Category: News

Guide: Your retirement choices: How to generate an income in later life

Retirement on your terms is likely to be one of the key elements of your financial plan.

So, as you approach or reach retirement, now is the time for you to start thinking about enjoying a comfortable life when you stop working.

Many people see retirement as the start of their “second life” – the time when you have the chance to do all the things you want to do. You may have been planning this moment for many decades and have grand plans for what you might like to do in the years ahead.

If you haven’t already done so, now is also the time to start thinking about your income in retirement, and how long it may need to last.

Aside from taking all your fund in one go – or not taking it at all and leaving it to pass to your heirs – there are four main options:

- Buy an income for a fixed period or for life, known as an “annuity”.

- Take an adjustable income, known as “flexi-access drawdown” (or sometimes just “drawdown”).

- Take lump sums from your pension fund, sometimes known as “uncrystallised funds pension lump sums” (UFPLS).

- Mix and match different options.

This useful guide explains the advantages and disadvantages of each option, as well as some other areas you might want to consider when planning for retirement.

Download your copy of ‘Your retirement choices: How to generate an income in later life’ to find out more now.

If you’d like to talk about your retirement plan, please contact us to arrange a meeting.

Investment market update: June 2024

2024 is a historic election year – elections will take place in 50 countries. More than 2 billion voters will head to the polls in countries including the UK, US, France, and South Africa throughout the year. Political uncertainty can affect investment markets and there was evidence of this in June.

During market volatility, remember that markets have, historically, recovered in the longer term. And, for most investors, sticking to their long-term investment strategy makes financial sense.

Read on to find out what affected investment markets around the world in June 2024.

UK

Despite hopes that the UK economy had turned a corner when it exited a recession in the first quarter of 2024, GDP figures were disappointing in April. Official figures show the economy flatlined when compared to a month earlier.

Yet, the Bank of England (BoE) remains optimistic. The central bank raised its second-quarter growth forecast to 0.5% after it revised upwards its May 2024 prediction of 0.2%.

There was further good news for the BoE too – UK inflation fell to its official target of 2% in the 12 months to May 2024 for the first time since 2021. The news led to speculation that the bank would cut its base interest rate, but the Monetary Policy Committee opted to hold it at 5.25%.

The positive inflation data sets the stage for a rate cut later this year, with the BoE saying it will keep interest rates “under review”.

As inflation pressures started to ease, figures from the Insolvency Service suggest fewer businesses are failing. The number of firms that became insolvent fell by 4% in May when compared to a month earlier. Even so, the number is 3% higher when compared to the same period in 2023.

Readings from the S&P Global Purchasing Managers’ Index (PMI), which measures business conditions, are also positive. In May:

- UK factories returned to growth with the most rapid expansion of output in two years. The boost was mainly supported by domestic demand, as new export orders fell.

- The service sector lost momentum but still posted growth. The slower pace is partly due to new orders easing when compared to the 11-month high recorded in April.

Uncertainty as UK political leaders campaigned ahead of the 4 July 2024 general election was partly linked to the FTSE 100 index, which includes the largest 100 companies listed on the London Stock Exchange, falling by 0.4% on 4 June.

Amid political turmoil in France, London regained its crown as Europe’s biggest stock market, which Paris has held for the last two years. According to Bloomberg, as of 17 June, stocks in the UK were collectively worth $3.18 trillion (£2.52 trillion) compared to France’s $3.13 trillion (£2.48 trillion) valuation.

Europe

At the start of the month, the European Central Bank (ECB) slashed its three key interest rates by 25 basis points in the first cut since the start of the Covid-19 pandemic.

Yet, figures released by Eurostat just two weeks later showed inflation was 2.6% in the year to May 2024 across the eurozone, up from 2.4% in April. The news prompted some commentators to speculate the cut to interest rates had been made too soon.

PMI data was positive in the eurozone as business activity grew at the fastest rate this year. Of the top four economies in the bloc, only France contracted slightly, while Germany, Spain, and Italy posted growth.

President of France Emmanuel Macron called a snap election, which is set to be held between 30 June and 7 July. The election has added to the political uncertainty affecting markets.

Indeed, on 10 June, France’s CAC index, which is comprised of 40 of the most prominent listed companies in the country, was down 2%. The effects were felt in other stock markets too, with Germany’s DAX falling 0.9% and Italy’s FTSE MIB losing 0.95%.

In response to the snap election, credit ratings agency Moody’s issued France with a credit warning, stating there was an increased risk to “fiscal consolidation”. Citigroup also downgraded its rating for European stocks to neutral from overweight due to “heightened political risks”.

US

The New York Stock Exchange got off to a rocky start in June. On 3 June, a technical issue led to large fluctuations in the listed prices of certain stocks. Warren Buffett’s Berkshire Hathaway was affected by the glitch, which suggested shares had fallen in value by 99%. Fortunately, the issue was resolved within an hour.

The rate of inflation fell to 3.3% in May 2024 but remains above the Federal Reserve’s target of 2%.

