategy that you have confidence in and provide ongoing support so you have someone to turn to if you have any questions or concerns.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Market volatility means thousands of families may have overpaid Inheritance Tax

Thousands of families may be entitled to an Inheritance Tax (IHT) rebate due to stock market volatility. As the government does not automatically refund estates when this happens, many families could be unaware they’ve overpaid.

Overpaying IHT could occur if the value of assets falls between the benefactor passing away and the sale of them. Read on to find out why this affects an IHT bill and what you can do if you’ve overpaid.

When is Inheritance Tax due?

IHT is paid on the estate when someone passes away if the value exceeds certain thresholds.

Usually, there are two key thresholds to consider when calculating if an estate could be liable for IHT:

- If the value of the estate is below the nil-rate band, no IHT is due. For 2023/24, the nil-rate band is £325,000 and the government has frozen it until 2027/28.

- If the deceased is leaving their main home to direct descendants, such as children or grandchildren, they may also be able to use the residence nil-rate band. For 2023/24, this is £175,000. Again, the residence nil-rate band is frozen until 2027/28.

You can pass on unused allowances to your spouse or civil partner. So, if you’re planning together, you could leave up to £1 million before IHT is due.

Assets that exceed these thresholds could be subject to IHT. The standard IHT rate is 40%, so it can significantly reduce the amount beneficiaries receive.

The number of families reclaiming overpaid Inheritance Tax has increased by 22%

According to a report in the Telegraph, the number of families that have reclaimed overpaid IHT increased by 22% in 2022/23, when compared to a year earlier.

Overpaying can occur because an IHT bill is calculated based on the value of the assets on the date of death. However, the value of assets, such as investments, can change and beneficiaries may sell the assets for less than the original valuation. Yet, families may have already paid an IHT bill based on the original value.

Stock market volatility could mean more families overpaid IHT in the last few years. A family inheriting investments may find they sell the assets for less than the original valuation as the price can change significantly, even in a short period.

Similarly, as experts expect house prices to fall in the near future, more families could find they overpay IHT.

According to the Halifax House Price Index, property prices fell by 2.6% in June 2023 when compared to a year earlier.

Economic challenges and rising interest rates mean some property experts expect the market to fall further. In March 2023, the Office for Budget Responsibility forecast that house prices would fall by 10% during 2023 and 2024.

So, families that inherit property could find the value falls and that they’ve overpaid IHT as a result.

As properties are often among the largest assets inherited, the amount overpaid could be substantial. The Telegraph analysis suggests a family inheriting a home initially valued at £1.2 million that falls by 3.5% by the time it’s sold could have overpaid IHT by £16,800.

If the value of assets falls, the government will not automatically refund the estate – you must reclaim the amount overpaid. So, some families may be unaware they’re entitled to a refund.

How to reclaim overpaid Inheritance Tax

As IHT must be paid within six months of the date of death to avoid incurring interest, some families may pay the bill before they sell assets, or the probate process is complete. It could make it difficult to understand if the figures used to calculate IHT are accurate.

So, if you’ve sold inherited assets, it’s worth reviewing the value at the date of death and comparing it to how much you received when selling them. You can reclaim IHT if you sell:

- Property within four years of the date of death

- Qualifying investments within 12 months of the date of death.

If falling values have affected your inheritance, you can fill in a form to recover overpaid IHT.

There is a time limit on submitting a relief form. For property, you must submit the form within seven years of the date of death, and within five years for investments.

One important thing to note is that when you submit a relief form for investments, HMRC will consider all inherited investments – not just those that have fallen in value. So, if some investments have increased in value, the amount you can reclaim may be lower than you expect.

Contact us to learn more about Inheritance Tax

Whether you want to understand if you’ve overpaid IHT or what steps you could take to reduce a potential IHT bill on your estate, please contact us. We can offer advice that’s tailored to you to help you get the most out of your assets.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate Inheritance Tax planning.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes, which cannot be foreseen.

