Month: August 2023

Investment market update: July 2023

Data from economies around the world indicate business output and confidence could be slowing. Read on to find out what influenced the investment market in July 2023.

Despite some data suggesting there could be a downturn in some areas, the International Monetary Fund (IMF) has lifted its global growth forecast for 2023. The organisation now expects the global economy to grow by 3%, up from its previous prediction of 2.8%.

Globally, both households and businesses could face pressure as energy prices may rise in the colder months. The International Energy Agency warned that, if China’s economy rebounds this year, energy prices may spike in winter.

UK

The pace of inflation in the UK is slowing. Yet, it remains stubbornly high and above many other economies at 7.9% in the 12 months to June 2023. The latest inflation figures prompted the Bank of England (BoE) to hike its base interest rate again – as of July 2023, it stands at 5%.

The IMF predicts the BoE will need to keep interest rates high for longer than expected due to economic challenges.

Further rises could cause market volatility – the FTSE 100 hit its lowest closing level of 2023 ahead of the July BoE announcement at the start of the month.

The interest rate increases have led to mortgage rates soaring. In July, the average five-year fixed-rate mortgage deal exceeded 6% for the first time since 2008. In fact, by the end of 2026, the BoE predicts that 1 million households will see their monthly mortgage repayments increase by £500.

While many borrowers have been affected by interest rates increasing almost immediately, saving rates have been lagging. The Financial Conduct Authority set out expectations for “fair and competitive savings” during the month, and savers may have started to see the earnings on their savings rise as a result.

The latest release from the Office for National Statistics shows that between February and April 2023, the average wage increased by 7.2%. While growth is good news, the figure is below inflation and so wages are falling in real terms.

As well as soaring mortgage costs, food inflation has significantly affected household budgets. So, it may be of little surprise that a survey for i newspaper found 67% of consumers would back the idea of a price cap on essential goods.

Data suggests many businesses are struggling too.

According to a Purchasing Managers’ Index (PMI) UK factories shrank at their fastest pace in six months in June. Output, new orders, and employment levels all fell and could signal the challenges will continue into the medium term.

As businesses struggle with rising costs, insolvencies are expected to rise. Figures released by the Insolvency Service show business bankruptcies were 27% higher in June when compared to the same period in 2022.

Begbies Traynor, a business recovery and financial consultancy, believes insolvencies will rise over the next 18 months due to interest rate hikes. The firm added that “zombie” businesses have been able to continue operating due to cheap borrowing costs but will now struggle to service debts.

While there have been ups and downs in the market throughout July, the pound hit a 15-month high after all major UK banks passed BoE stress tests.

Europe

Inflation in the Eurozone fell to 5.5% in the 12 months to June 2023. While still above the long-term average, it’s lower than the 8.6% recorded in June 2022.

In response, the European Central Bank increased interest rates to its highest level in more than 20 years. The deposit rate is 3.75% as of July 2023.

PMI data indicates businesses in the Eurozone are facing similar challenges to the UK. Overall business activity fell and moved into negative territory. Factory output was also weak in June, particularly in Austria, Germany and Italy, and employment fell for the first time since January 2021.

US

Steps taken by the Federal Reserve have successfully slowed inflation in the US. In the 12 months to June, it was 3% – a two-year low.

According to PMI data, the US factory sector took a “sharp turn for the worse” in June. The results mirror the situation in Europe, with new orders falling. It’s increased concerns that the country could slip into a recession in the second half of the year.

While there may be worries about the US economy, official data indicates businesses are still confident about their future. American companies added half a million jobs to the economy in June and US wages increased by 4.4%.

In company news, Twitter’s rebrand to X is estimated to have wiped billions off the company’s value.

Since Tesla owner Elon Musk took over the social media platform in October 2022, he’s made a raft of changes. In July, Musk revealed a new name and logo for the platform, which have drawn criticism. According to Fortune, changing the name has wiped out between $4 billion and $20 billion in brand value.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Why emotional decision-making could be costing you investment returns

It can be difficult not to let your emotions influence the decisions you make. When investing, emotional decision-making could be harming your portfolio’s performance and your ability to reach your goals.

While you try to make investment decisions based on logic and facts, it can be easy for emotions, from fear to excitement, to play a role at times. And a survey of financial advisers reveals it could be costing you more than you think.

According to a report in FTAdviser, financial advisers believe emotional decision-making costs investors at least 2% each year in foregone returns. They believe two of the biggest mistakes investors make are:

- Being too influenced by the news (47%)

- Taking too little risk (44%).