The drop in inflation led to a boost for Wall Street. On 12 June, both the S&P 500 index, which includes 500 of the largest companies listed in stock exchanges in the US, and tech-focused index Nasdaq opened at all-time highs.

Figures from the US Bureau of Labor Statistics indicated that businesses are feeling confident about their future. 272,000 jobs were added in May, far higher than the 185,000 Wall Street has forecast. Yet, unemployment also increased slightly to 4%.

Tesla shareholders voted in favour of CEO Elon Musk’s huge $56 billion (£44 billion) pay package – the largest corporate pay package in US history by a substantial margin. The results of the annual general meeting led to Tesla shares rising by around 6.6%, which helped recover some of the 28% losses they’ve suffered so far this year.

Asia

Moody’s raised China’s growth forecast to 4.5%, up from 4%. While growth of 4.5% would be great news in many developed countries, it would mark a slowdown for China, which saw its GDP rise by 5.2% in 2023.

However, signs of a trade war starting between China and the EU loomed and could dampen growth expectations.

The EU notified China that it intended to impose tariffs of up to 38% on imports of Chinese electric vehicles. The move would trigger duties of more than €2 billion (£1.69 billion) a year. The announcement followed an investigation into alleged unfair state subsidies and similar tariff increases from the US earlier this year.

In retaliation, China opened an anti-dumping investigation into imported pork and its by-products from the EU. China is the EU’s largest overseas market for pork, which was worth $1.8 billion (£1.42 billion) in 2023.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

3 fun ways you can pass on essential money lessons to children

As a parent or grandparent, you want the young children in your life to grow up to be happy and successful adults. A solid grasp of finances could set them off on the right track when they get older, but alarmingly, many children don’t receive any lessons on the subject during their formal education.

A Nationwide survey found that 84% of parents say their children haven’t received any financial education at school despite 96% believing it’s important for young people to learn about money.

In light of data such as this, it might be prudent to take on some of the responsibility and start educating your children or grandchildren about personal finances yourself.

Making the experience as enjoyable as possible could help to engage kids in money conversations. So, read on for three fun ways to pass on essential finance lessons to children as they grow up.

1. Use games to teach kids about money in an interactive way

According to a report from UNICEF, play is one of the most important ways in which young children gain essential knowledge and skills. So, integrating financial lessons into playtime through games could be an effective way to teach them about money.

Games let kids role-play everyday financial scenarios and learn money fundamentals without any risk.

There are several fun games you can play with young children using items you have at home:

- The desert island game – get your children or grandchildren to imagine they’re stranded on a desert island and can only bring six items. Through discussing their options, they’ll soon realise it’s sensible to prioritise essentials over fun items when they have limited choice, giving them an introduction to the basics of budgeting.

- Setting up shop – encourage your child to set up a shop selling household objects. Can they set accurate prices and give correct change? Next, flip the game and let them be the customer. Can they buy everything they need without going over budget?

Alternatively, there’s a plethora of fun financial board games you can buy for kids of all ages:

- Money Bags – in this game for ages five and above, players learn to recognise coins and develop their maths skills by completing chores and earning money as they move around the board.

- Pay Day – suitable for children aged eight and older, Pay Day simulates something most people are familiar with – the monthly payday cycle. Players must ensure their pay packet lasts the month and whoever has the most at the end of day 31 wins.

- The Game of Life – this classic board game takes players through an entire lifetime. It can teach children the financial implications of saving, further education, retiring and more, all in a family-friendly package.

The best money games reward kids for making decisions that would also benefit them in the real world, teaching them valuable lessons in a fun, interactive way. Playing these games is also a lovely chance for quality time together, so it’s a win-win all around.

2. Let them be in charge of money on a day out

As your children or grandchildren grow up, it’s important that they begin to understand the value of money.

While you will no doubt enjoy treating your loved ones, it can be hard for children to grasp how far money goes when adults buy things for them. Finding interesting ways for youngsters to practise spending money helps them understand exactly how much items and activities cost.

One fun way to do this is to let them be in charge of the family budget on a day out.

For example, say you’re visiting a castle. Before you arrive, give them £100 and explain that this money must pay for everything you do that day.

When you arrive, they’ll have to pay for entry. This might leave them with, say, £50.

After exploring the castle, your child might be tempted to buy something from the gift shop. However, if they buy a toy or book, they might not have enough money to pay for lunch.

They’ll need to carefully consider what’s more important. Hopefully, they’ll realise that food takes priority over souvenirs. If not, they’ll have to face the consequences of their actions and skip lunch.

Perhaps it would be wise to have backup sandwiches in the car to avoid any tantrums on the way home!

3. Books are a fun way to learn for kids of all ages

If your grandchild loves story time, or your bleary-eyed teenager stays up reading until the early hours, you could introduce them to books about money.

You might think personal finance is too dry a topic for children’s literature, but there’s an excellent range of entertaining books on the subject for children of all ages.

The Four Money Bears by Mac Gardner is a wonderful option for younger children.