Baffling financial jargon means Brits are overlooking ways to boost their wealth

Brits are struggling with financial jargon and aren’t sure where to start with investing. It could mean some people are missing out on opportunities to increase their wealth.

A survey from Lloyds Bank found that 50% of Brits say they were scared of investing. Furthermore, 38% say financial jargon is baffling.

Misunderstanding common financial terms could lead some people to make decisions that aren’t right for them.

Despite dominating the headlines over the last year, 3 in 10 people said they didn’t understand “inflation”. As inflation has a direct effect on your cost of living, not understanding how it influences your outgoings could mean some budgets are no longer realistic.

Other common investing terms people are clueless about include:

- Asset class (77%)

- Dividend (42%)

- Stocks (37%)

- Portfolio (37%)

- Shares (31%)

Uncertainty about financial terms mean that many people find learning about finances daunting. In fact, 26% of people believe it would be easier to learn a new language than start investing.

Yet, half of the participants said they wanted to learn more about the basics of investing and finances.

Overlooking investing could affect your long-term wealth

If a lack of financial confidence means you’ve not considered investing, you could be missing an opportunity to grow your long-term wealth.

While money in a savings account is “safe”, the interest it earns is likely to be below inflation, which reduces the value in real terms.

Inflation means the cost of goods and services is rising, so your money will gradually buy less. Unless the interest you earn on a cash account exceeds inflation, the spending power of your savings is falling in real terms.

As inflation is currently high, the value of your savings could be falling quickly. However, even when inflation isn’t high, the compounding effect may have a greater impact on your savings over the long term.

In some cases, investing could help grow your wealth. Historically, investment markets have delivered positive returns over the long term, which might provide a way to increase your wealth at a faster pace than inflation.

However, it is important to note that investing isn’t always the right option. For instance, if you’re saving for short-term goals, a cash account may be more appropriate. Or if you don’t have an emergency fund, focusing on building one first could provide you with greater financial resilience.

All investments carry some risk and returns cannot be guaranteed, so just as crucial as deciding whether to invest is choosing which investments suit you.

Here are three ways a financial planner could help improve your investment and financial knowledge.

1. Cut through confusing financial jargon

If you’ve been putting off financial decisions because jargon means you’re not sure which options are right for you, speaking to a financial planner could be useful.

We can not only explain what financial terms mean, but why they may be relevant to you. Having your options explained in clear language could give you the confidence to take control of your finances.

2. Assess which investments could be right for you

The survey suggests that many people don’t know where to start when they want to invest. It’s easy to see why – there are a lot of options to choose from, and it can be difficult to know which ones may be right for you.

To understand which investments suit your goals, you may need to consider areas like your investment time frame, what other assets you hold, and your risk profile. You should also keep in mind how different investments can be used to create a balanced and diversified portfolio.

A financial planner can assist with all of these, helping you build a financial plan to suit your needs and circumstances.

3. Provide you with someone to turn to when you’re uncertain

Even the best-laid plans can go awry. Perhaps, health reasons mean you want to stop working sooner than expected. Or investment market volatility means the value of your portfolio has unexpectedly fallen.

Working with a financial planner on an ongoing basis means you have someone to turn to if you need reassurance or would like to update your financial plan. They can also help ensure your financial decisions continue to reflect your goals and economic circumstances.

Contact us to talk about your finances

If you want help creating a financial plan that suits you, please get in touch. We can offer advice and guidance so you can feel more confident taking control of your long-term finances.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

A grocery shop would cost just 45p in 1940s when the first supermarket opened its doors

Visiting the supermarket to pick up a few items or do your weekly shopping is so common it can be difficult to imagine life without this convenience. Yet, it wasn’t too long ago that the first supermarket was opening its doors in the UK. And looking back offers an interesting insight into how money and shopping habits have changed.

The London Co-operative Society opened its doors for the first time in 1948.