If you’ve been guilty of these mistakes in the past, you’re certainly not alone. The good news is that there are things you can do to reduce the effect emotions have on your investments. Read on to find out how you could tackle these two mistakes.

1. Tuning out the news to focus on your long-term plan

Market volatility is part of investing. Unfortunately, sensational headlines about markets “soaring” or “plunging” sell. However, they often don’t show the bigger picture – that even after volatility, markets have, historically, smoothed out over the long term and delivered returns.

On top of providing a snapshot, rather than an in-depth look at markets, remember that the news isn’t tailored to you. An investment opportunity that is perfect for one person, may not be right for another.

If you read about markets falling sharply or the latest “must invest” tip in the newspaper, it’s natural to think about what it means for your investment portfolio. Perhaps you’re scared that volatility could mean the value of your assets will fall and you won’t be able to retire when you intend? Or maybe you feel a thrill at the thought of investing in the next big technology firm?

Tuning out the noise can be difficult, but it may reduce the chance of emotions affecting your decisions.

Working with a financial planner may help you reduce the effect the news has on your mindset. It means you have someone to turn to if you have concerns or would like to pursue an opportunity. Speaking to a professional about your options could prevent knee-jerk decisions you might regret later.

Creating an investment strategy that’s tailored to your goals and circumstances with a financial planner may also give you the confidence to dismiss the news.

At times, your portfolio may dip but understanding why investments have been selected and how it fits into your overall plan could put your mind at ease.

2. Balancing how much investment risk you should take

It’s common to hear that investors are worried about taking too much risk. After all, too much risk could mean you’re more likely to lose your money, and it could affect your progress towards your life goals. Yet, nervous investors can take too little risk.

While you may feel comfortable taking less risk as your money is “safer”, you could miss out on potential growth. Taking too little risk for your circumstances may mean falling short of your goals, even though you had an opportunity to achieve them.

Setting out a risk profile is an essential part of understanding which investments are right for you.

It can be difficult to understand how much risk is appropriate. A financial planner could help you here. By considering a range of areas, from what assets you hold to your investment goals, we can create a risk profile that suits you.

By understanding risk and what’s appropriate for your circumstances, you could reduce the effect emotions like fear have on your decisions. You may feel confident enough to take greater investment risk if it’s right for you and find yourself in a better position to reach your goals.

Want to review your investments? Contact us

Tailored investment advice may help you reduce the effect emotions have on your decisions so you can focus on what’s right for your circumstances.

Whether you want to start investing or would like a portfolio review, please contact us. We can work with you to create an investment strategy that you have confidence in and provide ongoing support so you have someone to turn to if you have any questions or concerns.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Market volatility means thousands of families may have overpaid Inheritance Tax

Thousands of families may be entitled to an Inheritance Tax (IHT) rebate due to stock market volatility. As the government does not automatically refund estates when this happens, many families could be unaware they’ve overpaid.

Overpaying IHT could occur if the value of assets falls between the benefactor passing away and the sale of them. Read on to find out why this affects an IHT bill and what you can do if you’ve overpaid.

When is Inheritance Tax due?

IHT is paid on the estate when someone passes away if the value exceeds certain thresholds.

Usually, there are two key thresholds to consider when calculating if an estate could be liable for IHT:

- If the value of the estate is below the nil-rate band, no IHT is due. For 2023/24, the nil-rate band is £325,000 and the government has frozen it until 2027/28.

- If the deceased is leaving their main home to direct descendants, such as children or grandchildren, they may also be able to use the residence nil-rate band. For 2023/24, this is £175,000. Again, the residence nil-rate band is frozen until 2027/28.

You can pass on unused allowances to your spouse or civil partner. So, if you’re planning together, you could leave up to £1 million before IHT is due.

Assets that exceed these thresholds could be subject to IHT. The standard IHT rate is 40%, so it can significantly reduce the amount beneficiaries receive.

The number of families reclaiming overpaid Inheritance Tax has increased by 22%

According to a report in the Telegraph, the number of families that have reclaimed overpaid IHT increased by 22% in 2022/23, when compared to a year earlier.

Overpaying can occur because an IHT bill is calculated based on the value of the assets on the date of death. However, the value of assets, such as investments, can change and beneficiaries may sell the assets for less than the original valuation. Yet, families may have already paid an IHT bill based on the original value.

Stock market volatility could mean more families overpaid IHT in the last few years. A family inheriting investments may find they sell the assets for less than the original valuation as the price can change significantly, even in a short period.

Similarly, as experts expect house prices to fall in the near future, more families could find they overpay IHT.

According to the Halifax House Price Index, property prices fell by 2.6% in June 2023 when compared to a year earlier.