Through beautiful illustrations and accessible storytelling, Gardner uses the tale of Spender Bear, Saver Bear, Investor Bear, and Giver Bear to teach kids about the functions of money and instil lessons such as spending cautiously, saving diligently, investing wisely, and giving generously.

For kids aged 8 to 12, Finance 101 for Kids: Money Lessons Children Cannot Afford to Miss by Walter Andal is a fun-to-read crash course on essential topics like earning, saving, investing, and credit. It even touches on more advanced subjects like the stock market, foreign exchanges, and basic economics.

Reality TV-loving teenagers might enjoy Deborah Meaden Talks Money. This insightful book from entrepreneur and TV personality Deborah Meaden features podcast-style interviews with stars including Gary Neville, Sophie Ellis-Bextor, and Joe Lycett. It’s designed to demystify the world of finance and help your children build good money habits in an exciting, relatable way.

Teaching your children and grandchildren about money may seem like a challenge now, but when they reach adulthood, all your patience and effort should pay off. You never know, you may even get a belated thank you!

Contact us to support your children in other ways

Sharing financial knowledge with children is important, but there are other ways you can support their financial future.

We can help you craft a financial plan that supports your children or grandchildren, laying the foundations for the next generation. Contact us to arrange a meeting.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

How to use life insurance to cover a future Inheritance Tax bill for your family

The amount the government collects through Inheritance Tax (IHT) is on the rise, and freezes to allowances mean it’s expected to increase further. If your family could face a bill when you pass away, life insurance could provide a valuable way to cover the expense.

According to MoneyAge, the amount collected through IHT hit a record £7.5 billion in 2023/24.

An IHT bill could not only mean passing on less wealth to your loved ones, but it may be stressful too. The portion of your estate that exceeds thresholds could be liable for IHT at a standard rate of 40%, and your family might need to consider which assets to sell to cover the expense.

Understanding whether IHT may be due on your estate could help you make provisions that will ease the burden for your family.

If the value of your estate exceeds £325,000, it could be liable for Inheritance Tax

IHT is paid if the value of your estate exceeds thresholds when you pass away.

In 2024/25, the nil-rate band is £325,000 – if the value of all your assets is below this threshold, no IHT will be due. In addition, many estates can use the residence nil-rate band, which is £175,000 in 2024/25 if your main home is passed on to direct descendants.

So, you can often pass on up to £500,000 before you need to consider IHT. If you’re planning with your spouse or civil partner, you can also pass on unused allowances to them.

Importantly, the nil-rate band and residence nil-rate band are frozen until 2028, which is predicted to lead to more estates becoming liable for IHT.

Indeed, the Institute for Fiscal Studies estimates that by 2032/33, 1 in 8 people will have IHT due either on their death or that of their partner. As a result, IHT revenues are predicted to double over the next decade.

Life insurance can provide a useful way to pay Inheritance Tax

Life insurance won’t reduce how much IHT your estate is liable for. However, it could provide a straightforward way for your loved ones to pay the bill.

When you take out whole of life insurance, you’ll need to pay regular premiums to maintain the cover. When you pass away, a lump sum will be paid to your beneficiaries, which they can then use to pay IHT. It could mean your family doesn’t need to break up your estate or sell assets to settle the bill.

The cost of the premiums will depend on a variety of factors, including your age, health, and lifestyle. In addition, the level of cover you require will also affect the cost.

You can select the level of cover that suits your needs, so understanding the size of a potential IHT bill is important.

A good place to start is by assessing the value of your estate now. Your estate covers all your assets, from property and investments to material items.

You’ll then want to consider how the value of each asset could change during your lifetime. For example, the value of your property will likely rise.

If you’re not using savings and investments to supplement your retirement income, they could also increase in value over the long term. On the other hand, there may be assets you’ll deplete during your lifetime, such as your pension.

As a result, the potential size of an IHT bill could be difficult to calculate. A financial planner could help you get to grips with how the value of your estate might change in different scenarios so you can choose the right level of life insurance for you.

You may want to place life insurance in a trust if it’s for Inheritance Tax purposes

If you’re considering using life insurance to provide your family with a way to pay a potential IHT bill, it’s sensible to place the life insurance in trust.

Using a trust means it sits outside of your estate and won’t be included when calculating how much IHT is due. If you didn’t take this step, the lump sum that the life insurance pays out might be included in your estate, which would lead to a larger IHT bill.

You can set up a trust yourself but they can be complex and there are several different types. Seeking the services of a legal professional could minimise the chance of mistakes occurring and ensure the trust you set up suits your purposes.

Get in touch to talk about your estate plan

Life insurance could provide your loved ones with a simple way to pay an IHT bill, but there may be other steps you can take as well. As part of an estate plan a financial planner would review your circumstances and goals to understand how you could pass on assets effectively, including steps that may reduce an IHT bill.

Please contact us to arrange a meeting to talk about your estate.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate estate planning.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Cover is subject to terms and conditions and may have exclusions. Definitions of illnesses vary from product provider and will be explained within the policy documentation.