It offered a very different service to other shops of the time. Shoppers were used to chatting with the shopkeeper while an assistant picked the items for them. In fact, shoppers wouldn’t have handled the goods at all until they paid.

So, walking into a “self-service” supermarket – where customers picked up their items themselves and took them to a till – was a very different experience. On top of that, there were all kinds of goods under one roof and competitive prices. It’s easy to see why supermarkets became popular.

Today, there are thousands of supermarkets across the UK, from the “big six” to independent stores. And “self-service” has gone one step further with many shops installing checkouts customers can use themselves.

In the 75 years since the first supermarket opened, how we use money, the value of it, and shopping habits have changed enormously. Looking at inflation and how it’s calculated offers a glimpse into this transition.

£1,000 in 1946 has the same value as almost £34,500 today

The UK first started tracking retail prices a year after the first supermarket opened. It shows how prices have changed over seven decades.

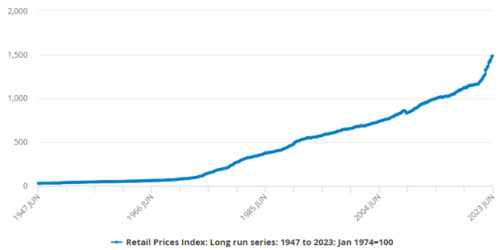

Data from the Office for National Statistics (ONS) demonstrates how inflation influenced prices between 1947 and 2023. While there have been times retail prices have dipped, overall, it’s been an upwards trend.

Source: Office for National Statistics

In fact, according to the Bank of England’s inflation calculator, £1,000 in 1946 would be equivalent to almost £34,500 today.

The ONS measures inflation by tracking a “basket of goods”. This basket is filled with common goods and services to understand how the cost of frequent purchases changes. Currently, there are around 700 representative consumer goods and services in the basket. As well as groceries from the supermarket, it also includes items like clothing and electronics.

The items are regularly reviewed. So, not only does it track prices, but trends and spending habits.

When the first supermarket opened, rationing was still in place. In the post-war era, the ONS included items like condensed milk, which was often used to make rations stretch further. Condensed milk remained in the basket until 1987 when fresh, pasteurised milk became more widely available.

Fast forward to 2023, and new additions to the basket include frozen berries and free-from products.

3 interesting comparisons that show the power of inflation

1. The average salary was 126 shillings, 9 pence

Before the government introduced decimalisation in 1971, there were 20 shillings to a pound and 12 pence to a shilling. According to the House of Commons library, the average worker earned 126 shillings, 9 pence a week in November 1946.

Inflation means the average earnings in April 2023 are significantly more. Data from ONS shows the average weekly salary is £603, excluding bonuses.

2. A weekly grocery shop was just 45p

According to the Northumberland Gazette, the average person needed just 45p to pick up a week’s worth of groceries in the 1940s. In today’s money that would be less than £20.

However, food inflation and changing habits mean the average adult spends around £44 a week on food in 2023.

3. A property “boom” led to prices quadrupling in some areas

Soaring property prices are often discussed in newspapers today, and it’s not a new phenomenon.

A 1947 article in the Guardian states there was a “boom in house property prices”. In 1939, houses went for around £500. Just eight years later, aspiring homeowners could expect to pay up to £1,500, or even up to £4,000 in select residential districts.

Over the next seven decades, house prices outstripped inflation. The Halifax House Price Index suggests the price of an average house in June 2023 was more than £285,000.

Have you considered how inflation could affect your finances?

Since the first supermarket opened its doors, inflation has affected the value of money. This is something you may need to consider when managing your finances.

For example, if you’re planning for retirement in 20 years, how will the income you need to maintain your lifestyle change? How can you grow your assets to keep up with the pace of inflation?

A financial plan that incorporates inflation could help you understand how it may affect your wealth and the steps you might take to protect it. Please contact us to arrange a meeting to discuss your financial plan.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Recent Comments