Economic challenges and rising interest rates mean some property experts expect the market to fall further. In March 2023, the Office for Budget Responsibility forecast that house prices would fall by 10% during 2023 and 2024.

So, families that inherit property could find the value falls and that they’ve overpaid IHT as a result.

As properties are often among the largest assets inherited, the amount overpaid could be substantial. The Telegraph analysis suggests a family inheriting a home initially valued at £1.2 million that falls by 3.5% by the time it’s sold could have overpaid IHT by £16,800.

If the value of assets falls, the government will not automatically refund the estate – you must reclaim the amount overpaid. So, some families may be unaware they’re entitled to a refund.

How to reclaim overpaid Inheritance Tax

As IHT must be paid within six months of the date of death to avoid incurring interest, some families may pay the bill before they sell assets, or the probate process is complete. It could make it difficult to understand if the figures used to calculate IHT are accurate.

So, if you’ve sold inherited assets, it’s worth reviewing the value at the date of death and comparing it to how much you received when selling them. You can reclaim IHT if you sell:

- Property within four years of the date of death

- Qualifying investments within 12 months of the date of death.

If falling values have affected your inheritance, you can fill in a form to recover overpaid IHT.

There is a time limit on submitting a relief form. For property, you must submit the form within seven years of the date of death, and within five years for investments.

One important thing to note is that when you submit a relief form for investments, HMRC will consider all inherited investments – not just those that have fallen in value. So, if some investments have increased in value, the amount you can reclaim may be lower than you expect.

Contact us to learn more about Inheritance Tax

Whether you want to understand if you’ve overpaid IHT or what steps you could take to reduce a potential IHT bill on your estate, please contact us. We can offer advice that’s tailored to you to help you get the most out of your assets.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate Inheritance Tax planning.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes, which cannot be foreseen.

Baffling financial jargon means Brits are overlooking ways to boost their wealth

Brits are struggling with financial jargon and aren’t sure where to start with investing. It could mean some people are missing out on opportunities to increase their wealth.

A survey from Lloyds Bank found that 50% of Brits say they were scared of investing. Furthermore, 38% say financial jargon is baffling.

Misunderstanding common financial terms could lead some people to make decisions that aren’t right for them.

Despite dominating the headlines over the last year, 3 in 10 people said they didn’t understand “inflation”. As inflation has a direct effect on your cost of living, not understanding how it influences your outgoings could mean some budgets are no longer realistic.

Other common investing terms people are clueless about include:

- Asset class (77%)

- Dividend (42%)

- Stocks (37%)

- Portfolio (37%)

- Shares (31%)

Uncertainty about financial terms mean that many people find learning about finances daunting. In fact, 26% of people believe it would be easier to learn a new language than start investing.

Yet, half of the participants said they wanted to learn more about the basics of investing and finances.

Overlooking investing could affect your long-term wealth

If a lack of financial confidence means you’ve not considered investing, you could be missing an opportunity to grow your long-term wealth.

While money in a savings account is “safe”, the interest it earns is likely to be below inflation, which reduces the value in real terms.

Inflation means the cost of goods and services is rising, so your money will gradually buy less. Unless the interest you earn on a cash account exceeds inflation, the spending power of your savings is falling in real terms.

As inflation is currently high, the value of your savings could be falling quickly. However, even when inflation isn’t high, the compounding effect may have a greater impact on your savings over the long term.

In some cases, investing could help grow your wealth. Historically, investment markets have delivered positive returns over the long term, which might provide a way to increase your wealth at a faster pace than inflation.

However, it is important to note that investing isn’t always the right option. For instance, if you’re saving for short-term goals, a cash account may be more appropriate. Or if you don’t have an emergency fund, focusing on building one first could provide you with greater financial resilience.

All investments carry some risk and returns cannot be guaranteed, so just as crucial as deciding whether to invest is choosing which investments suit you.

Here are three ways a financial planner could help improve your investment and financial knowledge.

1. Cut through confusing financial jargon

If you’ve been putting off financial decisions because jargon means you’re not sure which options are right for you, speaking to a financial planner could be useful.

We can not only explain what financial terms mean, but why they may be relevant to you. Having your options explained in clear language could give you the confidence to take control of your finances.

2. Assess which investments could be right for you

The survey suggests that many people don’t know where to start when they want to invest. It’s easy to see why – there are a lot of options to choose from, and it can be difficult to know which ones may be right for you.

To understand which investments suit your goals, you may need to consider areas like your investment time frame, what other assets you hold, and your risk profile. You should also keep in mind how different investments can be used to create a balanced and diversified portfolio.