Higher-rate taxpayers: Beware of the 60% tax trap

The tapering of the Personal Allowance means some higher-rate taxpayers effectively pay an Income Tax rate of 60%, sometimes without realising. Fortunately, if you’re affected, there could be ways to reduce your tax bill.

A report in the Telegraph suggests 1.35 million workers were affected by the 60% tax trap in 2023/24. Collectively, they paid an extra £4.7 billion to the Treasury. Read on to find out if you could unwittingly be paying a higher rate of Income Tax than you expect.

The tax trap affects those earning more than £100,000

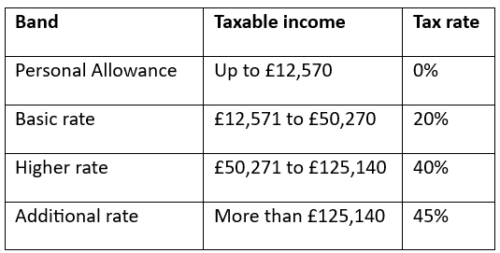

You might think the highest rate of Income Tax is 45%, and officially you’d be correct. Most people pay the standard rates of Income Tax. In 2024/25, Income Tax rates and bands are:

Please note, that different Income Tax bands and rates apply in Scotland.

However, the Personal Allowance is reduced by £1 for every £2 you earn over £100,000. If you earn more than £125,140, you don’t have a Personal Allowance and pay tax on all your income.

For example, if you earn £101,000, on the £1,000 above the threshold, you’d pay £400 of Income Tax at the higher rate. In addition, you’d lose £500 of your Personal Allowance, so this portion of your income would also be subject to Income Tax at 40%, adding up to £200.

So, out of the £1,000 you’ve earned above the tapered Personal Allowance threshold, you’d only take home £400 – a 60% effective tax rate. It’s led to the tapering being dubbed a “stealth tax” in the media.

Further compounding the issue is the fact that the Personal Allowance and Income Tax bands are frozen until 2028.

While the thresholds are frozen, many people are likely to receive wage increases. As a result, more people are expected to be caught in the 60% tax trap in the coming years.

Don’t forget your salary might not be your only income that’s considered when calculating your Income Tax bill. For example, you could be liable for interest earned on savings that aren’t held in a tax-efficient wrapper.

Contact us if you’re unsure which of your assets could be liable for Income Tax.

3 legal ways to avoid falling into the 60% tax trap

If you’re affected by the tapered Personal Allowance, thinking about how you structure your earnings may provide an opportunity to reduce how much you’re giving to the taxman. Here are three excellent options you might want to consider.

1. Boost your pension contributions

One of the simplest ways to avoid paying 60% tax if you could be affected is to increase your pension contributions.

Your taxable income is calculated after pension contributions have been deducted. As a result, boosting pension contributions could be used to reduce your adjusted net income so you retain the full Personal Allowance or reduce the proportion you lose.

Increasing pension contributions could help you secure a more comfortable retirement too. However, keep in mind that you cannot usually access your pension savings until you’re 55 (rising to 57 in 2028).

2. Use a salary sacrifice scheme

If your workplace has a salary sacrifice scheme, it could also provide a useful way to reduce your overall tax liability.

Salary sacrifice enables you to exchange a part of your salary for non-cash benefits from your employer. This could include higher pension contributions, childcare vouchers, or the ability to lease a car.

By essentially giving up part of your income, you might be able to bring your taxable income below the threshold for the tapered Personal Allowance.

You should note that salary sacrifice options vary between employers, so it may be worthwhile to check your employee handbook to see if any options could suit you.

3. Make charitable donations from your income

If you’d like to reduce your Income Tax bill and support good causes, you could make a charitable donation. Again, by deducting donations from your salary before tax is calculated, you could manage how much of the Personal Allowance you lose.

Contact us to talk about how to manage your tax bill effectively

There may be other steps you could take to reduce your overall tax bill. A tailored financial plan will consider your tax liabilities, including from other sources, such as your savings and investments, to highlight potential ways to cut the amount you pay to the taxman.

If you’d like to arrange a meeting, please get in touch.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Why the “4% rule” could put your retirement finances at risk

When you’re accessing your pension, it’s important to consider the sustainability of your withdrawals. You might have heard of the “4% rule”, which provides a seemingly simple way to calculate how much you can access each year. However, for modern retirees, applying this rule to your pension could be risky.

The 4% rule was first articulated by William Bengen, a retired US financial adviser. The rule essentially suggests you can withdraw up to 4% of your pension each year without fear of outliving the money. In fact, Bengen said 4% was the worst-case scenario for retirees and suggested a withdrawal rate of 7% would often be “safe”.

The 4% rule sounds simple, so it can be tempting to put it into practice yourself. Yet, it could leave retirees short in their later years.

With many retirees fearing that they may outlive their pension – a report from This Is Money suggests almost half of retirees worry about this – read on to find out why you shouldn’t rely on the 4% rule.

