A grocery shop would cost just 45p in 1940s when the first supermarket opened its doors

Visiting the supermarket to pick up a few items or do your weekly shopping is so common it can be difficult to imagine life without this convenience. Yet, it wasn’t too long ago that the first supermarket was opening its doors in the UK. And looking back offers an interesting insight into how money and shopping habits have changed.

The London Co-operative Society opened its doors for the first time in 1948.

It offered a very different service to other shops of the time. Shoppers were used to chatting with the shopkeeper while an assistant picked the items for them. In fact, shoppers wouldn’t have handled the goods at all until they paid.

So, walking into a “self-service” supermarket – where customers picked up their items themselves and took them to a till – was a very different experience. On top of that, there were all kinds of goods under one roof and competitive prices. It’s easy to see why supermarkets became popular.

Today, there are thousands of supermarkets across the UK, from the “big six” to independent stores. And “self-service” has gone one step further with many shops installing checkouts customers can use themselves.

In the 75 years since the first supermarket opened, how we use money, the value of it, and shopping habits have changed enormously. Looking at inflation and how it’s calculated offers a glimpse into this transition.

£1,000 in 1946 has the same value as almost £34,500 today

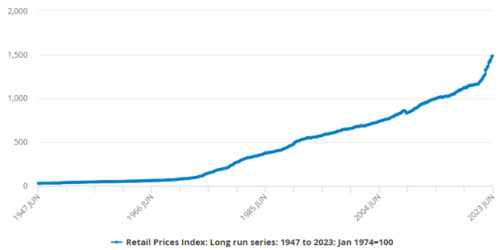

The UK first started tracking retail prices a year after the first supermarket opened. It shows how prices have changed over seven decades.

Data from the Office for National Statistics (ONS) demonstrates how inflation influenced prices between 1947 and 2023. While there have been times retail prices have dipped, overall, it’s been an upwards trend.

Source: Office for National Statistics

In fact, according to the Bank of England’s inflation calculator, £1,000 in 1946 would be equivalent to almost £34,500 today.

The ONS measures inflation by tracking a “basket of goods”. This basket is filled with common goods and services to understand how the cost of frequent purchases changes. Currently, there are around 700 representative consumer goods and services in the basket. As well as groceries from the supermarket, it also includes items like clothing and electronics.

The items are regularly reviewed. So, not only does it track prices, but trends and spending habits.

When the first supermarket opened, rationing was still in place. In the post-war era, the ONS included items like condensed milk, which was often used to make rations stretch further. Condensed milk remained in the basket until 1987 when fresh, pasteurised milk became more widely available.

Fast forward to 2023, and new additions to the basket include frozen berries and free-from products.

3 interesting comparisons that show the power of inflation

1. The average salary was 126 shillings, 9 pence

Before the government introduced decimalisation in 1971, there were 20 shillings to a pound and 12 pence to a shilling. According to the House of Commons library, the average worker earned 126 shillings, 9 pence a week in November 1946.

Inflation means the average earnings in April 2023 are significantly more. Data from ONS shows the average weekly salary is £603, excluding bonuses.

2. A weekly grocery shop was just 45p

According to the Northumberland Gazette, the average person needed just 45p to pick up a week’s worth of groceries in the 1940s. In today’s money that would be less than £20.

However, food inflation and changing habits mean the average adult spends around £44 a week on food in 2023.

3. A property “boom” led to prices quadrupling in some areas

Soaring property prices are often discussed in newspapers today, and it’s not a new phenomenon.

A 1947 article in the Guardian states there was a “boom in house property prices”. In 1939, houses went for around £500. Just eight years later, aspiring homeowners could expect to pay up to £1,500, or even up to £4,000 in select residential districts.

Over the next seven decades, house prices outstripped inflation. The Halifax House Price Index suggests the price of an average house in June 2023 was more than £285,000.

Have you considered how inflation could affect your finances?

Since the first supermarket opened its doors, inflation has affected the value of money. This is something you may need to consider when managing your finances.

For example, if you’re planning for retirement in 20 years, how will the income you need to maintain your lifestyle change? How can you grow your assets to keep up with the pace of inflation?

A financial plan that incorporates inflation could help you understand how it may affect your wealth and the steps you might take to protect it. Please contact us to arrange a meeting to discuss your financial plan.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.