A financial planner can assist with all of these, helping you build a financial plan to suit your needs and circumstances.

3. Provide you with someone to turn to when you’re uncertain

Even the best-laid plans can go awry. Perhaps, health reasons mean you want to stop working sooner than expected. Or investment market volatility means the value of your portfolio has unexpectedly fallen.

Working with a financial planner on an ongoing basis means you have someone to turn to if you need reassurance or would like to update your financial plan. They can also help ensure your financial decisions continue to reflect your goals and economic circumstances.

Contact us to talk about your finances

If you want help creating a financial plan that suits you, please get in touch. We can offer advice and guidance so you can feel more confident taking control of your long-term finances.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

A grocery shop would cost just 45p in 1940s when the first supermarket opened its doors

Visiting the supermarket to pick up a few items or do your weekly shopping is so common it can be difficult to imagine life without this convenience. Yet, it wasn’t too long ago that the first supermarket was opening its doors in the UK. And looking back offers an interesting insight into how money and shopping habits have changed.

The London Co-operative Society opened its doors for the first time in 1948.

It offered a very different service to other shops of the time. Shoppers were used to chatting with the shopkeeper while an assistant picked the items for them. In fact, shoppers wouldn’t have handled the goods at all until they paid.

So, walking into a “self-service” supermarket – where customers picked up their items themselves and took them to a till – was a very different experience. On top of that, there were all kinds of goods under one roof and competitive prices. It’s easy to see why supermarkets became popular.

Today, there are thousands of supermarkets across the UK, from the “big six” to independent stores. And “self-service” has gone one step further with many shops installing checkouts customers can use themselves.

In the 75 years since the first supermarket opened, how we use money, the value of it, and shopping habits have changed enormously. Looking at inflation and how it’s calculated offers a glimpse into this transition.

£1,000 in 1946 has the same value as almost £34,500 today

The UK first started tracking retail prices a year after the first supermarket opened. It shows how prices have changed over seven decades.

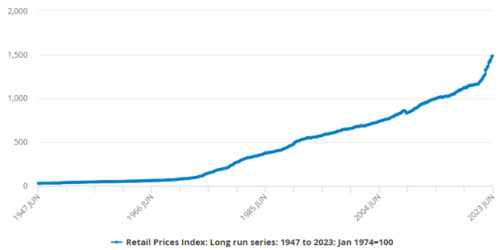

Data from the Office for National Statistics (ONS) demonstrates how inflation influenced prices between 1947 and 2023. While there have been times retail prices have dipped, overall, it’s been an upwards trend.

Source: Office for National Statistics

In fact, according to the Bank of England’s inflation calculator, £1,000 in 1946 would be equivalent to almost £34,500 today.

The ONS measures inflation by tracking a “basket of goods”. This basket is filled with common goods and services to understand how the cost of frequent purchases changes. Currently, there are around 700 representative consumer goods and services in the basket. As well as groceries from the supermarket, it also includes items like clothing and electronics.

The items are regularly reviewed. So, not only does it track prices, but trends and spending habits.

When the first supermarket opened, rationing was still in place. In the post-war era, the ONS included items like condensed milk, which was often used to make rations stretch further. Condensed milk remained in the basket until 1987 when fresh, pasteurised milk became more widely available.

Fast forward to 2023, and new additions to the basket include frozen berries and free-from products.

3 interesting comparisons that show the power of inflation

1. The average salary was 126 shillings, 9 pence

Before the government introduced decimalisation in 1971, there were 20 shillings to a pound and 12 pence to a shilling. According to the House of Commons library, the average worker earned 126 shillings, 9 pence a week in November 1946.

Inflation means the average earnings in April 2023 are significantly more. Data from ONS shows the average weekly salary is £603, excluding bonuses.

2. A weekly grocery shop was just 45p

According to the Northumberland Gazette, the average person needed just 45p to pick up a week’s worth of groceries in the 1940s. In today’s money that would be less than £20.

However, food inflation and changing habits mean the average adult spends around £44 a week on food in 2023.

3. A property “boom” led to prices quadrupling in some areas

Soaring property prices are often discussed in newspapers today, and it’s not a new phenomenon.

A 1947 article in the Guardian states there was a “boom in house property prices”. In 1939, houses went for around £500. Just eight years later, aspiring homeowners could expect to pay up to £1,500, or even up to £4,000 in select residential districts.

Over the next seven decades, house prices outstripped inflation. The Halifax House Price Index suggests the price of an average house in June 2023 was more than £285,000.

Have you considered how inflation could affect your finances?