4 compelling reasons to avoid the 4% rule

1. Longevity has increased how long your pension might need to last

One of the key challenges when deciding how much you can sustainably withdraw from your pension is that you don’t know how long it’ll need to last.

Bengen based his 4% rule on the need to create a retirement income for 30 years. Yet, there’s a real possibility that many modern retirees will need to fund a longer period than this.

Data from the Office for National Statistics suggests a man retiring today at age 60 would, on average, need to fund 25 years in retirement. Yet, there’s a 1 in 4 chance he’d live to be 92 and a 10% chance he’d celebrate his 97th birthday.

So, while a plan to spread your pension over 30 years might seem sensible at first glance, there’s a risk that you could run out of money in your later years.

For women, the risk could be even higher. A 60-year-old woman has an average life expectancy of 87, with a 1 in 4 chance of reaching 94 and a 10% chance of marking her 98th birthday.

As life expectancy continues to rise and retirees will likely need to draw on their pension for longer, using the 4% rule could become even riskier.

2. Periods of high inflation could mean withdrawing too much

When Bengen first named the 4% rule, he noted that retirees should adjust their annual withdrawals by the rate of inflation to maintain their spending power.

As recent events have shown, inflation isn’t always stable. A period of high inflation could mean you end up needing to withdraw higher sums to maintain your standard of living and deplete your pension faster than you expect as a result.

Inflation began to rise in the UK in 2021 and reached a peak of more than 11% in 2022. While the figure has fallen, it’s had a lasting impact on the budgets of households, including retirees.

According to the Bank of England, if you retired in 2021 with an annual income of £35,000, average inflation of 8.9% would mean your income would need to rise to more than £41,000 in 2023 to provide the same spending power.

That’s a huge jump in just two years. Over a retirement that might span decades, inflation might affect your income needs more than you anticipate, especially if events outside of your control lead to periods of high inflation.

3. Investment returns cannot be guaranteed

Another assumption that Bengen makes is that investment returns will help your pension continue to grow in retirement.

It’s important to note that investment returns cannot be guaranteed.

In addition, Bengen used historical performance figures from the US stock market, which isn’t a reliable indicator of future performance. While his calculations held up when compared to market performance between the 1920s and 1970s, that doesn’t mean it’s automatically the case for your portfolio.

It’s often important to consider how your pension is invested and whether it reflects your risk profile.

As well as understanding the potential returns, reviewing how the value of your pension could be affected during downturns could improve your financial resilience in retirement.

4. Your retirement income needs may not be static

Another drawback of the 4% rule is that it assumes your income needs will remain the same throughout retirement. In reality, many retirees find their outgoings change.

For instance, you might spend more in your first years of retirement as you make the most of having more freedom. Or you might plan to provide family members with financial gifts in the future, which may affect how you use your assets to create an income.

Another possibility retirees might want to consider is needing care or other type of support later in life. If you need to rely on care services, your outgoings could rise sharply in your later years.

A tailored financial plan could help you create your own pension rules

One of the biggest downsides to the 4% pension rule is that there’s simply no one-size-fits-all solution. How much you may withdraw from your pension depends on a whole host of other factors, from your retirement plans to what other assets you have.

So, instead of relying on a seemingly simple rule, working with a professional to create a tailored financial plan could help you devise your own set of rules to give you retirement confidence. Please contact us to arrange a meeting.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

The fantastic benefits of basing your financial plan on happiness

When you think about what you want the future to look like, it’s probably not the value of your assets that comes to mind first. Instead, you might think about the experiences you want or the wellbeing of your loved ones

Yet, to build the life you want, money is usually an important factor. While you often hear that “money can’t buy happiness”, the reality is that your financial circumstances are likely to play a role in whether you can secure the lifestyle you want.

By making your financial plan as much about happiness as your wealth, you could work towards your long-term goals and improve your overall wellbeing.

Combining your financial goals and happiness could improve your wellbeing

There are several excellent reasons to consider both your wealth and happiness when creating a financial plan.

First, financial stress can be detrimental to your wellbeing.

According to findings from the National Debtline, almost half of people in the UK were worried about money at the start of 2024 – the equivalent of 24.9 million people. Only 22% of people said they were not at all worried and felt able to cope financially.

Indeed, a report from Aegon found even among top earners, 1 in 3 people worried about their finances. So, taking control of your finances could improve your overall mental wellbeing.

In addition, it could focus on how you use your wealth to deliver outcomes that boost your happiness over the long term.

Rather than focusing simply on wealth creation, a financial plan would consider what steps you need to take to be able to reach your goals.

For example, after reviewing your finances, you might decide to reduce your working hours to phase into retirement sooner than expected. While that could mean the value of your pension is lower than if you continued to work, the free time you’d gain could be far more valuable. You might use the freedom to spend more time with your grandchildren or indulge in a hobby that brings you joy.

Making happiness a key part of your financial plan may allow you to make decisions that balance getting more out of your life with financial security.

3 valuable ways making happiness part of your financial plan could improve it

1. It gives you a chance to define what makes you happy

While you might work hard to build a fulfilling life, when was the last time you really considered what makes you happy?

According to the Financial Wellbeing Index from Aegon, just 1 in 4 people are very aware of the day-to-day experiences that give them joy and purpose in life. Similarly, only 1 in 4 people have a concrete vision of the things and experiences their future self might want.

This disconnect could mean some people are making decisions that don’t align with the future they picture for themselves.

By basing your financial plan on happiness, it provides an opportunity to set out what could improve your wellbeing now and in the future.

2. It could enhance your motivation to follow a long-term plan

Sticking to a financial plan over a long period can be difficult. However, knowing that your efforts will help you create the life you want may improve your motivation and help you stay on track.

If you daydream about retiring early, having a financial plan that’s been tailored to this goal might mean you’re less likely to pause pension contributions to fund short-term expenses.

So, putting your happiness at the centre of your financial plan could improve the outcomes.

3. It may help you calculate how much is “enough”

While money can’t buy happiness, it certainly can play a role in creating a life that will make you happy. Effective financial planning could help you calculate how much is “enough” for you.

Whether your goal is to retire early, have the financial freedom to travel more, or spend time with your family, financial security is often important for peace of mind. A financial plan could help you get your finances in order, so you can focus on what’s more important – enjoying your life.

Contact us to devise a financial plan that focuses on your happiness

If you’d like to work with us to devise a financial plan that places your happiness and wellbeing at the centre, please contact us. We’ll work with you to understand your goals and circumstances to build a tailored plan that suits your needs.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Investment market update: March 2024

While inflation continues to be a challenge for many economies, there are positive signs in the UK and around the world. Read on to find out what may have affected stock markets and your investment portfolio in March 2024.

Remember, volatility is part of investing and most people should invest with a long-term outlook. If you have any questions about your investment strategy or performance, please contact us.

UK

In March, chancellor Jeremy Hunt delivered the 2024 Budget and set out the government’s spending and changes to taxation. One of the big announcements was a 2% cut to employee National Insurance, which follows a previous cut made in the 2023 Autumn Statement.

The Resolution Foundation, a thinktank, said pensioners were among the biggest losers in the Budget, as National Insurance is paid by workers but not people who are retired.

Investment bank Citigroup responded to the Budget by saying the Office for Budget Responsibility (OBR) was being too optimistic when it assumed productivity would grow by 0.9%. The organisation predicts a more modest 0.5% and said it means the UK could be “fiscally offside by around £50 – £60 billion”.

The OBR recognised that productivity has been poor since the 2008 financial crisis. In fact, growth has fallen from 2.5% a year to 0.5% – the economy would have been around 30% bigger today if the pre-2008 trend had continued.

David Miles, a member of the OBR, said the last 15 years have been so bad, that the next 5 to 10 years are likely to be a “bit better”. He particularly noted that AI could help boost productivity.

Inflation continued to fall in the 12 months to February 2024, with a rate of 3.4% – the lowest since September 2021.

Despite the positive news, the Bank of England (BoE) held its base interest rate at 5.25%. Huw Pill, chief economist at the BoE, said he believed more compelling evidence was needed before a cut would be made and it could be “some way off”.

The UK fell into a technical recession at the end of 2023, but the BoE said signs suggest it is already over.

Figures from the S&P Global Purchasing Managers’ Index (PMI) also support this. Private sector growth hit a nine-month high in February, indicating that the recession was shallow. However, the manufacturing sector continued to face challenges, with PMI data showing weak demand and supply chain disruption are contributing to a downturn.

Despite figures from the Insolvency Service indicating businesses are struggling, as insolvencies hit a 30-year high in 2023, there is some good news for investors.

The FTSE 100 – an index of the 100 largest companies listed on the London Stock Exchange – hit a 10-month high on 21 March when it increased by around 1.1%. Mining stocks were among the main risers amid expectations that the US Federal Reserve will cut its base interest rate soon.

Greggs also saw its stock rise during March. The bakery chain revealed like-for-like sales increased by 13.7% in 2023, while pre-tax profits jumped 27% to £188.3 million. The firm added it expected another year of good progress in 2024.

Europe

According to data from Eurostat, inflation across the eurozone continued to fall in February 2024, when it was 2.6% compared to 2.8% a month earlier.

While many countries in Europe are battling high inflation, Turkey’s rate of inflation has consistently been in double digits since the end of 2019. In February, it hit a 15-month high of 67%. In a bid to cool the soaring cost of living, Turkey’s central bank increased its interest rate to 50%; this compares to a rate of 8.5% just a year ago.

The pan-European Stoxx 600 index reached a record high on 13 March boosted by upbeat company results from the likes of energy supplier E.ON and retailer Zalando. Buoyant company forecasts indicate that businesses are feeling optimistic about the future.

US

Inflation in the US unexpectedly increased to 3.2% in the 12 months to February 2024. The news dampened hopes that an interest rate cut would be announced soon.