Since the first supermarket opened its doors, inflation has affected the value of money. This is something you may need to consider when managing your finances.

For example, if you’re planning for retirement in 20 years, how will the income you need to maintain your lifestyle change? How can you grow your assets to keep up with the pace of inflation?

A financial plan that incorporates inflation could help you understand how it may affect your wealth and the steps you might take to protect it. Please contact us to arrange a meeting to discuss your financial plan.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Investing 101: What you need to know about tax efficiency and your investment options

Investing may provide a useful way to grow your wealth, but getting started can be overwhelming. There are some important decisions to make when investing that could affect the outcomes and the tax you’re liable for, and we’re here to offer support.

Last month, you read about investment risk and what to consider when creating a risk profile. Now, read on to discover what your options are if you’re ready to start investing.

Shares v funds: What’s the difference?

Investing is filled with terms that can seem confusing. When you’ve looked at investing, you may have come across options like investing in shares or through a fund.

You may want to consider both options and understanding the differences is important.

Shares

When you purchase a share, you’re investing in a single company. When you hold a share, you essentially own a very small portion of the business. You can then sell the share at a later date and, hopefully, make a profit.

The value of shares is affected by demand. A whole range of factors can affect demand, from company performance and long-term plans to global economic conditions.

If you purchase shares, you’re in control and can decide which companies to invest in and when to sell them.

It’s normal for the value of shares to fluctuate, even daily. It can be tempting to try and time the market by buying when the price of a share is low and selling when it’s high. However, consistently timing the market is impossible. For most investors, buying shares to hold them for the long term often makes sense.

Funds

A fund pools together your money with that of other investors. This money is then used to purchase shares in a range of companies.

A fund is managed on behalf of investors. So, you wouldn’t make decisions about which companies to invest in or when to buy or sell shares.

There are lots of funds to choose from, so you can select an option that suits your risk profile and goals.

Funds can be a useful way to ensure your investments are diversified. As your money is spread across many companies, it can help create balance. When one company performs poorly, the success of another could balance this out. So, the value of your investment in a fund may be less volatile than individual shares.

However, the value of your investment will still rise and fall, and investing with a long-term plan is often advisable.

2 tax-efficient ways to invest and reduce your potential tax bill

When you sell certain assets and make a profit, you could be liable for Capital Gains Tax (CGT). This includes investments that aren’t held in a tax-efficient wrapper.

For the 2023/24 tax year, individuals can make £6,000 of gains before CGT is due – this is known as the “annual exempt amount”. If profits from the sale of all liable assets exceed this threshold, you could face a CGT bill. In 2024/25, the annual exempt amount will fall to £3,000.

The rate of CGT depends on your other income, but when selling investments, it can be as high as 20%. So, CGT may significantly affect your profits.

The good news is that there are tax-efficient ways to invest that could reduce your bill, including these two:

1. Invest through a Stocks and Shares ISA

ISAs provide a tax-efficient way to save and invest. For the 2023/24 tax year, you can add up to £20,000 to ISAs. The returns made on investments held in a Stocks and Shares ISA are not liable for CGT.

There are many ISAs to choose from. They can hold shares or you can invest in a fund through one. Usually, you can access your investments that are held in an ISA when you choose.

2. Use your pension to invest for the long term

If you’re investing with your long-term wealth in mind, you may want to consider pensions. Pensions are tax-efficient for two reasons.

- First, you could claim tax relief on the contributions you make. This provides a boost to your contributions, which may grow further too, as tax relief would be invested alongside other deposits.

- Second, your investment returns are not liable for CGT when held in a pension. Instead, you could pay Income Tax when you start to access your pension once you reach retirement age.

In 2023/24, you can usually add up to £60,000 (up to 100% of your annual earnings) into a pension while retaining tax relief – this is known as your “Annual Allowance”.

If you are a high earner or have taken an income from your pension already, your Annual Allowance may be lower. Please contact us if you’re not sure how much you can tax-efficiently save into a pension.

Before you start investing in a pension, one key thing to consider is when you’ll want to access the money. Usually, you cannot make withdrawals from your pension until you are 55, rising to 57 in 2028. So, your goals and other assets should play a role in deciding if investing more into a pension is right for you.

Contact us if you have questions about your investment portfolio

We can work with you to create an investment portfolio that suits your risk profile and goals. We’re also on hand to answer any questions you may have, from deciphering financial jargon to explaining tax-efficient options. Please contact us to arrange a meeting to talk about your investments.

Once you’ve set up an investment portfolio, how often should you review the performance? Why is ongoing advice useful? Read our blog next month to learn about managing investments on an ongoing basis.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Recent Comments