A consumer sentiment index from the University of Michigan suggests Americans have a gloomy outlook about economic conditions and prospects for the future. Pessimistic consumers might be more likely to curb their spending, which could harm businesses.

Data from the US Federal Reserve also indicates that businesses are taking a more cautious approach. Average hourly earnings increased by just 0.1% in February 2024, while unemployment reached 3.9% – the highest figure since January 2022.

Technology giant Apple saw its shares fall by around 2.5%, wiping around $70 billion (£55 billion) off the value of the company, on 4 March following an EU-issued fine. The EU fined the company €1.8 billion (£1.54 billion) after it was found to have broken competition laws by imposing curbs on app developers.

Asia

Japan’s main index, the Nikkei, hit 40,000 points for the first time on 4 March after it increased by 0.5%, partly thanks to a weak Japanese Yen helping exporting businesses. The milestone follows a strong start to the year – the Nikkei has gained almost 20% since the start of 2024 thanks to booming technology firms.

The Bank of Japan also made its first interest rate hike in 17 years and ended eight years of negative interest rates, which sought to encourage lending. The bank’s base rate increased from -0.1% to 0.1% after board members said they expected to achieve 2% inflation in the coming year after decades of deflation and stagflation.

China continues to face a property crisis, which is affecting consumer spending and lending, as well as economic growth.

The Chinese government previously cracked down on property speculation that sent prices soaring. However, the property market peaked in 2020 and has faced a downturn ever since.

According to the country’s National Bureau of Statistics, house prices continued to fall in major cities in February. The organisation said it expects real estate to remain the main drag on economic growth in 2024.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

How financial protection could offer security to parents

As a parent, your child facing an illness could affect your finances just as much as becoming ill yourself. Appropriate financial protection could offer you a safety net when you need it most, including if you need to take a long period off work to care for your child.

Read on to find out how financial protection could offer parents peace of mind and financial security if the worst should happen.

Financial protection could pay out a lump sum if your child is diagnosed with a critical illness

No parent wants to think about their child being diagnosed with a serious illness, but, while rare, it does happen.

Reviewing whether critical illness cover could provide security for your family now means that if your child suffers an illness you can focus on them, rather than worrying about your finances.

Critical illness cover pays out a lump sum if you’re diagnosed with a covered illness. If your child is diagnosed, it will usually pay out a proportion of the full amount, such as 50%. This financial safety net could mean you’re able to take time off work to care for your child or spend it enjoying time with your family.

Critical illness cover might also come with other benefits that would be valuable for your family, such as:

- Lump sum payout if your child is hospitalised following an accident

- Accommodation payments so you’re able to stay close to your child if they’re in hospital

- Childcare costs if you’re diagnosed with a critical illness.

The cost of critical illness cover will depend on the potential payout you want, as well as factors like your age and health. If you don’t pay the premiums, your cover will lapse.

Often, children will be added to your critical illness cover automatically. However, for some providers, you may need to contact them, and your premiums could rise as a result.

Your children will typically be covered from when they are a few weeks old until they’re 18, or 21 if they’re in full-time education. This can vary between providers, so it’s important to check the details when comparing options.

There might be other restrictions you need to be aware of. For example, some forms of cover will allow only one claim per child or may exclude conditions that are present at birth.

Private medical insurance could also put your mind at ease

While you’re considering taking out financial protection that would pay out if your child is diagnosed with a serious illness, you might also want to think about private medical insurance.

According to a BBC report, waiting times and staff shortages have led to public satisfaction in the NHS falling. In fact, just 24% of people polled said they were satisfied with the NHS in 2023.

If you’re worried about accessing services through the NHS, private medical insurance could offer you peace of mind. It could cut down waiting times for a range of services, such as tests and consultations, as well as more choice when deciding where your family receives treatment.

If you or your child needed to stay in a hospital, private medical insurance could also cover the cost of a private room to give you more privacy.

It’s not just physical illnesses that private medical insurance might cover either. Some providers could also give you access to mental health services, which may be valuable for your child.

Indeed, Aviva reported that the number of children and young people seeking support for their mental health increased by 25% in 2023 when compared to just a year earlier.

The cost of private medical insurance will depend on a range of factors, including who is covered, your lifestyle, and family medical history. The level of cover can vary. So, taking the time to understand how comprehensive cover is and any exclusions that might affect your family could help you choose an option that’s right for you.

Contact us if you’d like to discuss how you could prepare for the unexpected

Taking out appropriate financial protection is just one way you could prepare for the unexpected and protect your family. If you’d like to talk to us about how you could update your financial plan to reflect your priorities, please contact us.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Note that financial protection plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Cover is subject to terms and conditions and may have exclusions. Definitions of illnesses vary from product provider and will be explained within the policy documentation.

3 valuable ways business owners could extract profits

As a business owner, deciding how to extract profits from your firm could be a crucial decision. It may affect your tax liability and that of your company. Read on to understand three essential ways you could take money from your business and potential tax implications you might want to weigh up before deciding which is the right route for you.

Many business owners will use a combination of the three options below to extract profit from their business to fund their day-to-day expenses and create long-term financial security.

1. Taking a salary

An obvious way to access profit from your business is to pay yourself a salary.

Paying yourself a salary from your business could help ensure you have a regular income to cover day-to-day expenses. A reliable income source could also make some situations more straightforward, such as applying for a mortgage. So, you might want to consider your short- and medium-term plans when deciding your salary.

In addition, you may also factor in how your salary could affect your tax liability. Your salary could be liable for Income Tax in the same way as other employees.

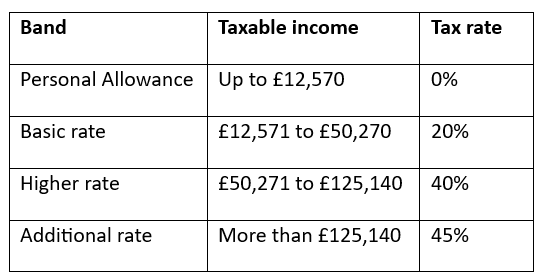

For the 2024/25 tax year, the Income Tax bands and rates are:

Income Tax allowances and rates are different in Scotland

Being mindful of the Income Tax thresholds might help you to manage your finances and avoid an unexpected bill.

As well as Income Tax, there could be other taxes and allowances you factor in. For instance, moving into a higher tax bracket could reduce your Personal Savings Allowance and lead to you paying tax on the interest your savings earn. In addition, high earners could be affected by the Tapered Annual Allowance, which reduces the amount you can tax-efficiently contribute to your pension.

If you would like to talk about the implications of your Income Tax bracket when setting your salary, please contact us.

2. Supplementing your income with dividends

Dividends could be a tax-efficient way to boost your salary. They provide a way to distribute company profits among its shareholders. So, when your business is doing well, dividends could supplement your other sources of income.

In 2024/25, the Dividend Allowance means you can take dividends up to £500 before tax is due. This allowance has fallen in recent years – it was £2,000 in 2022/23. So, if you’re a business owner who uses dividends to extract profits and haven’t reviewed your tax liability recently it could be a worthwhile task.

Dividends could prove valuable even if you exceed the Dividend Allowance due to the tax rate likely being lower than the rate of Income Tax.

The rate of tax you pay will depend on which Income Tax band(s) the dividends that exceed the allowance fall within once your other income is considered. For 2024/25, the Dividend Tax rates are:

- Basic rate: 8.75%

- Higher rate: 33.75%

- Additional rate: 39.35%

It’s not possible to carry forward your Dividend Allowance if you don’t use it in the current tax year. So, making dividends a regular part of your income could be useful.

3. Making pension contributions

Making pension contributions could help secure your long-term finances. This is because a pension is a tax-efficient way to save for your retirement – the investment returns held in a pension aren’t liable for Capital Gains Tax.

In addition, your contributions benefit from tax relief at the highest rate of Income Tax you pay. So, if you’re a basic-rate taxpayer who wants to top-up your pension by £1,000, you’d only need to deposit £800.

Usually, your pension provider will automatically claim tax relief at the basic rate on your behalf. However, if you’re a higher- or additional-rate taxpayer, you’ll need to complete a self-assessment tax return to claim the full amount you’re eligible for.

As well as contributions from your salary, you can set up employer contributions from your business to support your retirement goals.

In 2024/25, the pension Annual Allowance is £60,000. This is the maximum you can pay into your pension while retaining tax relief. However, you can only claim tax relief on 100% of your annual earnings. All contributions count towards your Annual Allowance, including employer contributions and those made by other third parties.

Remember, you can’t usually access your pension until you’re 55 (rising to 57 in 2028). So, if you’re using pension contributions to extract profits from your business you may want to consider when you’ll want to access the money and your long-term plans.

Extracting profits tax-efficiently could reduce your business’s Corporation Tax bill

As well as your personal finances, you may want to incorporate your business’s tax liability when deciding how to extract profits.

Corporation Tax is paid on the profits you make, and some outgoings are allowable expenses that could be deducted during your calculations. Allowable expenses may cover employee salaries, including your own, and pension contributions. In addition, employer pension contributions are deducted before employer National Insurance is calculated.

If your company makes more than £250,000 profit during a tax year, you’ll usually pay the main rate of Corporation Tax, which is 25% in 2024/25. If your company made a profit of £50,000 or less, then you’ll pay the “small profits rate”, which is 19% in 2024/25.

You may be entitled to “marginal relief” if your profits are between £50,000 and £250,000. The relief provides a gradual increase in the Corporation Tax rate between the small profits rate and the main rate.

Keeping these thresholds in mind when you’re extracting profits from your business could help you make decisions that are tax-efficient for both you and your company.

Contact us to talk about your personal finances

As a business owner, your personal finances might be more complex. We could offer support and create a tax-efficient financial plan that reflects your circumstances and long-term goals, including your business exit strategy. Please contact us to arrange a meeting to discuss how we can help you.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Recent Comments